As European markets grapple with concerns over Middle East tensions, the pan-European STOXX Europe 600 Index has seen a decline of 1.54%, reflecting broader economic uncertainties and inflation pressures across the region. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those seeking to navigate market volatility while benefiting from regular payouts.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.50% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.63% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.60% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.97% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.30% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.66% | ★★★★★★ |

| ERG (BIT:ERG) | 5.37% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.53% | ★★★★★★ |

Click here to see the full list of 240 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

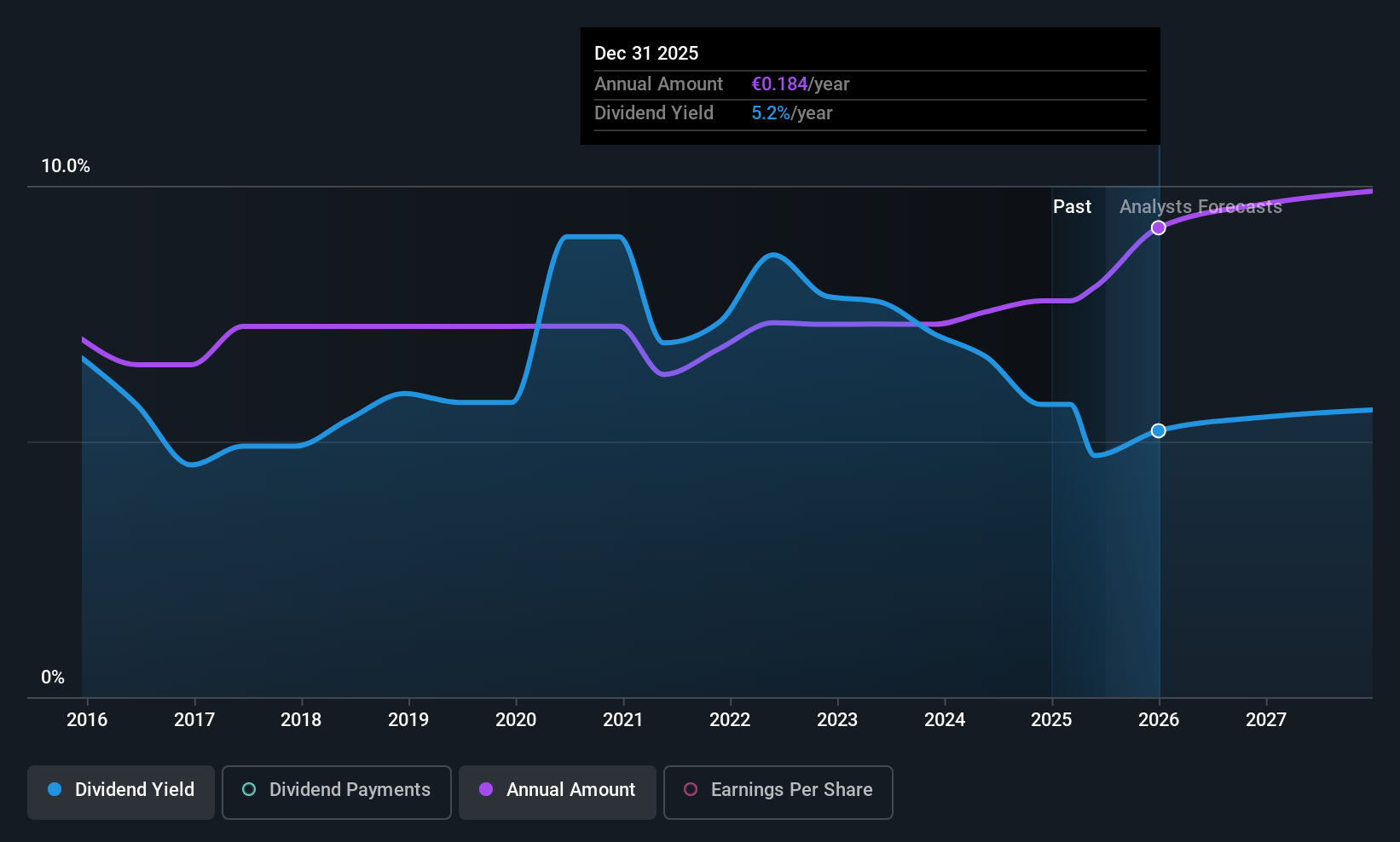

Mapfre (BME:MAP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mapfre, S.A. operates in the investment, insurance, property, financial, and services sectors in Spain with a market cap of approximately €10.42 billion.

Operations: Mapfre's revenue segments include EMEA (€1.72 billion), Brazil (€5.23 billion), Iberia (€8.72 billion), Global Risks (€2.48 billion), and North America (€3.12 billion).

Dividend Yield: 4.7%

Mapfre's dividend strategy is supported by a sustainable payout ratio of 50.8% and a cash payout ratio of 40.6%, indicating strong coverage by earnings and cash flows. The company declared a final dividend of €0.095 per share, payable on May 29, 2025, maintaining its history of reliable and stable dividends over the past decade. While trading at good value relative to peers, Mapfre's yield slightly lags behind the top tier in Spain's market.

- Click here to discover the nuances of Mapfre with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Mapfre is trading behind its estimated value.

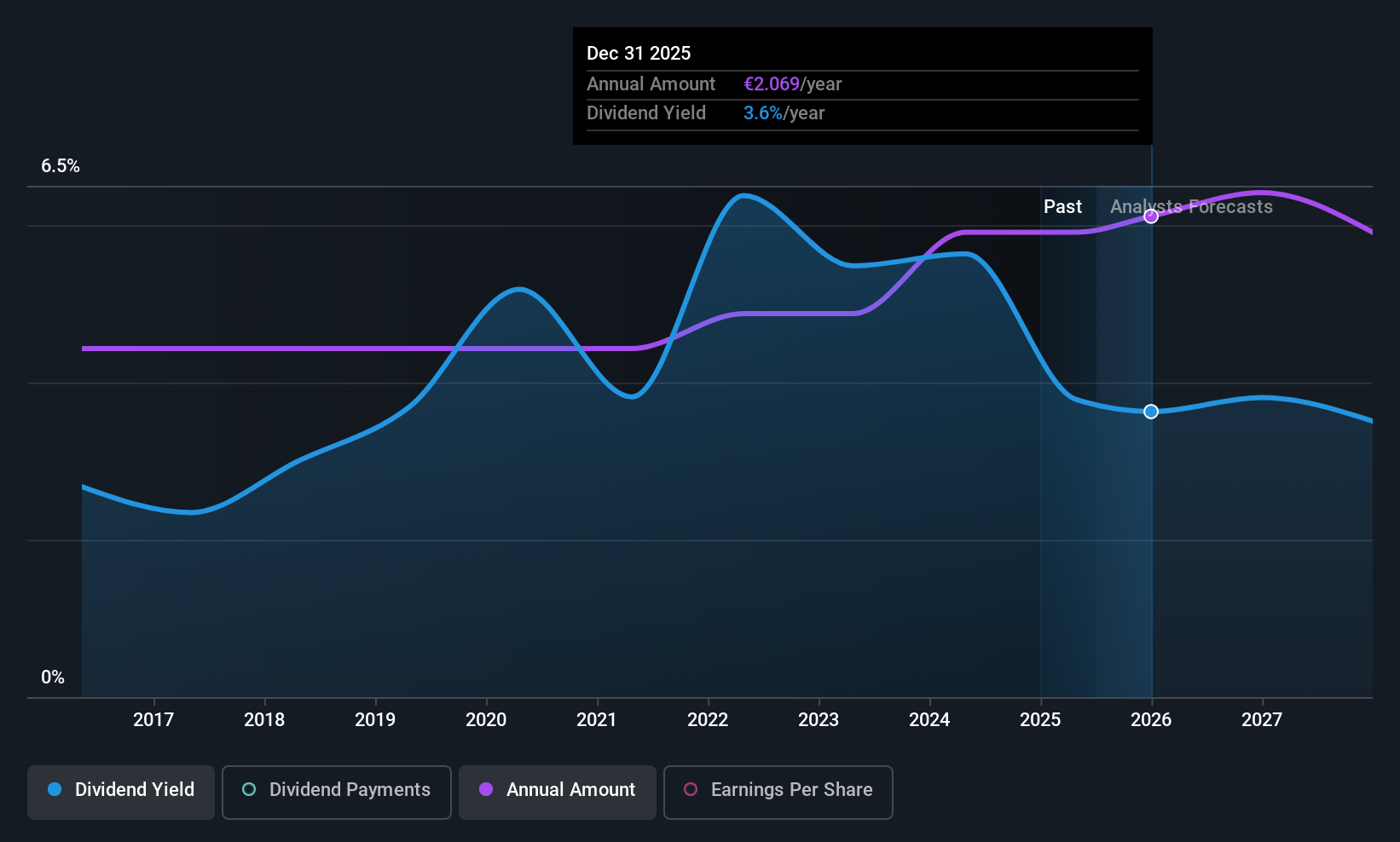

Vicat (ENXTPA:VCT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Vicat S.A., along with its subsidiaries, operates in the construction industry by producing and selling cement, ready-mixed concrete, and aggregates, with a market cap of approximately €2.52 billion.

Operations: Vicat S.A.'s revenue is primarily derived from its Cement segment, which generated €2.45 billion, and its Concrete & Aggregates segment, contributing €1.53 billion.

Dividend Yield: 3.5%

Vicat's dividend strategy is robust, with a low cash payout ratio of 24.9% and a payout ratio of 32.6%, ensuring strong coverage by earnings and cash flows. Although the yield of 3.53% is below France's top dividend payers, Vicat offers stable dividends that have grown consistently over the past decade without volatility. The stock trades at good value, significantly below its estimated fair value, presenting an attractive opportunity for investors seeking reliable income sources in Europe.

- Unlock comprehensive insights into our analysis of Vicat stock in this dividend report.

- Our valuation report here indicates Vicat may be undervalued.

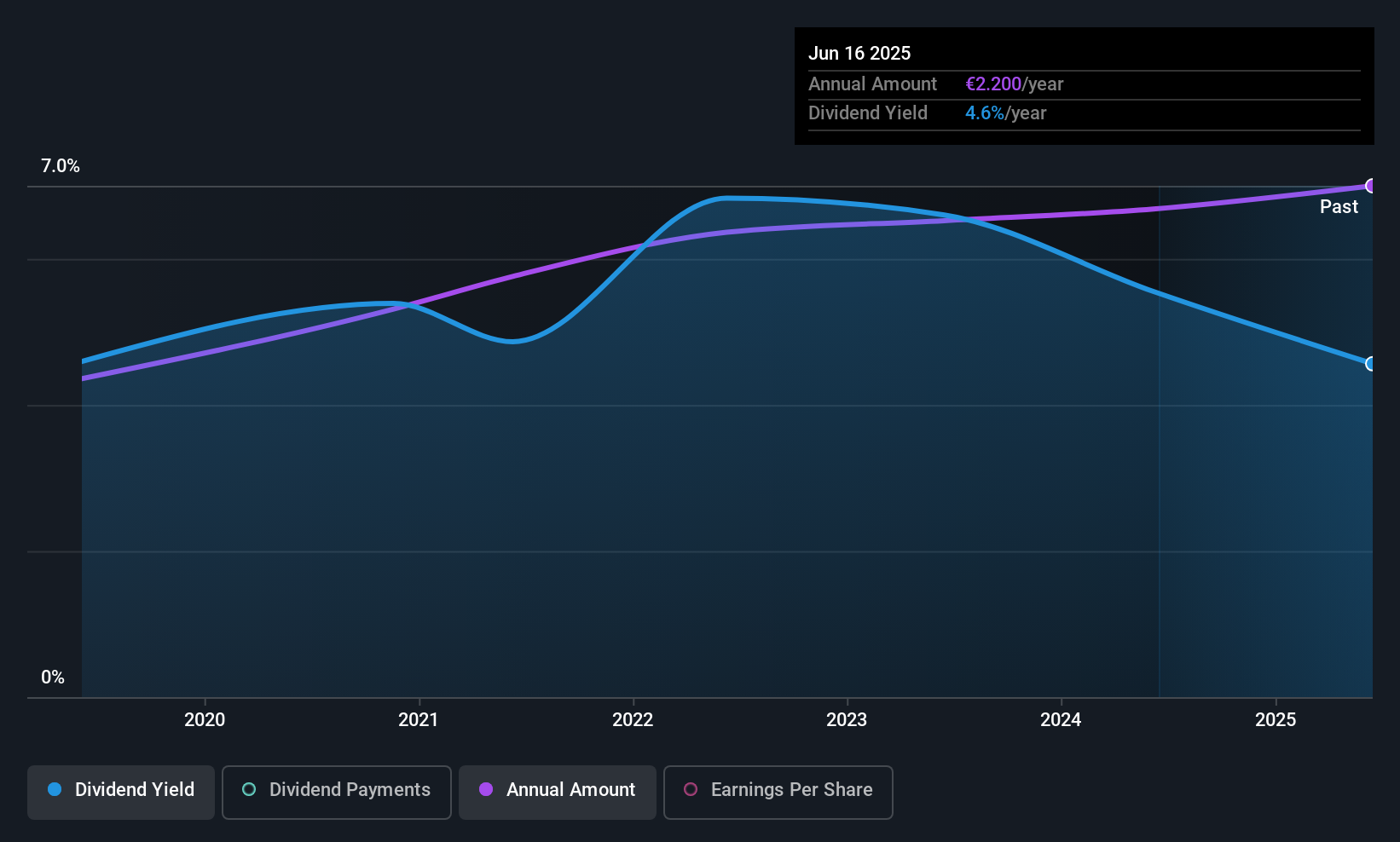

DWS Group GmbH KGaA (XTRA:DWS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DWS Group GmbH & Co. KGaA provides asset management services across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of €9.78 billion.

Operations: DWS Group GmbH & Co. KGaA generates revenue primarily from its asset management services, totaling €4.24 billion.

Dividend Yield: 4.5%

DWS Group GmbH KGaA's dividend yield of 4.5% places it among the top 25% of German dividend payers, with dividends reliably covered by earnings and cash flows, given payout ratios of 67.8% and 65.2%, respectively. Despite a relatively short history of six years in paying dividends, DWS has shown consistent growth in payments without volatility. Recent earnings growth and strategic plans for acquisitions could further enhance its position within Europe's competitive asset management industry.

- Navigate through the intricacies of DWS Group GmbH KGaA with our comprehensive dividend report here.

- The analysis detailed in our DWS Group GmbH KGaA valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Explore the 240 names from our Top European Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:MAP

Mapfre

Engages in the investment, insurance, property, financial, and services businesses in Spain.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives