- France

- /

- Entertainment

- /

- ENXTPA:BOL

Bolloré Shares Climb Amid Volatility But Do Recent Earnings Justify the Current Price?

Reviewed by Simply Wall St

If you have been watching Bolloré’s stock and wondering whether it is time to buy, sell, or simply stay put, you are certainly not alone. With Bolloré closing most recently at €4.89, investors are left debating what’s next after a rather mixed ride. Over the past week, shares have nudged upward by 0.4%. That short burst sits in sharp contrast to a longer pattern: a drop of 2.0% over the last month, and declines of 17.3% year-to-date and 16.3% over the past year. Yet, looking further back, the story becomes more encouraging, with the stock up 6.4% over three years and a hefty 67.9% over five.

What is driving these shifts? Part of the movement in recent weeks can be traced to changing market dynamics in the sectors where Bolloré operates. Broader European market sentiment has shifted as investors digest changes in economic outlook and sector rotations, which have rippled through to companies like Bolloré. While there has not been major news directly tied to Bolloré’s operations lately, these wider forces can weigh on prices and, at times, reveal interesting pockets of value.

Speaking of value, if you are hoping Bolloré is a hidden bargain, the company’s current valuation score is 1 out of 6. This means it is flagged as undervalued by just one of the six key valuation metrics we will be breaking down. However, do not get too comfortable with just the raw numbers. In the sections that follow, we will dive into how each valuation approach sees Bolloré and, ultimately, why one method of looking at valuation might give you a deeper edge.

Bolloré scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Bolloré Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future cash flows and discounting them back to today’s value. This approach offers a snapshot of what Bolloré’s future financial health could mean for investors right now.

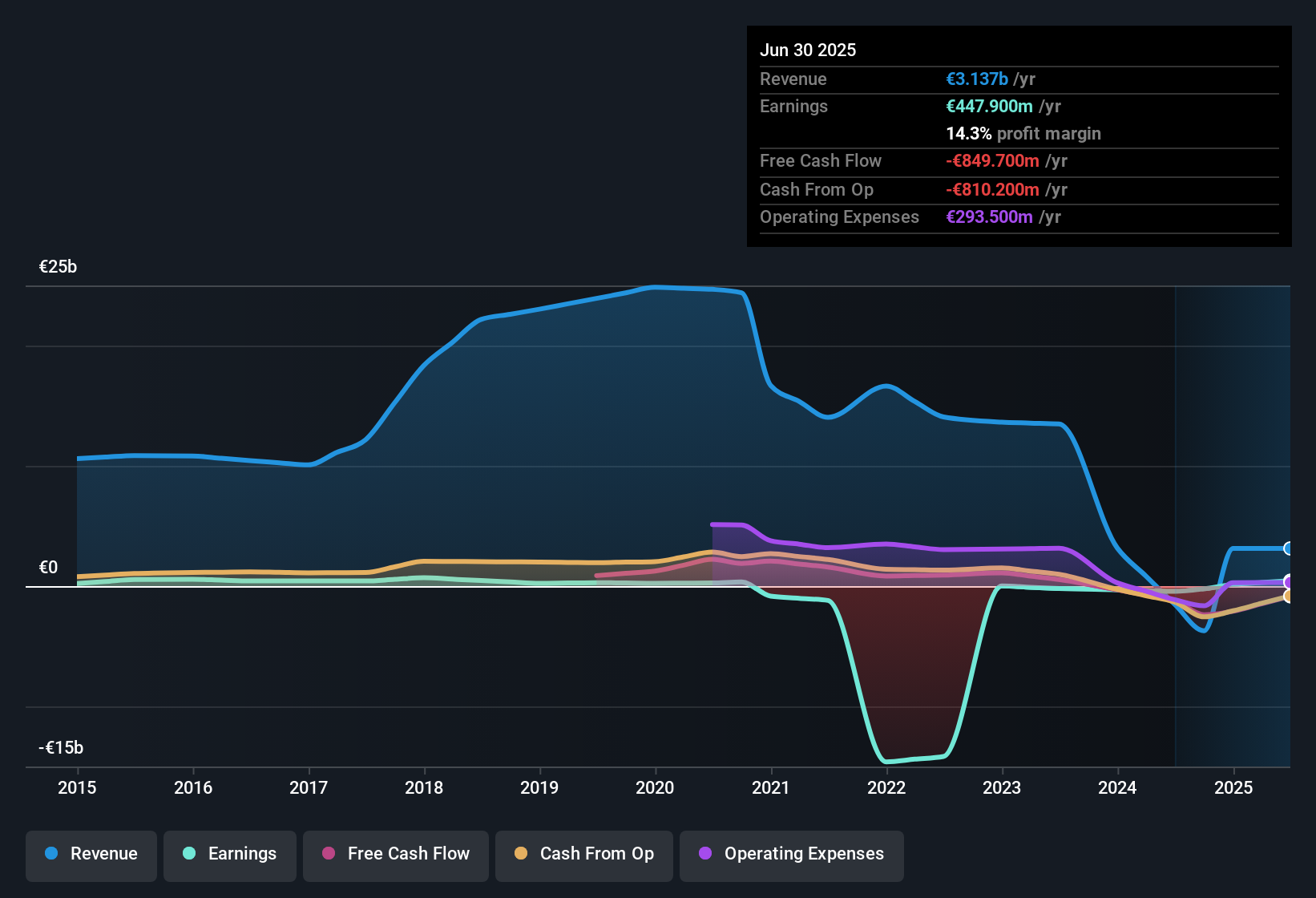

According to the latest analysis, Bolloré’s last twelve months of Free Cash Flow (FCF) was negative, amounting to -€2.13 billion. Looking ahead, analyst projections indicate a rebound, with FCF expected to reach €671 million by 2027. Projections beyond five years, which are extrapolated instead of directly forecasted, suggest modest growth, with FCF estimates climbing towards €671 million by 2035. Year-over-year growth appears gradual.

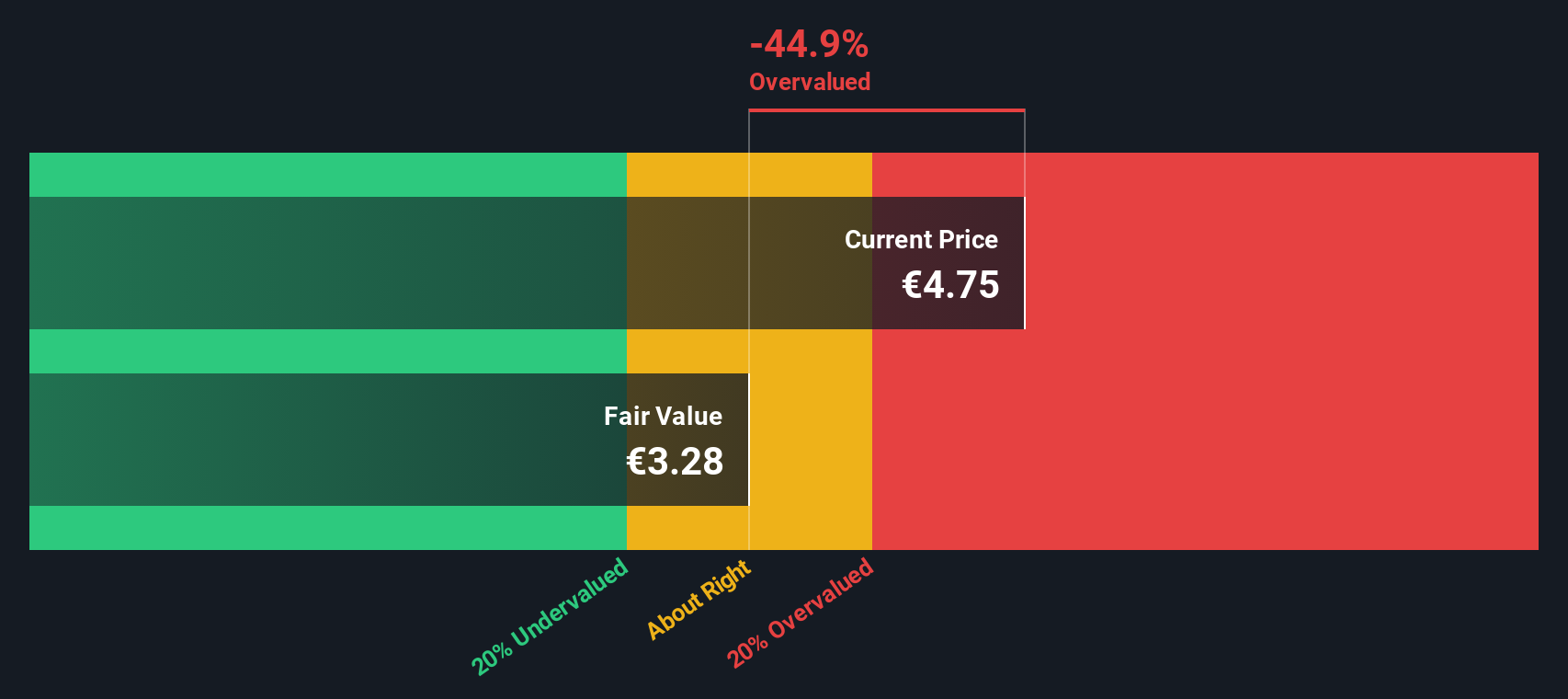

After these numbers are processed through the DCF model, the estimated intrinsic value of Bolloré stands at €3.19 per share. When compared to the current market price of €4.89, this valuation shows the stock is trading at a 53.2% premium to its projected worth. In other words, the DCF model indicates that Bolloré is significantly overvalued based on the company’s expected cash generation over the next decade.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Bolloré.

Approach 2: Bolloré Price vs Earnings

Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies, as it directly connects a company’s market price to its actual earnings. A higher PE ratio can reflect strong growth expectations or unusually low risk, while a lower PE may point to doubts about future growth or higher perceived risk.

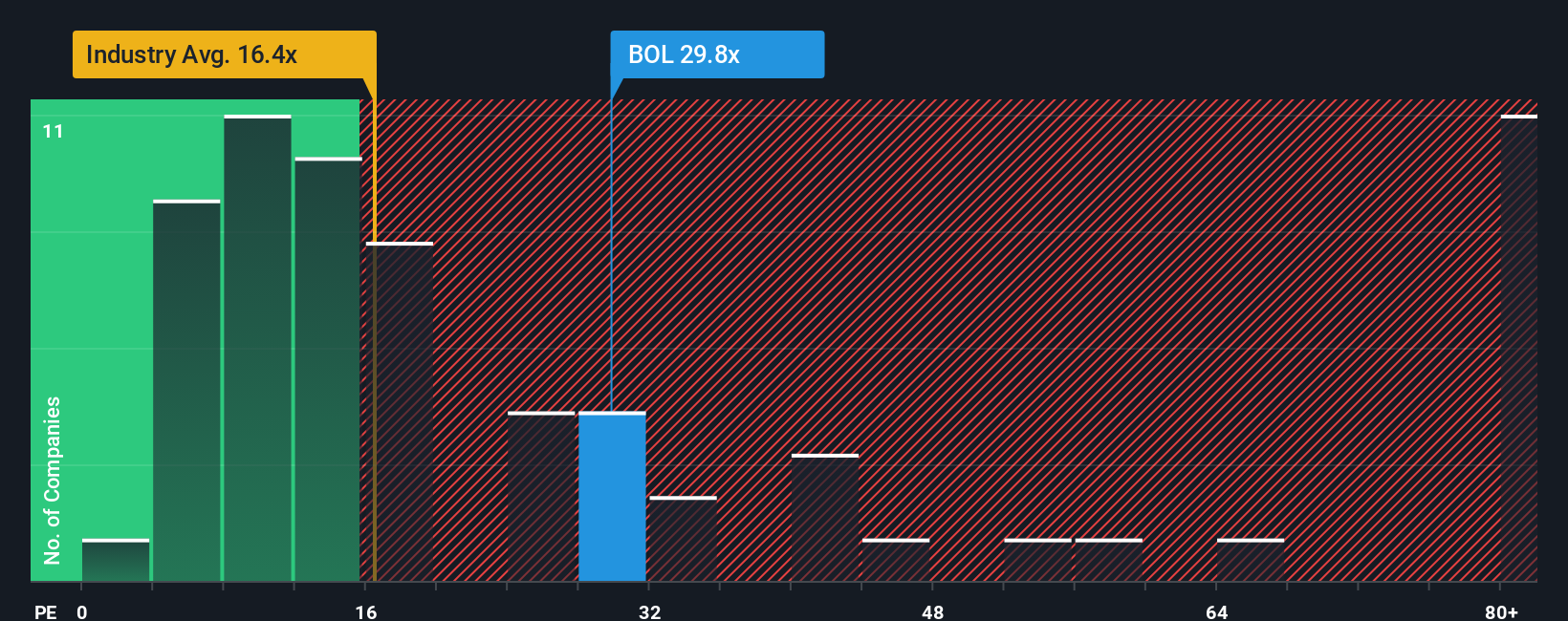

Bolloré currently trades at a PE ratio of 97.1x, which stands out compared to its Entertainment industry average of 23.8x and a peer average of 24.8x. These benchmarks serve as useful context, but without factoring in things like the company’s specific growth outlook, profit margins, and risks, they only tell part of the story.

This is where Simply Wall St's proprietary Fair Ratio comes in. The Fair Ratio for Bolloré, calculated at 22.9x, offers a refined benchmark by adjusting for not just industry averages but also the company’s earnings growth potential, margin profile, risk factors, and market cap. Unlike simple peer or sector comparisons, the Fair Ratio delivers a more complete assessment of what investors should truly expect given current company dynamics.

With Bolloré’s actual PE of 97.1x sitting far above its Fair Ratio of 22.9x, the stock appears significantly overvalued on this metric.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Bolloré Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your perspective on a company, where you tell the story behind the numbers by setting your own assumptions for fair value, future revenue, earnings, and margins.

With Narratives, you connect a company’s story to a concrete financial forecast, which then leads to your own view of fair value. This approach goes far beyond just looking at ratios or trends. It helps you make investment decisions by directly comparing your Fair Value to the current market Price.

Accessible and easy to use right from Simply Wall St’s Community page, Narratives are available to millions of investors and update dynamically whenever new information, such as breaking news or fresh earnings, comes in. This means your outlook always reflects the latest developments.

For example, one Bolloré Narrative may forecast significant growth and set a much higher Fair Value estimate, while another could anticipate tougher conditions and arrive at a lower Fair Value. This allows you to instantly see how different viewpoints lead to different decisions.

Do you think there's more to the story for Bolloré? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bolloré might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BOL

Bolloré

Engages in the transportation and logistics, communications, and industry businesses in France, rest of Europe, the Americas, the Asia-Pacific, and Africa.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives