Bilendi (ENXTPA:ALBLD) Valuation Discount Reinforces Bullish Narrative After Accelerating Earnings Growth

Reviewed by Simply Wall St

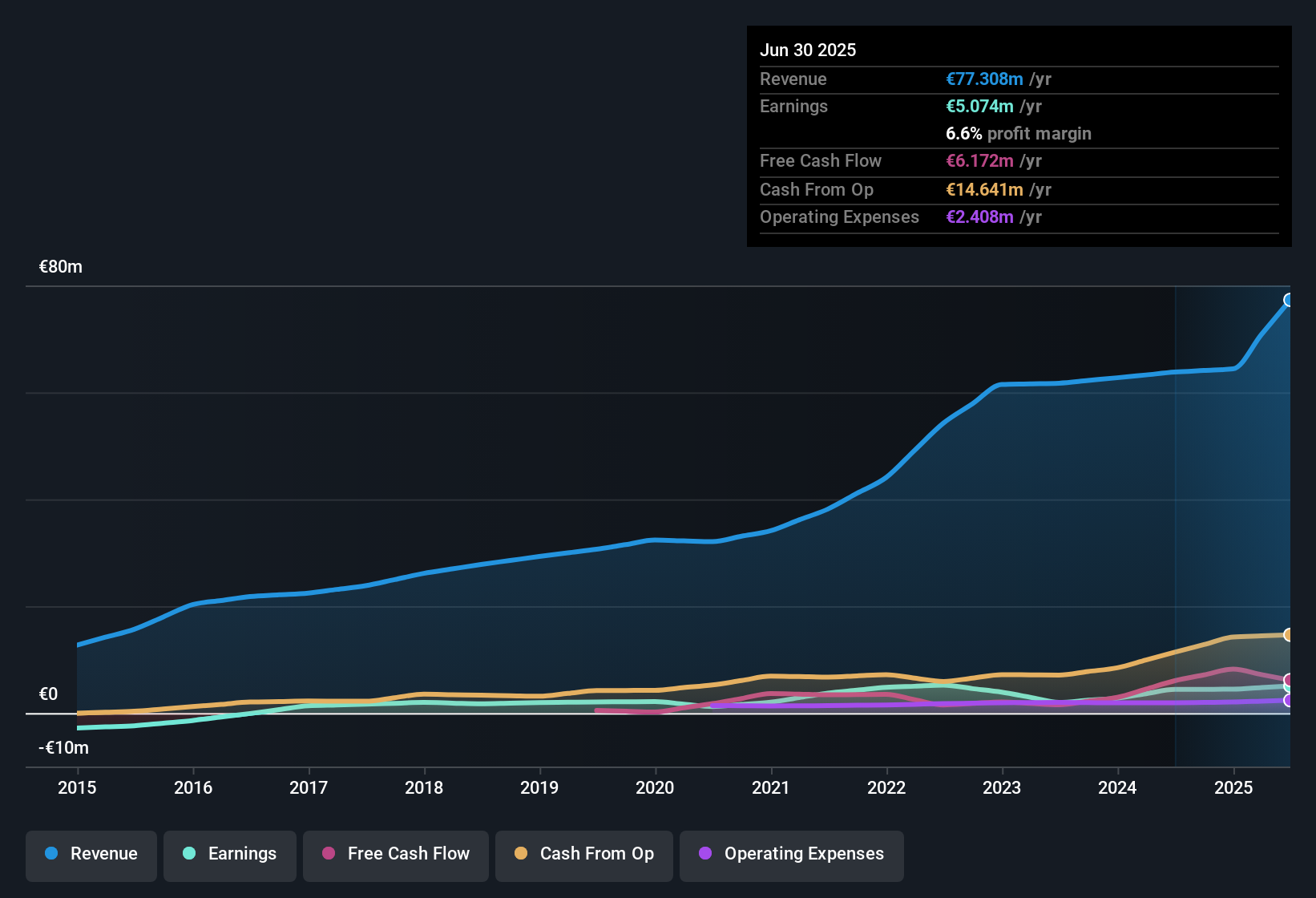

Bilendi (ENXTPA:ALBLD) posted annual earnings growth of 14.4% for the most recent year, up from a five-year average of 10.6%. Net profit margin landed at 6.6%, just under last year’s 7%. With earnings now forecast to rise by 26.57% per year, outpacing both the company’s own history and the French market, investors have plenty of growth to factor in.

See our full analysis for Bilendi.As always, the next step is measuring how these results stack up to the leading narratives. Some expectations will be confirmed, while others might come into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Holds Firm Amid Rapid Growth

- Bilendi posted a net profit margin of 6.6% for the year, just slightly below the prior year’s 7%, even as revenue is forecast to accelerate by 12.3% annually. This rate is more than double the French market average of 5.4%.

- Prevailing optimism among investors is anchored in the company’s ability to combine high expected top-line growth with margin resilience, a trend often touted as a signal of business quality.

- Where some growth stories see margin erosion as sales ramp up, Bilendi’s performance challenges that risk by keeping margins relatively steady while guidance points to even stronger gains ahead.

- This dynamic heavily supports the view that Bilendi is well-positioned in the highly competitive market research sector and makes its growth cycle appear more durable than many digital peers.

Financial Position Lags Operational Momentum

- Despite robust profit and sales growth prospects, Bilendi’s financial position was not rated as strong in the filings. This highlights a disconnect between operational momentum and balance sheet strength.

- Prevailing skepticism around the company centers on whether weaker financial health could eventually constrain growth or valuation.

- While there are no major flagged risks from the filings, cautious investors may question the ability to withstand market shocks or pursue strategic investments if the company’s financial footing does not improve.

- This tension means that, for some, rapid profit growth alone is not enough to outweigh reservations about underlying stability when compared to stronger-capitalized sector rivals.

DCF Valuation Deepens Discount Case

- With shares trading at €22.30, less than 55% of the DCF fair value estimate of €43.50, Bilendi sits at a far steeper discount than both peer group averages and the broader French media sector’s price-to-earnings ratio.

- The current gap between price and DCF fair value intensifies the investment appeal for those viewing Bilendi as a growth bargain.

- Strong expected profit growth rates and the deep DCF discount both reinforce the case for re-rating if forecasts materialize in coming years.

- Investors focused on valuation multiples may see this as a rare chance to buy accelerating growth at a below-market price, especially given the company’s resilient profit margins and market outperformance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bilendi's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Bilendi’s robust profit outlook, its weaker financial position raises concerns about resilience compared to sector peers with stronger balance sheets.

If solid fundamentals matter to you, now is the time to explore companies with steadier finances and growth momentum by checking out our solid balance sheet and fundamentals stocks screener (1977 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilendi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALBLD

Bilendi

Provides services for market research and customer engagement and loyalty services in France, United Kingdom, Germany, Switzerland, Spain, Italy, Morocco, Denmark, Sweden, Finland, Belgium, the Netherlands, and Mauritius.

Good value with reasonable growth potential.

Market Insights

Community Narratives