Undiscovered Gems With Strong Fundamentals For December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with major indexes like the Russell 2000 underperforming larger-cap counterparts and economic indicators pointing to a cooling labor market, investors are increasingly attentive to the Federal Reserve's anticipated rate cut. In such an environment, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth; these undiscovered gems often exhibit robust financial health and solid business models that can withstand broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Chilanga Cement | NA | 12.53% | 25.20% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative (ENXTPA:CIV)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative offers banking services in France and has a market capitalization of approximately €389.89 million.

Operations: The cooperative generates revenue primarily from its retail banking segment, which contributes €299.55 million.

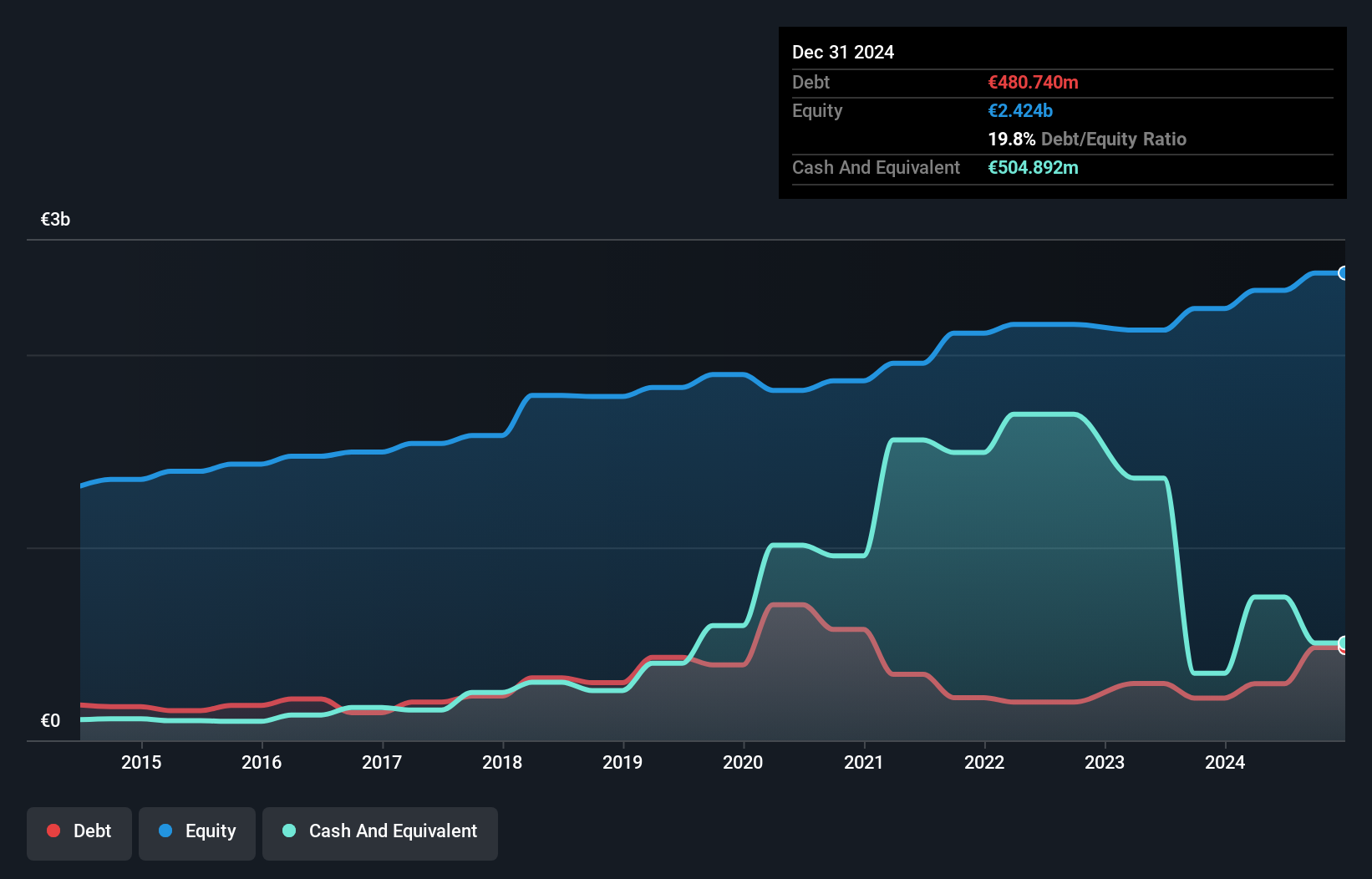

Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine, a cooperative bank with total assets of €20.2 billion and equity of €2.3 billion, stands out for its robust financial health. It boasts sufficient allowance for bad loans at 123% and maintains an appropriate level of non-performing loans at 1.5%. The bank's earnings grew by 17.9% over the past year, outpacing the industry average growth of 5.3%. Moreover, it trades at a significant discount to its estimated fair value by about 45%, suggesting potential undervaluation in the market context despite being primarily funded through low-risk customer deposits (93%).

Robertet (ENXTPA:RBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Robertet SA is a company that specializes in the production and sale of perfumes, aromas, and natural products with a market capitalization of €1.80 billion.

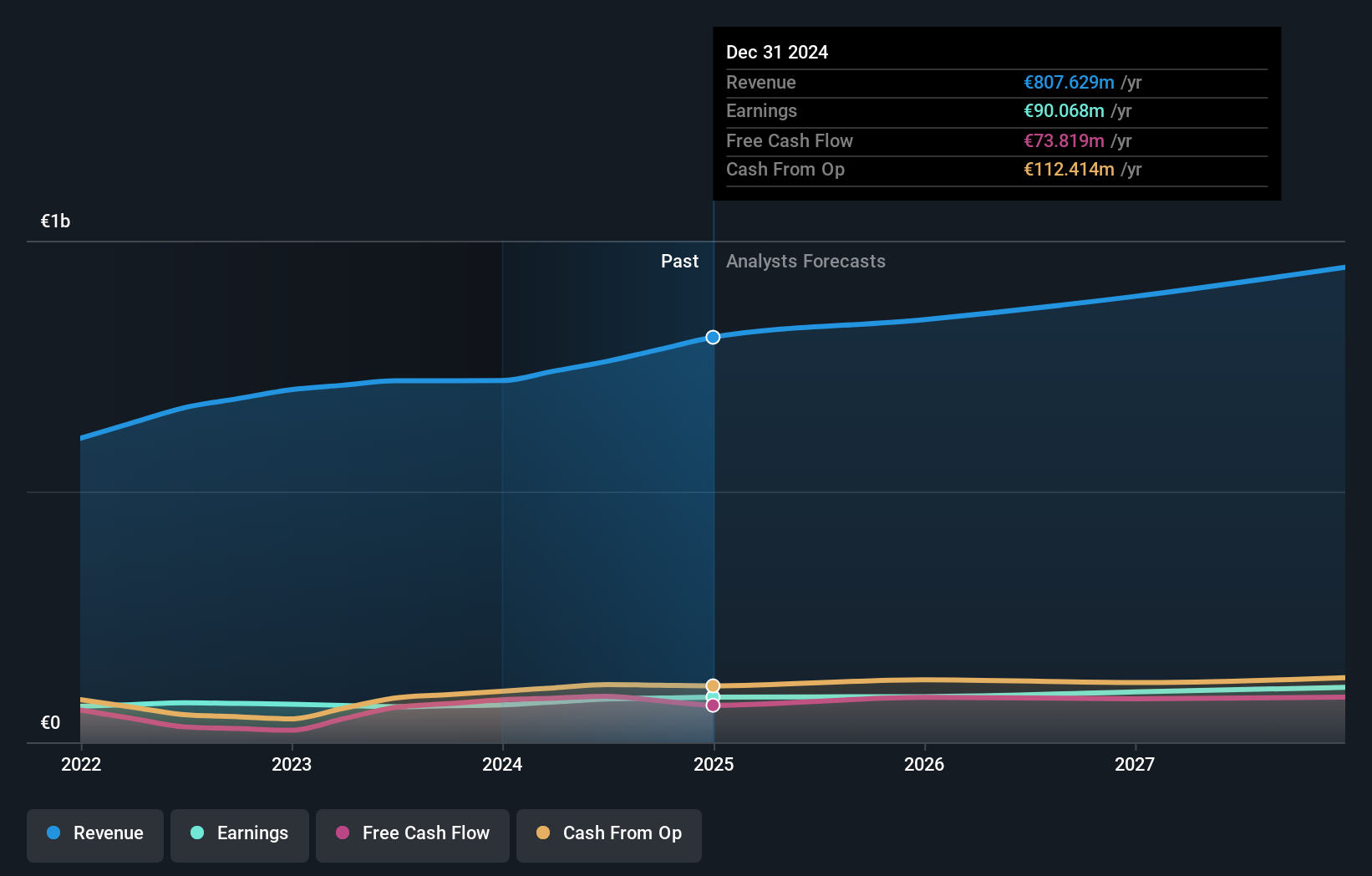

Operations: Robertet's revenue streams are primarily derived from its Aroma (€268.72 million), Perfumery (€290.80 million), and Raw Materials and Health & Beauty (€199.75 million) segments.

Robertet, a notable player in the fragrance and flavor industry, has demonstrated robust financial health with earnings growth of 21.8% over the past year, significantly outpacing the broader chemicals sector's -8.2%. This growth aligns with their reported sales increase to €414.58 million for the first half of 2024 from €376.44 million last year, while net income rose to €51.69 million from €39.94 million in the same period. Despite a rise in debt-to-equity ratio to 61.8% over five years, Robertet's net debt level remains satisfactory at 23.4%, and interest payments are well covered by EBIT at an impressive 18x coverage rate.

- Take a closer look at Robertet's potential here in our health report.

Understand Robertet's track record by examining our Past report.

Beijing ZZNode Technologies (SZSE:003007)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing ZZNode Technologies Co., Ltd. offers operation support system software and solutions for information networks and IT infrastructure to telecom operators and large enterprises in China, with a market cap of CN¥3.52 billion.

Operations: Beijing ZZNode Technologies generates revenue primarily from providing software and solutions for telecom operators and large enterprises in China. The company's financial data indicates a focus on maintaining efficient operations with attention to cost management, impacting its profitability metrics.

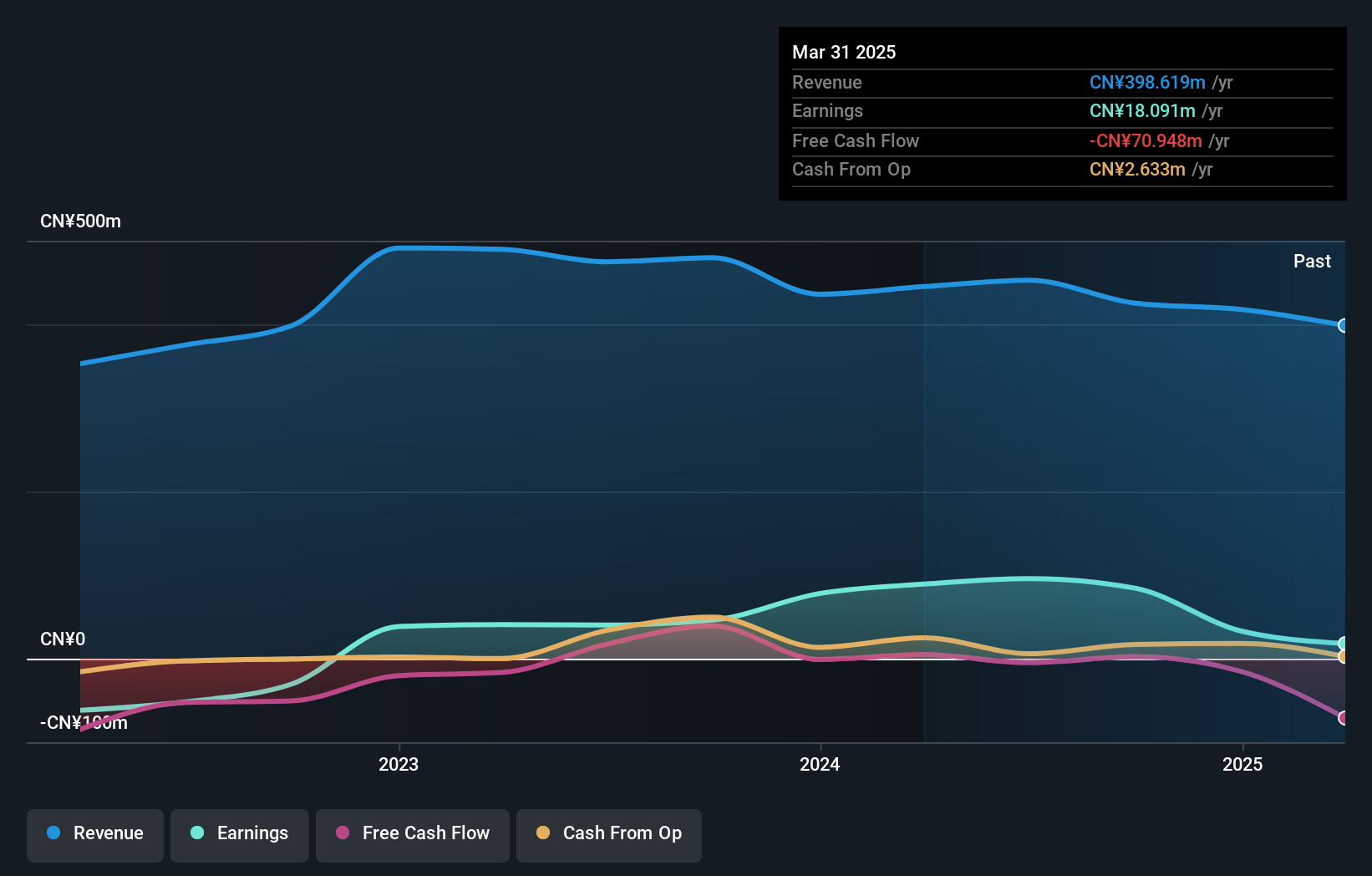

Beijing ZZNode Technologies, a smaller player in the tech space, is showing resilience despite some challenges. The company's debt to equity ratio has improved from 0.3% to 0.2% over five years, indicating better financial health. With a price-to-earnings ratio of 41.8x, it's attractively valued compared to the industry average of 97.7x. Their earnings growth of 82.6% last year outpaced the broader software industry decline of -11.2%. Although sales for nine months ending September fell slightly to CNY 187 million from CNY 198 million last year, net losses narrowed from CNY 47 million to CNY 41 million, suggesting potential operational improvements ahead.

- Navigate through the intricacies of Beijing ZZNode Technologies with our comprehensive health report here.

Learn about Beijing ZZNode Technologies' historical performance.

Seize The Opportunity

- Click through to start exploring the rest of the 4505 Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CIV

Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative

Provides banking services in France.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives