Reworld Media Société Anonyme (EPA:ALREW) Might Not Be As Mispriced As It Looks After Plunging 25%

The Reworld Media Société Anonyme (EPA:ALREW) share price has fared very poorly over the last month, falling by a substantial 25%. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

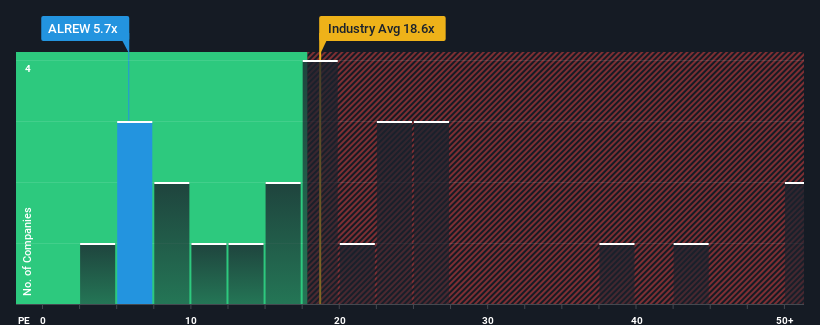

Since its price has dipped substantially, given about half the companies in France have price-to-earnings ratios (or "P/E's") above 16x, you may consider Reworld Media Société Anonyme as a highly attractive investment with its 5.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Earnings have risen at a steady rate over the last year for Reworld Media Société Anonyme, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

View our latest analysis for Reworld Media Société Anonyme

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Reworld Media Société Anonyme would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a decent 6.7% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 88% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 17% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Reworld Media Société Anonyme's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Reworld Media Société Anonyme's P/E

Reworld Media Société Anonyme's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Reworld Media Société Anonyme currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Reworld Media Société Anonyme (including 1 which is a bit unpleasant).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALREW

Reworld Media Société Anonyme

Engages in the thematic media business in France.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026