Assessing ABIVAX After Its 891% Rally and Recent Biotech Sector Surge

Reviewed by Bailey Pemberton

If you have been watching ABIVAX Société Anonyme, you are probably wondering whether now is the right time to make a move. With a recent close at 72.2, the stock has been on quite a ride this year. Just look at the numbers: up 2.7% over the past week, 1.0% in the last month, and an eye-popping 891.8% year-to-date gain. Even over the past five years, shares have returned 245.5%, showing this is hardly a flash in the pan. Most observers connect this upward surge to the broader excitement around biotech innovation, with investors sizing up growth potential and changes in perceived risk. No single news story explains all these moves, but overall market sentiment seems to be fueling the rally.

But before getting carried away with impressive returns, let us take a closer look at whether ABIVAX Société Anonyme is truly undervalued. According to standard valuation checks, the company scores a 0 out of 6, meaning it does not come up as undervalued on any of the usual metrics. That may surprise some, especially given the immense run-up in price.

So, what does this mean for those considering buying or holding? The most popular valuation approaches can shed some light on that question. And, if you are looking for a smarter way to think about valuation beyond the basics, stick around for the end because we will get there.

ABIVAX Société Anonyme scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ABIVAX Société Anonyme Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future free cash flows and then discounts them back to their present value. This approach helps estimate what ABIVAX Société Anonyme might really be worth today, based on how much cash the business is expected to generate in the years ahead.

Currently, ABIVAX Société Anonyme has a Free Cash Flow (FCF) of -€135.90 Million, indicating negative cash generation over the last twelve months. Looking ahead, analysts estimate that FCF will remain negative in 2026 at -€41.33 Million, but is expected to turn positive from 2027, reaching €8.27 Million. Projections beyond 2027, extrapolated further out to 2035, suggest steadily increasing FCF, reaching approximately €39.93 Million by that year.

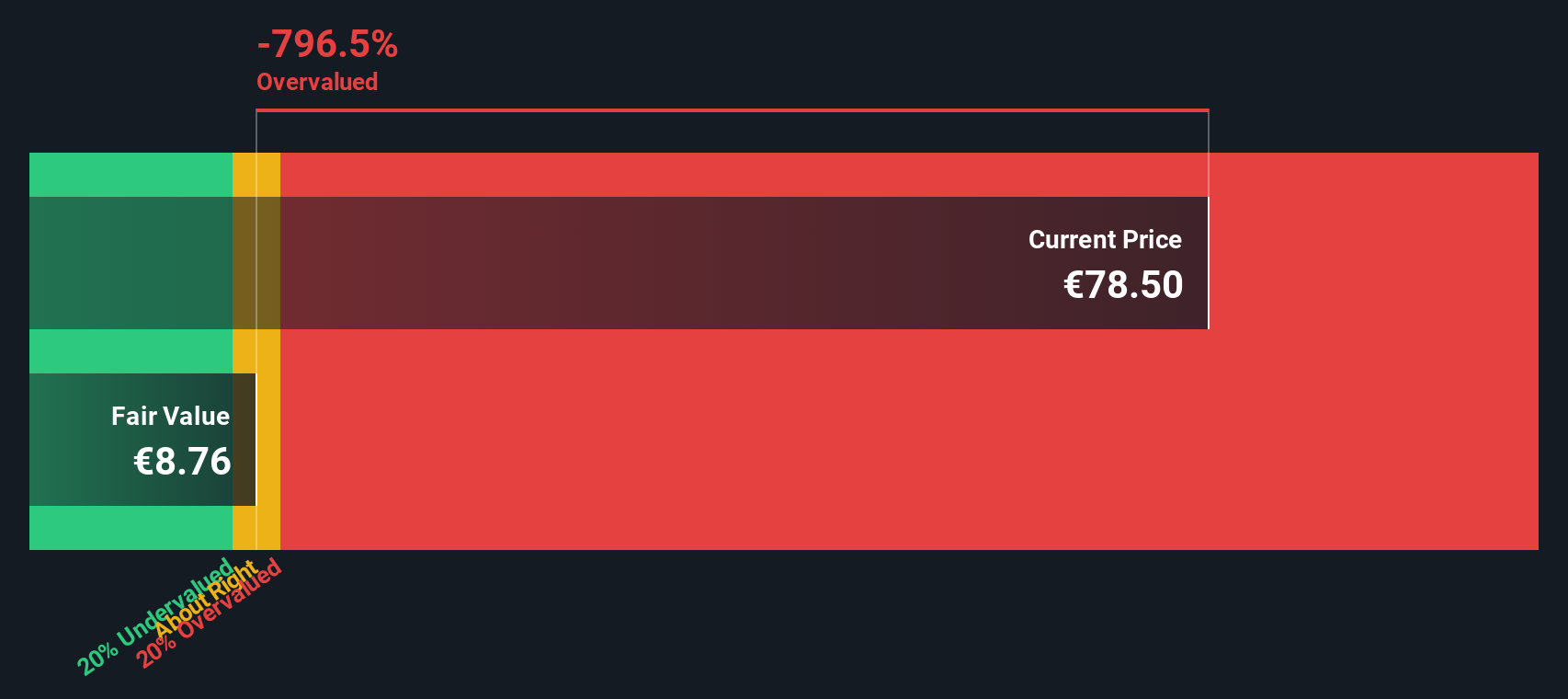

Based on these projections and discounting future cash flows back to today, the DCF model calculates an intrinsic value per share of €8.90. With the current share price standing at €72.20, this implies the stock is trading at a 711.3% premium to its intrinsic value, or is considered severely overvalued when judged by this methodology.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ABIVAX Société Anonyme may be overvalued by 711.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ABIVAX Société Anonyme Price vs Book

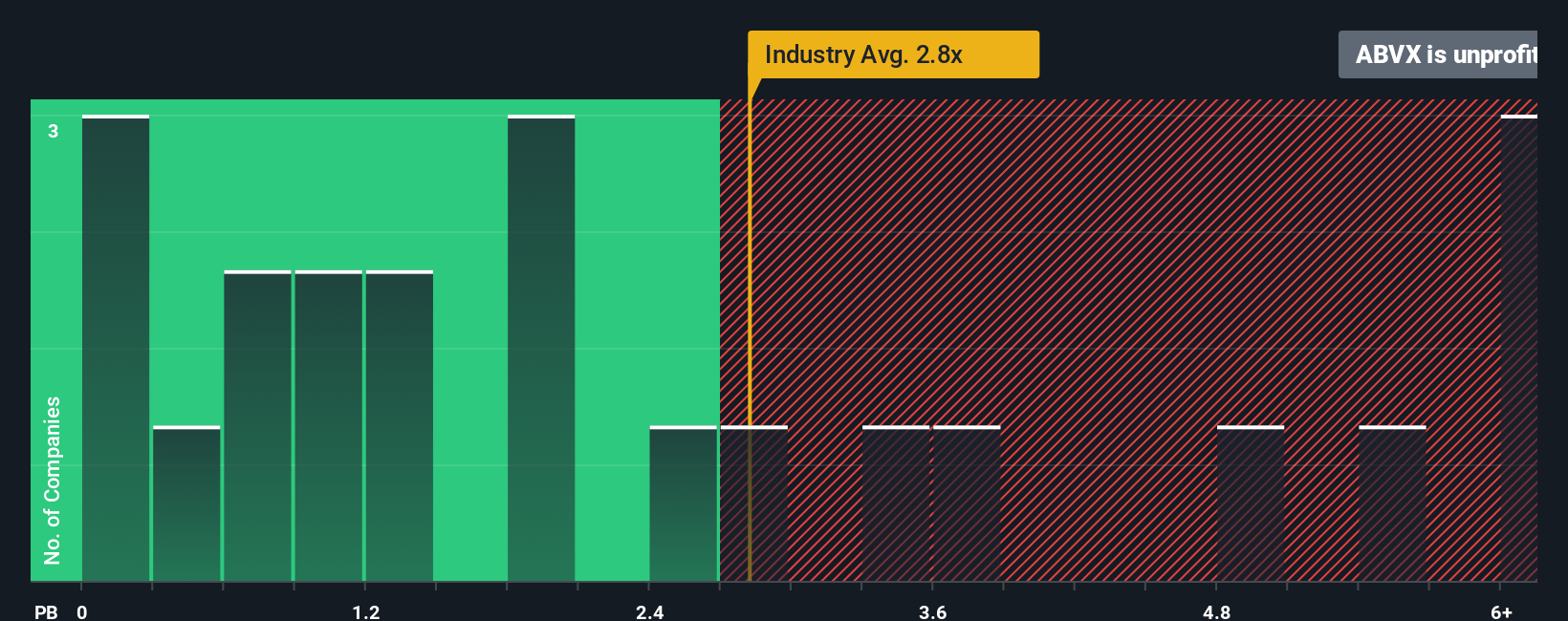

The price-to-book (PB) ratio is a widely used metric for valuing companies, especially in sectors like biotech where profits can be unpredictable or negative, as is the case for ABIVAX Société Anonyme. The PB ratio compares the market value of a company to the value of its net assets. This helps investors understand if a stock is trading at a premium or discount to the value of what the company owns.

Growth expectations and risk profile play a significant role in what makes a "fair" PB ratio. Fast-growing or less risky companies often deserve higher multiples because investors anticipate stronger returns or greater stability. In contrast, companies facing more uncertainty or limited growth potential typically trade at lower multiples.

Currently, ABIVAX Société Anonyme trades at a PB ratio of -113.02x. For context, the average PB ratio among its biotech industry peers is 3.29x and the industry average is 2.66x. This extremely negative PB ratio signals that the market views the company's balance sheet position or accounting losses with considerable skepticism, or that there are significant off-balance-sheet risks.

Simply Wall St’s Fair Ratio is a proprietary metric considering not just industry averages and peer group but also ABIVAX Société Anonyme’s specific characteristics such as its projected earnings growth, profit margins, risk profile, and market capitalization. This approach gives a more individualized view of value, rather than relying solely on broad peer or industry comparisons that may ignore company-specific strengths or weaknesses.

In this case, the gap between the actual PB ratio and Fair Ratio is far larger than 0.10 in absolute value, indicating that ABIVAX Société Anonyme appears substantially overvalued by the PB metric, relative to what its fundamentals would suggest is fair.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ABIVAX Société Anonyme Narrative

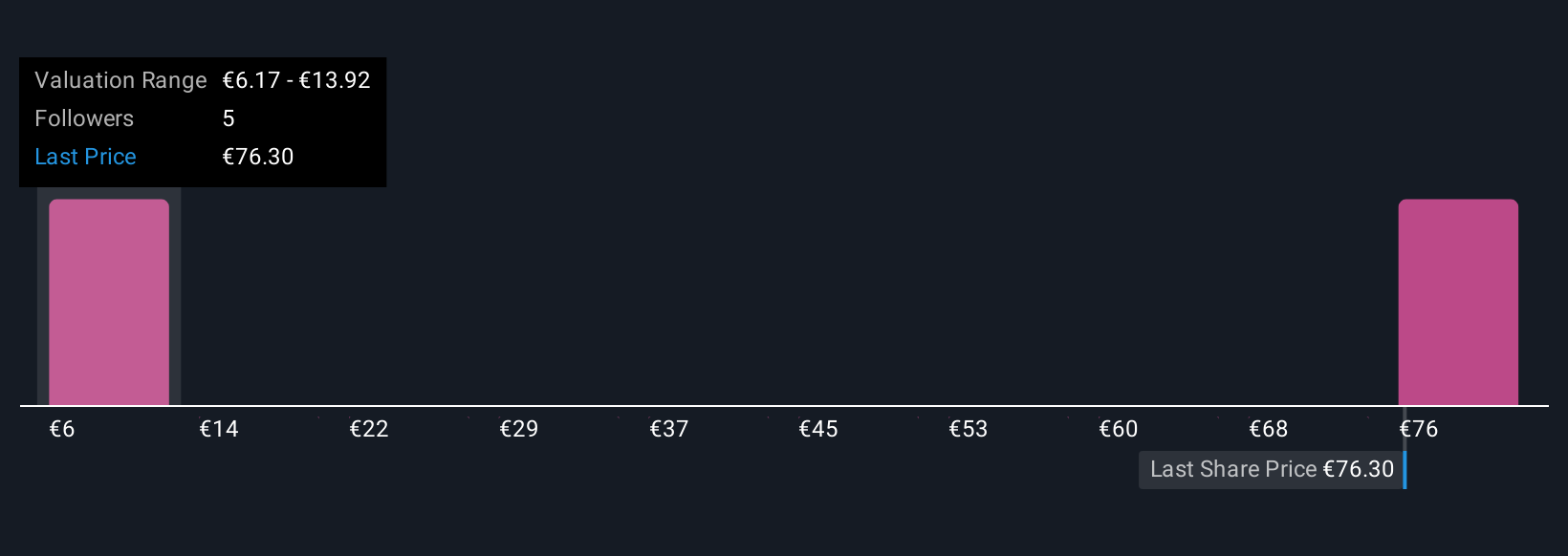

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is more than just a number; it is your personal interpretation of a company's potential, combining your assumptions about fair value and future performance with the story you see unfolding for ABIVAX Société Anonyme.

Narratives connect the dots between a company's unique story, financial forecasts, and what you estimate as a fair price, making decision-making easier and more dynamic. Available to millions of investors on Simply Wall St's Community page, Narratives empower you to visualize and refine your view, helping you decide if now is the right time to buy or sell by comparing your Fair Value to the current Price.

Best of all, Narratives update quickly whenever new information emerges, so your perspective stays relevant, no matter how the news changes. For ABIVAX Société Anonyme, you might notice one Narrative valuing the stock at €4 per share while another sees it at €75, showing just how personal investing decisions can be.

Do you think there's more to the story for ABIVAX Société Anonyme? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ABVX

ABIVAX Société Anonyme

A clinical-stage biotechnology company, focuses on developing therapeutics that harness the body’s natural regulatory mechanisms to stabilize the immune response in patients with chronic inflammatory diseases.

Slight risk with limited growth.

Market Insights

Community Narratives