- France

- /

- Entertainment

- /

- ENXTPA:UBI

Announcing: Ubisoft Entertainment (EPA:UBI) Stock Soared An Exciting 319% In The Last Five Years

Long term investing can be life changing when you buy and hold the truly great businesses. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held Ubisoft Entertainment SA (EPA:UBI) shares for the last five years, while they gained 319%. And this is just one example of the epic gains achieved by some long term investors. It's also up 8.8% in about a month. But the price may well have benefitted from a buoyant market, since stocks have gained 3.7% in the last thirty days.

See our latest analysis for Ubisoft Entertainment

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Ubisoft Entertainment actually saw its EPS drop 8.9% per year. The impact of extraordinary items on earnings, in the last year, partially explain the diversion.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

In contrast revenue growth of 7.2% per year is probably viewed as evidence that Ubisoft Entertainment is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

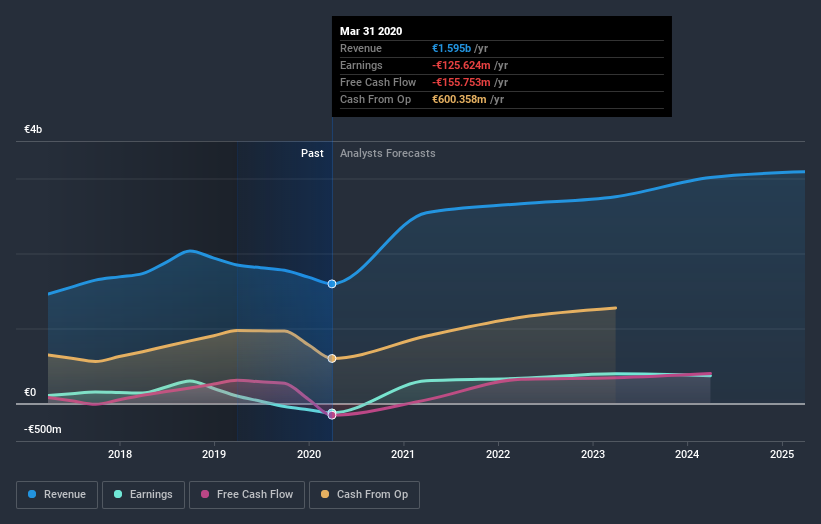

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Ubisoft Entertainment in this interactive graph of future profit estimates.

A Different Perspective

While it's never nice to take a loss, Ubisoft Entertainment shareholders can take comfort that their trailing twelve month loss of 1.2% wasn't as bad as the market loss of around 7.2%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 33% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Ubisoft Entertainment (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

When trading Ubisoft Entertainment or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:UBI

Ubisoft Entertainment

Ubisoft Entertainment SA produce, publishes, and distributes video games for consoles, PC, smartphones, and tablets in both physical and digital formats in Europe, North America, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives