As the European markets navigate a landscape shaped by dovish signals from the U.S. Federal Reserve and mixed economic indicators, investors are keenly observing opportunities in dividend stocks, which can offer stability amid volatility. In this context, selecting stocks with strong fundamentals and consistent dividend payouts becomes crucial for those looking to bolster their portfolios against market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.80% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.85% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.59% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.18% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.17% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 11.91% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.72% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.01% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.65% | ★★★★★☆ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

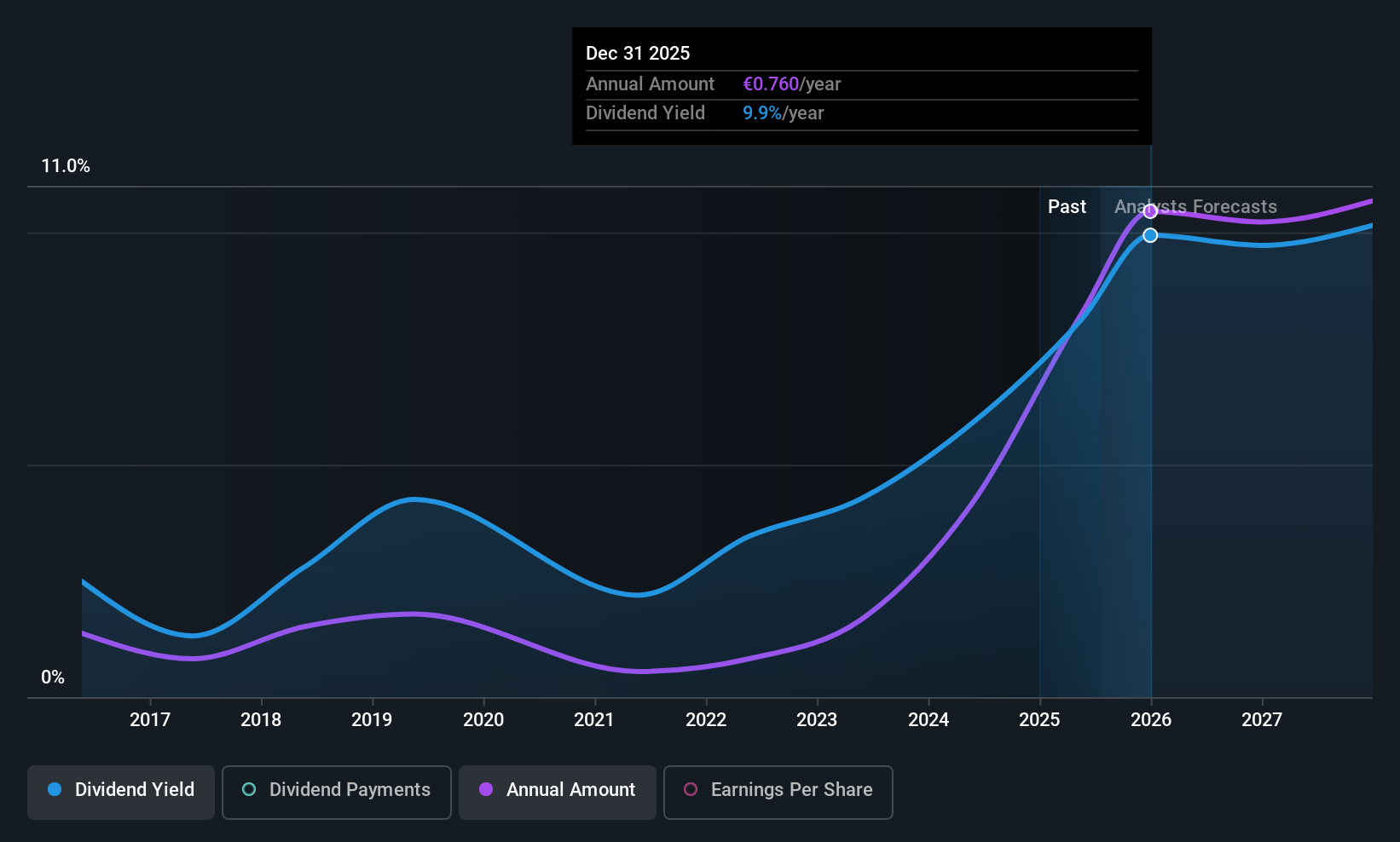

BPER Banca (BIT:BPE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BPER Banca SpA offers a range of banking products and services to individuals, businesses, and professionals both in Italy and internationally, with a market cap of €18.75 billion.

Operations: BPER Banca SpA generates its revenue through various banking products and services tailored for individual clients, businesses, and professionals across Italy and international markets.

Dividend Yield: 6%

BPER Banca has been added to major indices like the S&P EUROPE 350, reflecting its growing prominence. The bank's recent earnings report shows net income growth, though net interest income declined slightly. Its dividend yield is competitive within Italy, supported by a sustainable payout ratio of 53.7%. However, dividends have been volatile and unreliable over the past decade despite increasing overall. The bank also faces challenges with high non-performing loans at 2.1%.

- Dive into the specifics of BPER Banca here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of BPER Banca shares in the market.

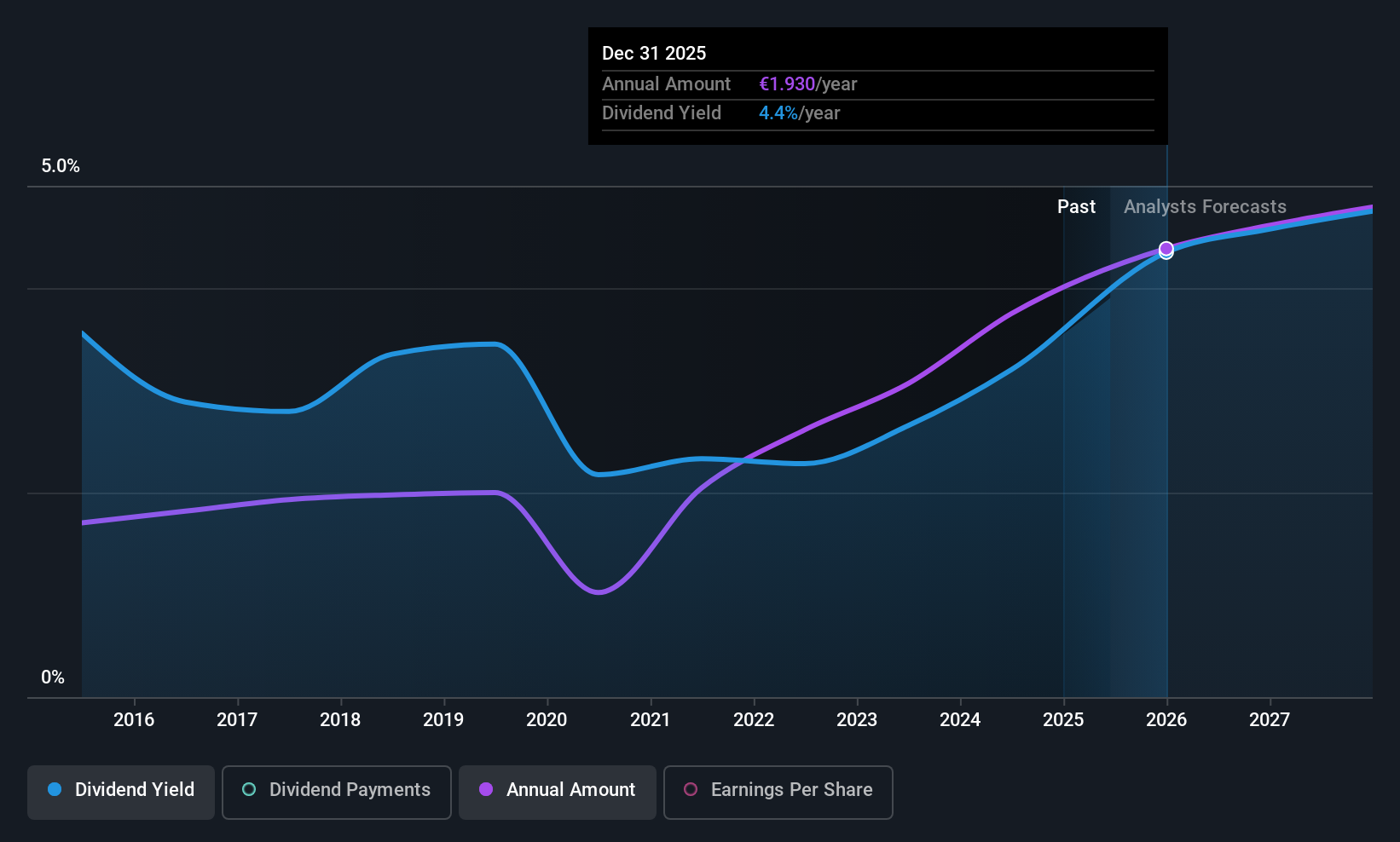

Ipsos (ENXTPA:IPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ipsos SA, with a market cap of €1.55 billion, offers survey-based research services to companies and institutions across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific through its subsidiaries.

Operations: Ipsos SA generates revenue of €2.46 billion from its survey-based research services across various global regions.

Dividend Yield: 5.1%

Ipsos, while trading significantly below its estimated fair value, offers a dividend yield of 5.07%, slightly lower than the top quartile in France. Its dividends are well-covered by earnings and cash flows with payout ratios of 44.3% and 35.8%, respectively, indicating sustainability despite a history of volatility over the past decade. Recent strategic partnerships, including a collaboration with Volkswagen Group UK to enhance customer experience initiatives, highlight Ipsos' focus on leveraging advanced analytics and technology for growth under new CEO Jean-Laurent Poitou's leadership.

- Navigate through the intricacies of Ipsos with our comprehensive dividend report here.

- Our valuation report here indicates Ipsos may be undervalued.

Marimekko Oyj (HLSE:MEKKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Marimekko Oyj is a lifestyle design company that creates and sells clothing, bags, accessories, and interior decoration products globally, with a market cap of €529.86 million.

Operations: Marimekko Oyj generates its revenue primarily from the Marimekko Business segment, which amounted to €185.40 million.

Dividend Yield: 3%

Marimekko Oyj's dividend yield of 3.03% is modest compared to Finland's top payers, with a reasonable payout ratio of 69.7% indicating coverage by earnings but not by free cash flows. Despite a stable and growing dividend history over the past decade, high cash payout ratios suggest potential sustainability concerns. Recent expansions in Hong Kong and Paris underscore Marimekko's strategic focus on growth in Asia and Europe, aiming to bolster brand presence amidst evolving market dynamics.

- Click here to discover the nuances of Marimekko Oyj with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Marimekko Oyj's current price could be inflated.

Key Takeaways

- Discover the full array of 228 Top European Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IPS

Ipsos

Through its subsidiaries, provides survey-based research services for companies and institutions in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives