A Look at Eutelsat (ENXTPA:ETL) Valuation Following Greenland OneWeb Connectivity Deal

Reviewed by Kshitija Bhandaru

Eutelsat Communications (ENXTPA:ETL) just announced a multi-year deal to expand its OneWeb low Earth orbit connectivity to Greenland. The company aims to deliver secure communications across the country’s wide and remote regions.

See our latest analysis for Eutelsat Communications.

Momentum has surged for Eutelsat Communications recently, with a 37% share price return in the past month and a remarkable 78% gain year-to-date, following news of the Greenland deal and key board appointments. However, the stock’s longer-term total shareholder returns remain deeply in the red. This underscores that while the short-term growth story is compelling, the company is still recovering from a challenging period.

If this story of renewed momentum caught your interest, consider broadening your search and discover fast growing stocks with high insider ownership.

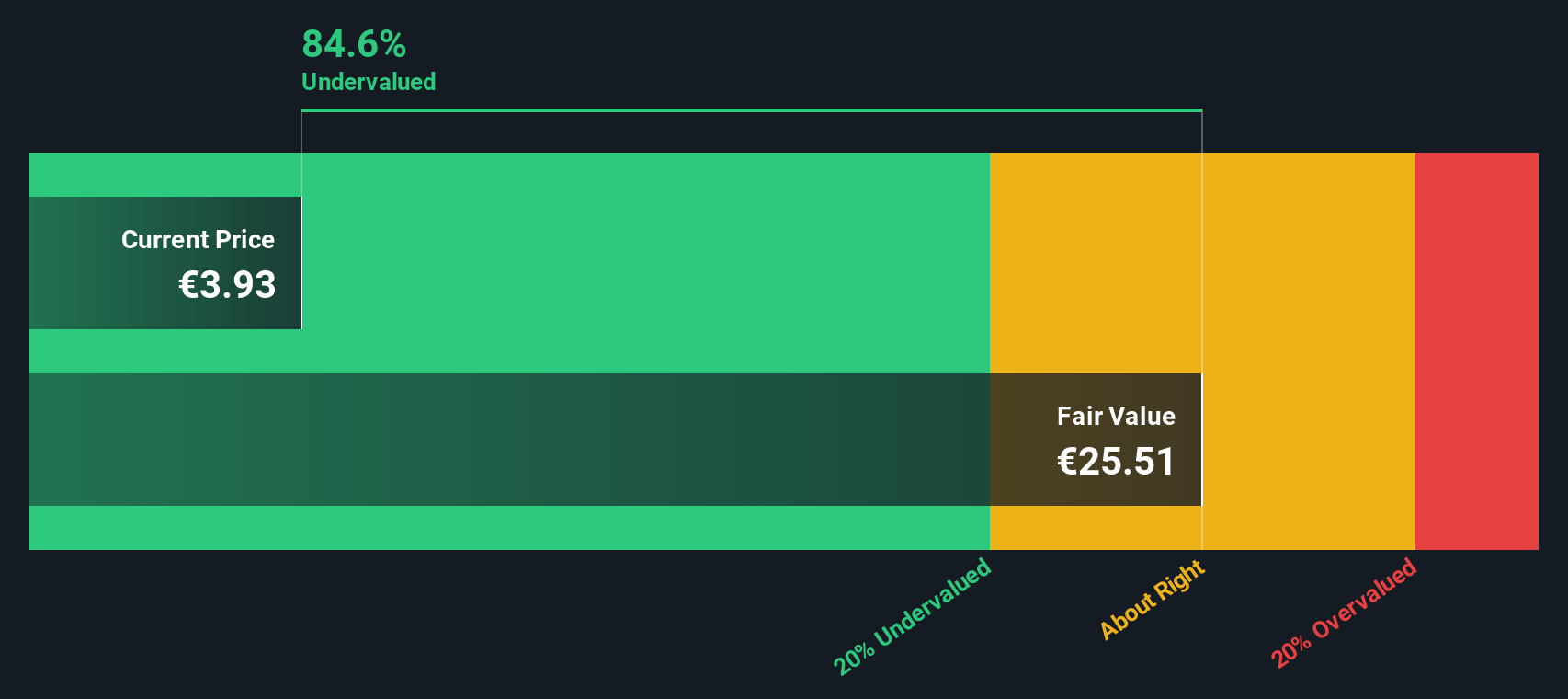

With the stock surging alongside positive news, investors may be wondering if Eutelsat Communications remains undervalued despite its recovery, or if the market has already priced in the company’s future growth potential. Is there still a buying opportunity?

Most Popular Narrative: 16% Overvalued

The most widely followed valuation narrative puts Eutelsat Communications’ fair value at €3.39, slightly below its last close of €3.93. The gap reflects optimism about future growth, but also hints at some overheated expectations in today’s price.

The signing of the SpaceRISE consortium agreement and the IRIS² multi-orbit constellation project is a catalyst for growth, as it represents significant investment in future satellite infrastructure and is expected to generate around €6.5 billion in revenues over a 12-year concession period, which will positively impact future revenue streams.

Curious what dramatic financial assumptions are driving this price target? Hint: key calculations rely on a bold swing in margins, futuristic revenue estimates, and a valuation multiple that will surprise even seasoned investors. Want the story behind the numbers? Take a peek at what could move the market.

Result: Fair Value of €3.39 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition in the GEO segment and ongoing financial headwinds could significantly impact revenue stability and present challenges to Eutelsat’s recovery story.

Find out about the key risks to this Eutelsat Communications narrative.

Another View: SWS DCF Model Says Deeply Undervalued

While analysts’ price targets suggest Eutelsat Communications is slightly overvalued, our SWS DCF model offers a radically different take. It estimates a fair value of €25.51 per share. This means the current market price is nearly 85% below what the model suggests. Could the market be missing a major upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eutelsat Communications for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eutelsat Communications Narrative

Don’t just take these views at face value. Explore the figures for yourself and craft a narrative that fits your own perspective: Do it your way.

A great starting point for your Eutelsat Communications research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investing strategy to the next level and seize fresh opportunities before everyone else by tapping into these smart, pre-screened picks:

- Uncover companies poised for strong returns when you tap into these 891 undervalued stocks based on cash flows and focus on stocks offering genuine value based on their cash flows.

- Spot the trends changing healthcare by checking out these 32 healthcare AI stocks, a selection driven by innovation in artificial intelligence for better health outcomes.

- Set your sights on potential growth with these 3575 penny stocks with strong financials, highlighting lesser-known stocks with robust financials and breakthrough potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ETL

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives