Verallia Société Anonyme (ENXTPA:VRLA) Eyes Growth with €600M Bond and Strong Dividend Yield

Reviewed by Simply Wall St

Verallia Société Anonyme (ENXTPA:VRLA) has recently announced a €600 million fixed-income offering with a 3.875% senior unsecured bond, signaling a strategic move to enhance financial flexibility as raw material costs rise. Challenges such as a 40.9% decline in earnings and a high net debt to equity ratio persist, yet Verallia continues to attract investor interest due to its appealing valuation and strong dividend yield. The following discussion will explore the company's strategic initiatives, financial health, and emerging market opportunities, providing insights into its growth potential and the external threats it faces.

Click to explore a detailed breakdown of our findings on Verallia Société Anonyme.

Core Advantages Driving Sustained Success for Verallia Société Anonyme

With a Price-To-Earnings Ratio of 11.2x, Verallia is trading significantly below the industry average, reflecting an attractive valuation for investors. Analysts' confidence is bolstered by a target price more than 20% above the current share price, underlining anticipated growth. The company's strategic initiatives, including product innovation and customer engagement, have led to a 15% year-over-year revenue increase, as noted by CEO Patrice Lucas. Moreover, Verallia's high Return on Equity, projected at 31.6% over three years, and a strong dividend yield of 7.96%, highlight its financial health and commitment to shareholder returns. In addition, the recent fixed-income offering of €600 million in senior unsecured bonds indicates a strategic move to strengthen financial flexibility.

To dive deeper into how Verallia Société Anonyme's valuation metrics are shaping its market position, check out our detailed analysis of Verallia Société Anonyme's Valuation.Internal Limitations Hindering Verallia Société Anonyme's Growth

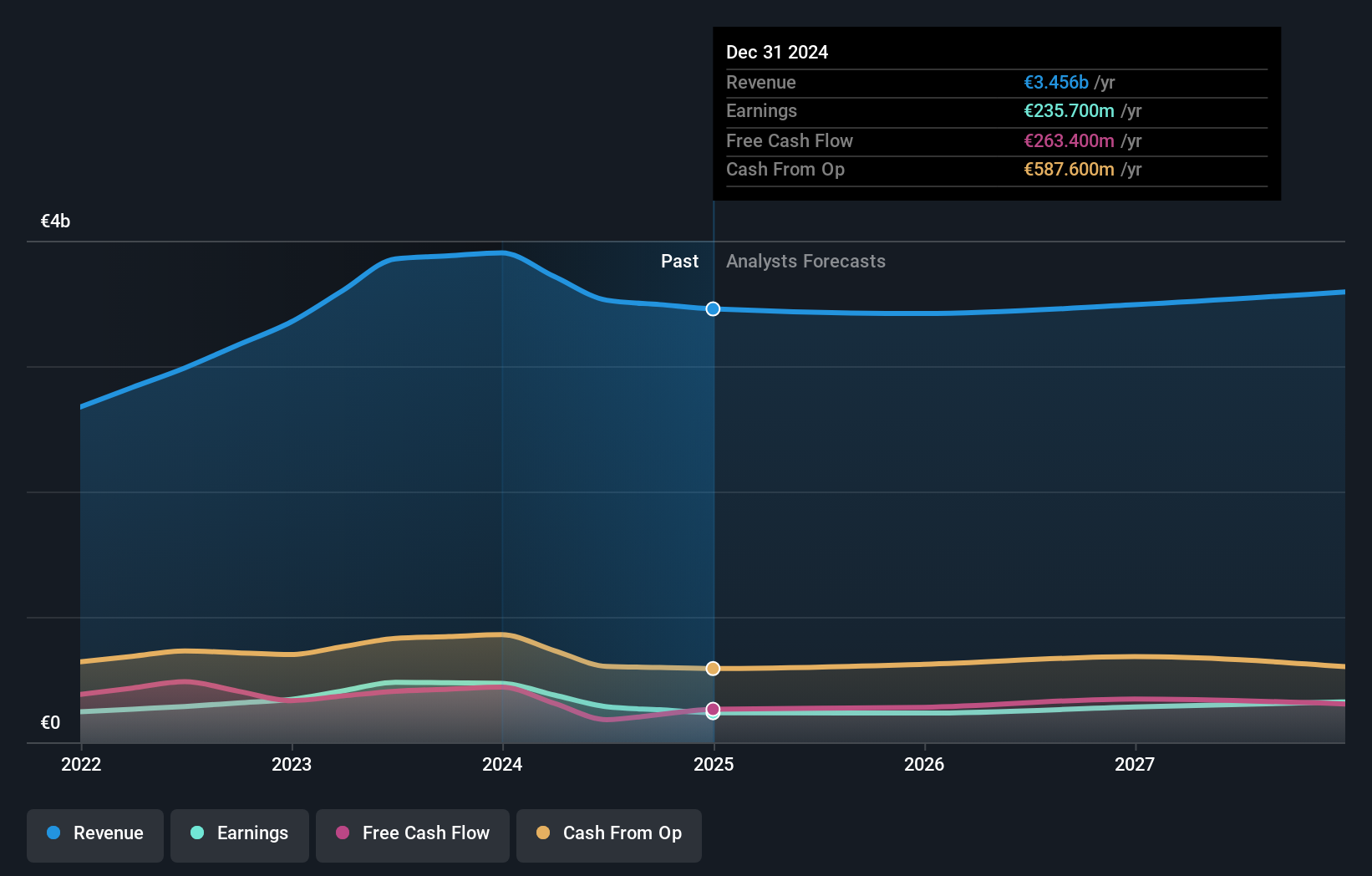

Verallia faces challenges with slower revenue growth of 1.7% annually, compared to the French market average of 5.6%. The past year's earnings have seen a 40.9% decline, impacting profitability and reducing net profit margins from 12.4% to 8%. The high net debt to equity ratio of 172.5% raises concerns about financial stability, especially as dividend payments are not fully covered by earnings. These financial challenges are compounded by rising raw material costs, which the company is actively addressing to protect margins, as highlighted by CEO Patrice Lucas.

To gain deeper insights into Verallia Société Anonyme's historical performance, explore our detailed analysis of past performance.Emerging Markets Or Trends for Verallia Société Anonyme

Opportunities abound with analysts predicting a 35.5% rise in stock price, suggesting significant capital appreciation potential. The company's focus on product innovation, exemplified by the successful launch of three new product lines, positions it well to capture emerging market trends. Additionally, Verallia's strategic alliances and the undervaluation based on discounted cash flow analysis indicate room for price appreciation, enhancing its market position.

See what the latest analyst reports say about Verallia Société Anonyme's future prospects and potential market movements.External Factors Threatening Verallia Société Anonyme

However, external threats such as a €142.5 million one-off loss could dampen investor confidence. High debt levels pose risks to financial stability, potentially affecting future earnings and dividends. Furthermore, economic uncertainties and supply chain disruptions, as acknowledged by Patrice Lucas, present ongoing challenges that Verallia must navigate strategically to maintain its competitive edge and market share.

Learn about Verallia Société Anonyme's dividend strategy and how it impacts shareholder returns and financial stability.Conclusion

Verallia Société Anonyme presents a compelling investment opportunity, trading at a share price of €27, significantly below its estimated fair value of €80.7. This discrepancy highlights the potential for substantial price appreciation, driven by strategic initiatives in product innovation and customer engagement that have already resulted in a 15% revenue increase. While the company faces challenges such as a high net debt to equity ratio and declining profit margins, its strong return on equity and dividend yield underscore its financial resilience and commitment to shareholder returns. Verallia must address external threats like economic uncertainties and supply chain disruptions to sustain its competitive edge and capitalize on its undervaluation for future growth.

Make It Happen

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ENXTPA:VRLA

Verallia Société Anonyme

Manufactures and sells glass packaging products for beverages and food products worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives