As European markets experience a modest rise, buoyed by expectations of U.S. interest rate cuts and stable policies from the European Central Bank, investors are increasingly looking towards dividend stocks as a means to generate steady income amidst economic uncertainties. In this environment, identifying stocks with strong fundamentals and attractive yields can provide a reliable source of returns for those seeking stability in their investment portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.32% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.83% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.13% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.41% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.45% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.46% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.88% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.26% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.66% | ★★★★★★ |

| Afry (OM:AFRY) | 3.87% | ★★★★★☆ |

Click here to see the full list of 224 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

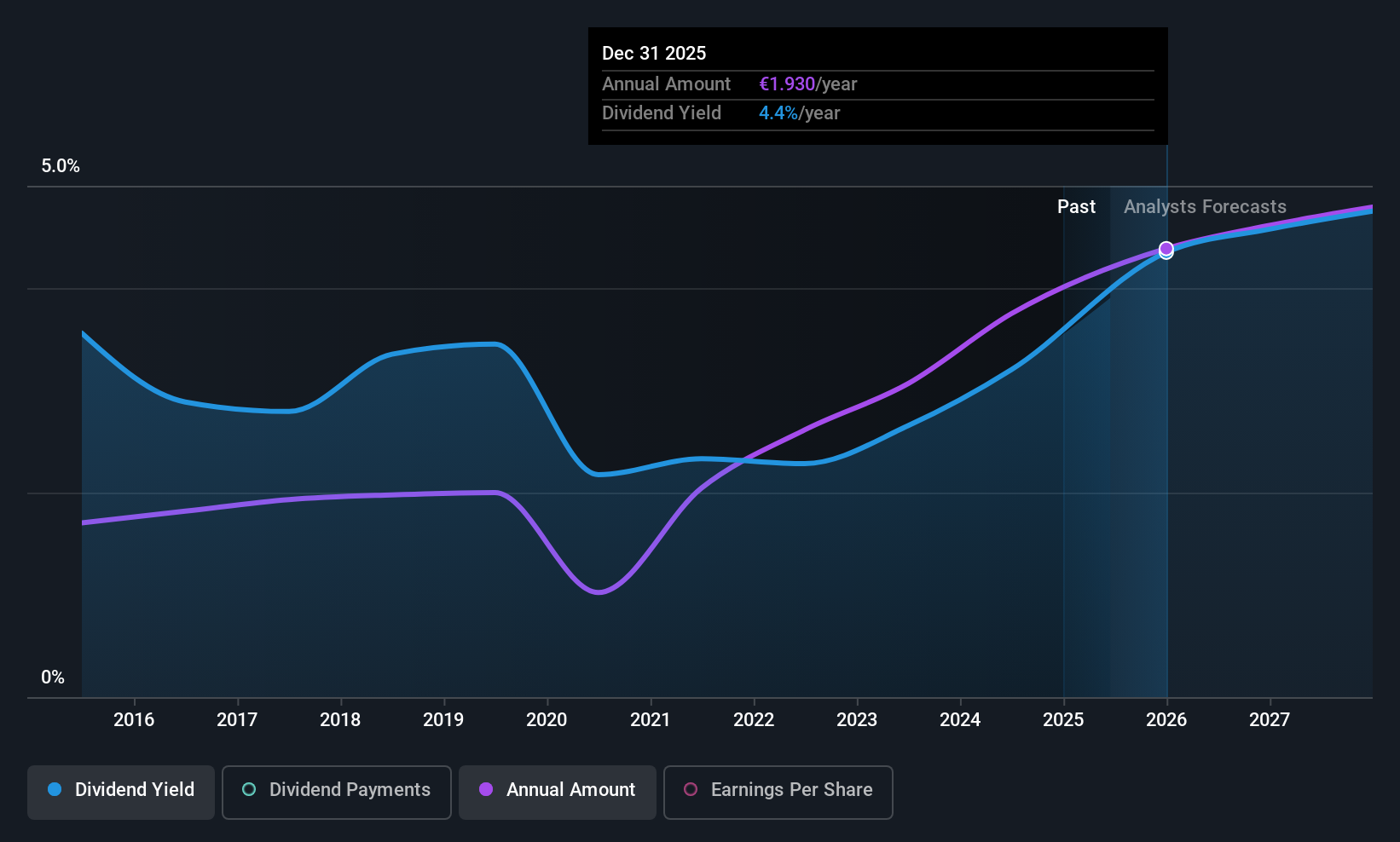

Mapfre (BME:MAP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mapfre, S.A. operates in investment, insurance, property, financial, and services sectors in Spain with a market cap of €12 billion.

Operations: Mapfre, S.A.'s revenue segments include EMEA (€1.76 billion), Brazil (€5.08 billion), Iberia (€8.87 billion), Reinsurance (€7.23 billion), Global Risks (€2.57 billion), North America (€3.10 billion), and Mapfre Asistencia-Mawdy (€202 million).

Dividend Yield: 4.1%

Mapfre, S.A. offers a stable and reliable dividend profile with payments increasing over the past decade. The company's recent earnings growth of 22.8% supports its low payout ratio of 27.6%, ensuring dividends are well covered by both earnings and cash flows, with a cash payout ratio of 29.5%. Despite trading at 36% below estimated fair value and offering a dividend yield of 4.1%, it lags behind top-tier Spanish market payers but remains attractively valued relative to peers.

- Click here and access our complete dividend analysis report to understand the dynamics of Mapfre.

- The valuation report we've compiled suggests that Mapfre's current price could be quite moderate.

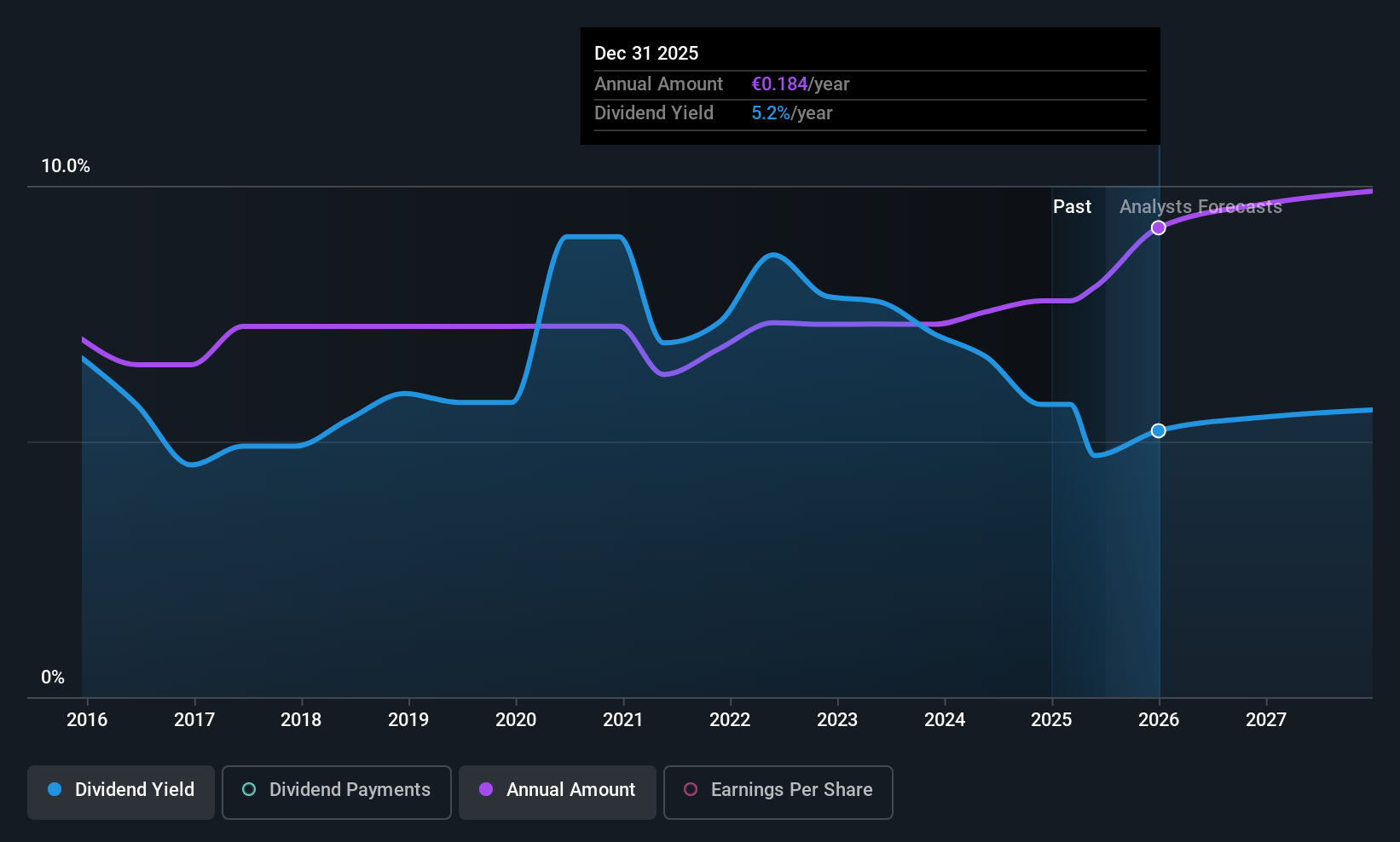

Ipsos (ENXTPA:IPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ipsos SA, with a market cap of €1.59 billion, operates through its subsidiaries to provide survey-based research services for companies and institutions across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Operations: Ipsos SA generates €2.46 billion in revenue from its survey-based research services across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Dividend Yield: 5%

Ipsos presents a mixed dividend profile, with dividends well-covered by earnings and cash flows, reflected in payout ratios of 44.3% and 35.8%, respectively. However, its dividend history is volatile and unreliable over the past decade despite recent increases. Trading at a significant discount to estimated fair value, Ipsos offers good relative value compared to peers but falls short of the top-tier French market yield of 5.45%. Recent executive changes may impact future growth strategies.

- Click here to discover the nuances of Ipsos with our detailed analytical dividend report.

- Our valuation report here indicates Ipsos may be undervalued.

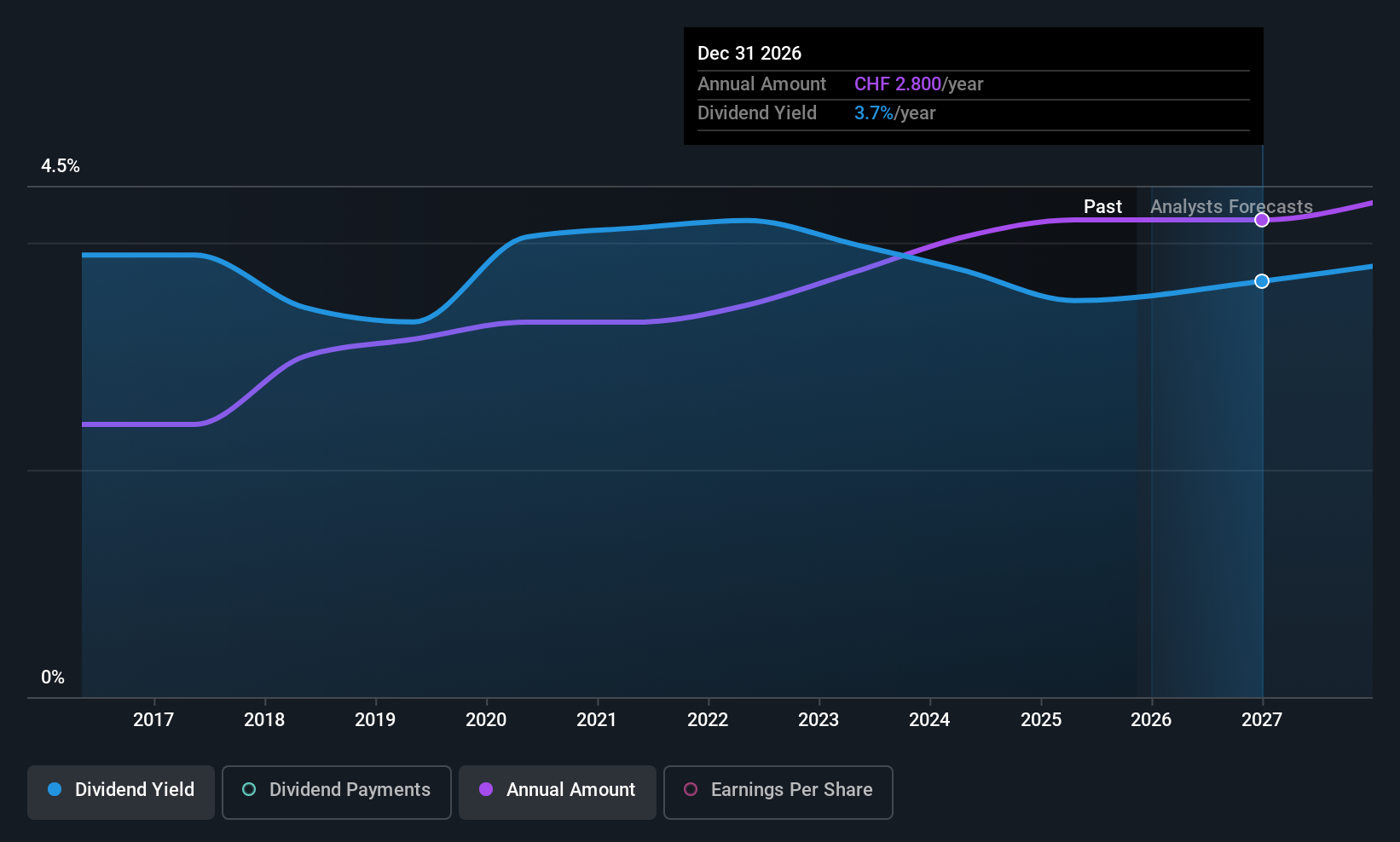

Liechtensteinische Landesbank (SWX:LLBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liechtensteinische Landesbank Aktiengesellschaft offers banking products and services in Liechtenstein, Switzerland, Germany, and Austria, with a market cap of CHF2.51 billion.

Operations: Liechtensteinische Landesbank's revenue is primarily derived from Retail & Corporate Banking (CHF306.49 million) and International Wealth Management (CHF250.77 million), with additional contributions from the Corporate Center (CHF38.33 million).

Dividend Yield: 3.4%

Liechtensteinische Landesbank's dividend profile shows a mixed picture. While dividends have grown over the past decade, they remain volatile, with significant annual drops. Current and forecast payout ratios of 50.8% and 53.5% suggest dividends are covered by earnings, though the yield of 3.39% is below top-tier Swiss market payers at 3.83%. Trading at a discount to estimated fair value, recent strategic downsizing from Middle Eastern operations may impact future earnings stability and dividend reliability.

- Click to explore a detailed breakdown of our findings in Liechtensteinische Landesbank's dividend report.

- Our valuation report unveils the possibility Liechtensteinische Landesbank's shares may be trading at a discount.

Where To Now?

- Gain an insight into the universe of 224 Top European Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IPS

Ipsos

Through its subsidiaries, provides survey-based research services for companies and institutions in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives