As European markets show resilience with the STOXX Europe 600 Index rising on easing trade tensions and optimism surrounding U.S. interest rate cuts, investors are increasingly eyeing dividend stocks for stable returns amidst economic fluctuations. In this environment, a good dividend stock is characterized by its ability to provide consistent payouts, supported by strong fundamentals and the potential for growth even as industry output faces challenges.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.26% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.57% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.18% | ★★★★★☆ |

| Swiss Re (SWX:SREN) | 4.04% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.03% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.58% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.94% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.54% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.03% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.71% | ★★★★★★ |

Click here to see the full list of 216 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client segments in France, with a market cap of €1.56 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates revenue by providing a variety of banking products and services to individuals, professionals, associations, farmers, businesses, private banking customers, and public and social housing community clients in France.

Dividend Yield: 3.4%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a reliable dividend yield of 3.38%, supported by a low payout ratio of 28.5%, indicating strong coverage by earnings. The company's dividends have been stable and growing over the past decade, although the yield is lower than the top quartile in France at 5.31%. Recent earnings showed net income growth to €125.83 million for H1 2025, reflecting steady financial performance amidst market conditions.

- Get an in-depth perspective on Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's performance by reading our dividend report here.

- The analysis detailed in our Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative valuation report hints at an inflated share price compared to its estimated value.

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. is a global company offering marketing, communications, and digital business transformation services across various regions including North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East with a market cap of approximately €19.97 billion.

Operations: Publicis Groupe's revenue is primarily derived from its Advertising and Communication Services segment, which generated €16.86 billion.

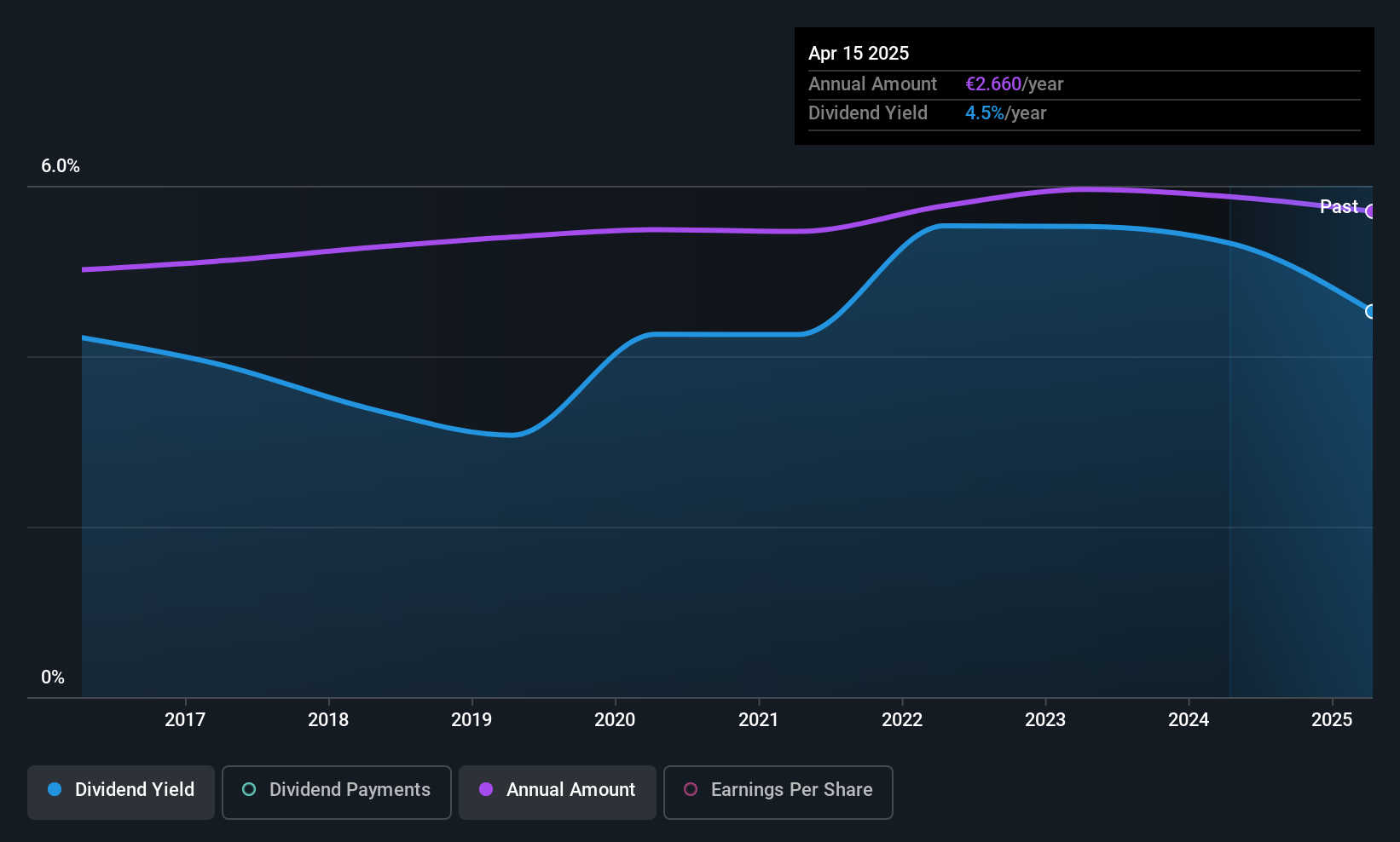

Dividend Yield: 4.5%

Publicis Groupe's dividend payments, while historically volatile, are currently well-covered by earnings and cash flows, with payout ratios of 52.8% and 43.5%, respectively. Despite a lower yield of 4.52% compared to top French payers, dividends have grown over the past decade. Recent H1 results showed revenue growth to €8.48 billion and net income increase to €824 million, suggesting solid financial performance that may support future dividend stability amidst market fluctuations.

- Unlock comprehensive insights into our analysis of Publicis Groupe stock in this dividend report.

- Our expertly prepared valuation report Publicis Groupe implies its share price may be lower than expected.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IVF Hartmann Holding AG operates in the medical consumer goods sector, supplying products both in Switzerland and internationally, with a market cap of CHF350.06 million.

Operations: IVF Hartmann Holding AG generates revenue from various segments, including Wound Care (CHF44.04 million), Infection Management (CHF58.87 million), and Incontinence Management (CHF33.92 million).

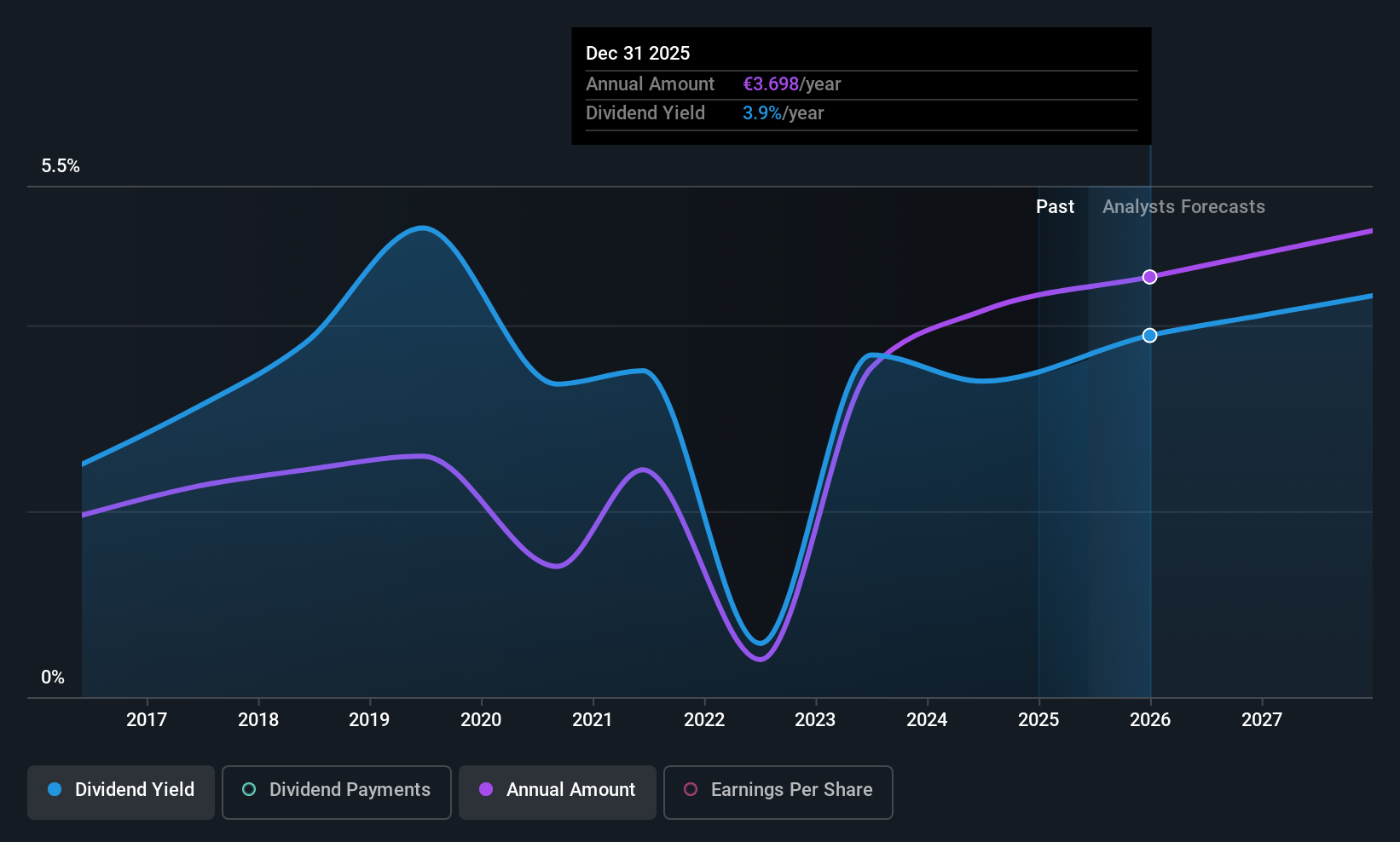

Dividend Yield: 4.2%

IVF Hartmann Holding's dividend yield of 4.22% ranks in the top 25% within the Swiss market, supported by a low payout ratio of 37.8%, indicating earnings coverage. Despite this, dividends have been historically volatile with significant annual drops and an unstable track record over the past decade. While cash flow coverage is adequate at an 82.9% payout ratio, investors should note potential fluctuations in dividend reliability despite recent earnings growth of CHF34 million last year.

- Take a closer look at IVF Hartmann Holding's potential here in our dividend report.

- Our valuation report here indicates IVF Hartmann Holding may be overvalued.

Where To Now?

- Unlock our comprehensive list of 216 Top European Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PUB

Publicis Groupe

Provides marketing, communications, and digital business transformation services in North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives