As the pan-European STOXX Europe 600 Index recently ended a two-week losing streak with a modest gain, hopes for increased government spending have buoyed investor sentiment despite ongoing concerns about U.S. tariffs. In this dynamic environment, identifying promising stocks requires careful consideration of companies that can navigate economic uncertainties and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| FRoSTA | 6.15% | 4.62% | 14.67% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -1.57% | -8.96% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Robertet (ENXTPA:RBT)

Simply Wall St Value Rating: ★★★★★☆

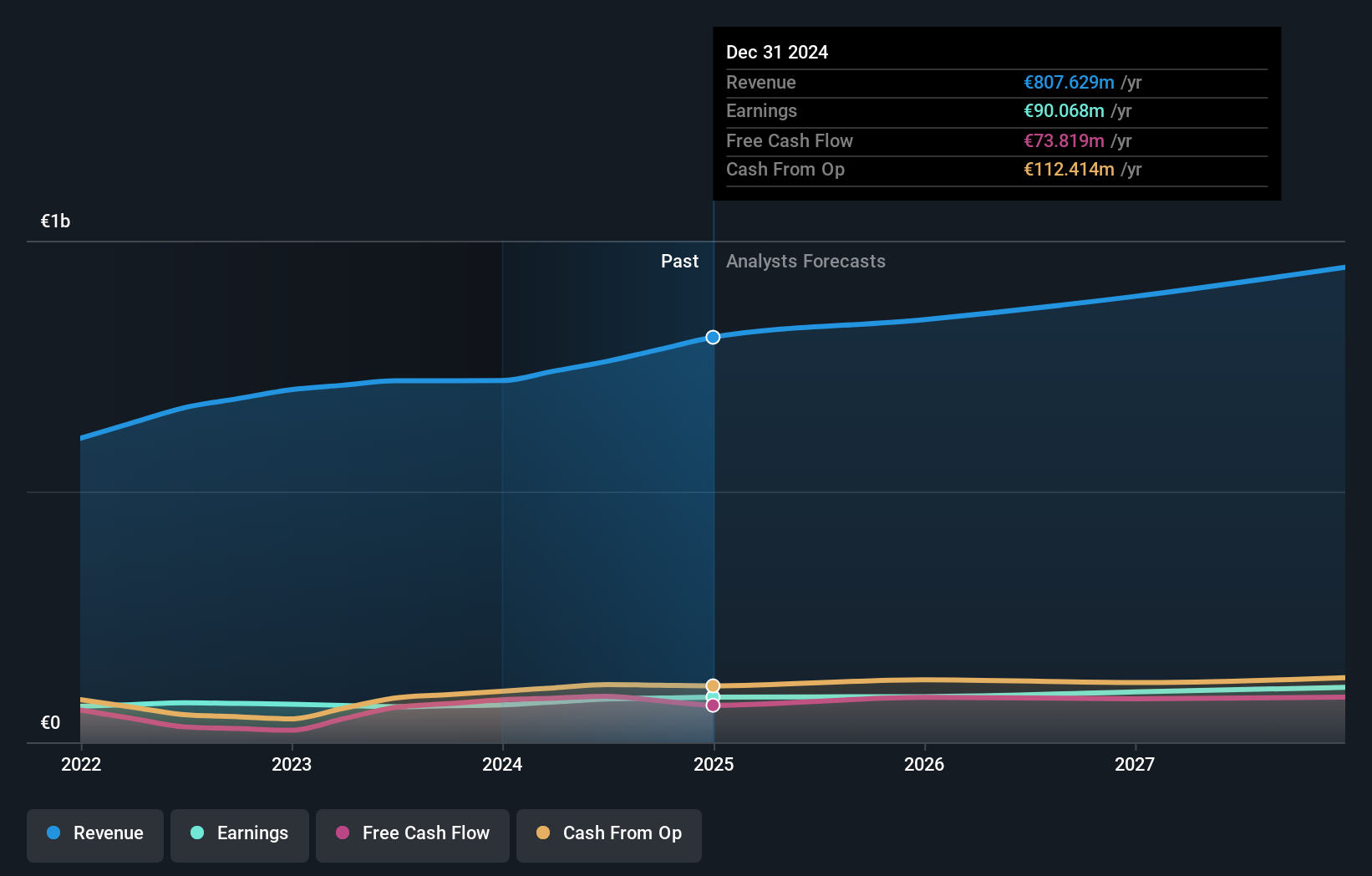

Overview: Robertet SA is a company that specializes in the production and sale of perfumes, aromas, and natural products with a market capitalization of €1.58 billion.

Operations: The company generates revenue from three primary segments: Aroma (€268.72 million), Perfumery (€290.80 million), and Raw Materials and Health & Beauty (€199.75 million).

Robertet, a niche player in the fragrance and flavor industry, showcases a solid financial profile with its net debt to equity ratio at 23.4%, deemed satisfactory. The company has demonstrated impressive earnings growth of 21.8% over the past year, outpacing the broader chemicals industry's -4.3%. Its interest payments are well-covered by EBIT at an 18.1x coverage, reflecting robust operational efficiency. Despite an increase in debt to equity from 26.5% to 61.8% over five years, Robertet trades at a slight discount of 4.5% below its estimated fair value and remains free cash flow positive, suggesting potential for continued performance stability and growth prospects in its sector.

- Navigate through the intricacies of Robertet with our comprehensive health report here.

Review our historical performance report to gain insights into Robertet's's past performance.

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Value Rating: ★★★★☆☆

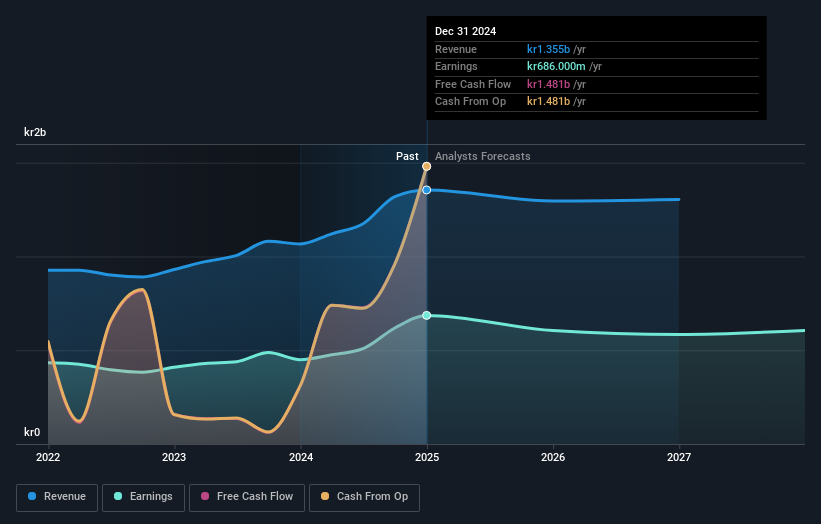

Overview: SpareBank 1 Ringerike Hadeland is a financial institution offering a range of banking products and services to both private and corporate clients in Norway, with a market capitalization of NOK6.49 billion.

Operations: The primary revenue streams for SpareBank 1 Ringerike Hadeland include the Retail Market at NOK456 million and the Business Market at NOK467 million. Property management contributes NOK56 million, while IT and Accounting Services add NOK87 million.

With total assets reaching NOK31.5 billion and equity at NOK5.3 billion, SpareBank 1 Ringerike Hadeland showcases a robust financial foundation. The bank's earnings surged by 52.6% over the past year, significantly outpacing the industry average of 16.2%. Trading at a notable 29% below its estimated fair value, this entity benefits from primarily low-risk funding sources with customer deposits making up 80% of liabilities. Despite positive cash flow and high-quality earnings, future earnings are projected to decline by an average of 4.4% annually over the next three years, presenting both opportunities and challenges for investors.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Value Rating: ★★★★★★

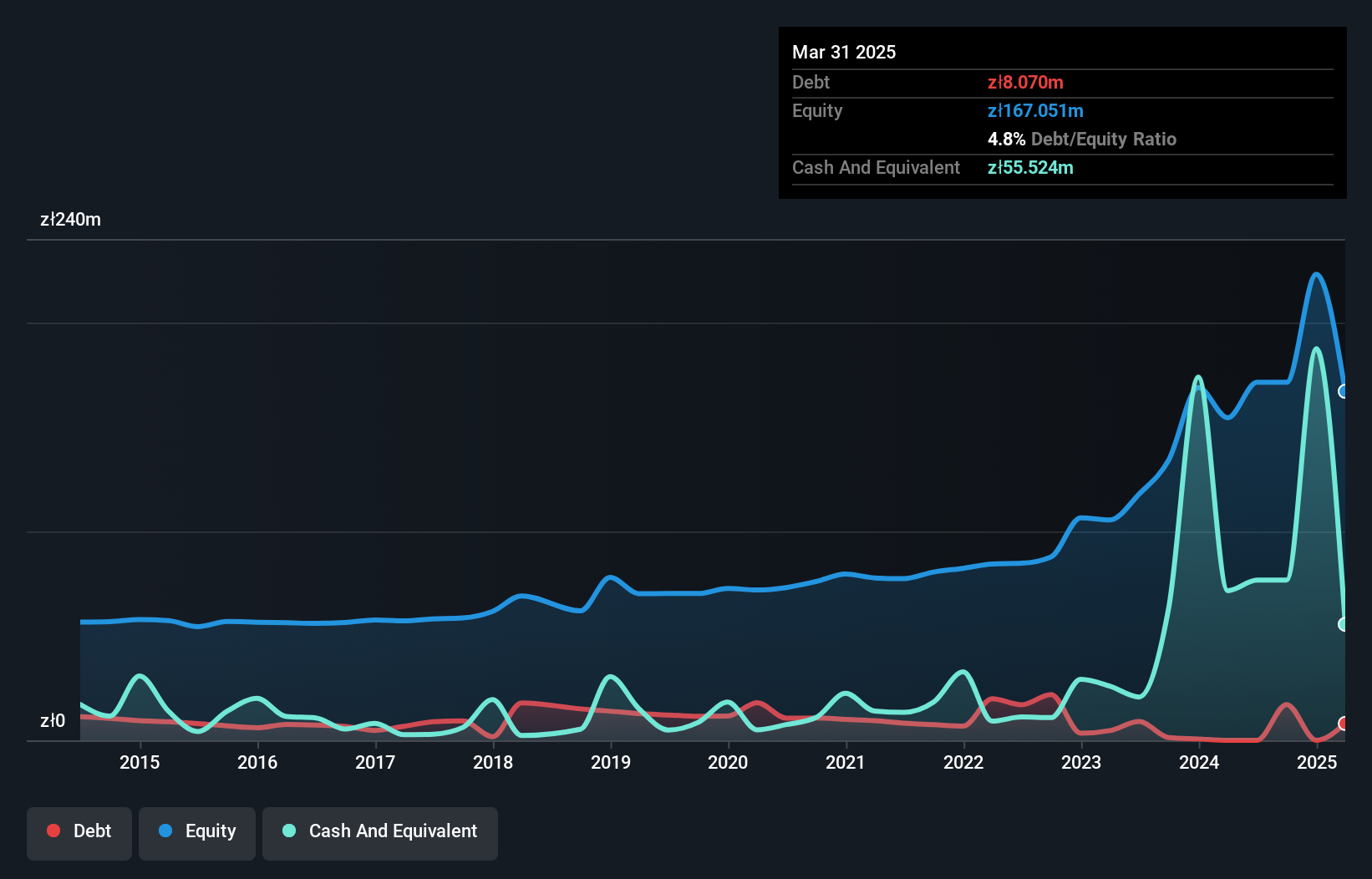

Overview: Synektik Spólka Akcyjna operates in Poland, offering products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications with a market capitalization of PLN1.89 billion.

Operations: Synektik generates revenue through its offerings in surgery, diagnostic imaging, and nuclear medicine applications. The company has a market capitalization of PLN1.89 billion.

Synektik Spólka Akcyjna, a nimble player in the healthcare sector, shows promising signs with its debt-free status and high-quality earnings. Over the past year, it outpaced industry growth at 22.1%, while trading at 32.1% below its estimated fair value seems to enhance its appeal. Although recent revenue dipped to PLN 203.13 million from PLN 271.3 million a year prior, net income remained relatively stable at PLN 33.13 million compared to PLN 34.67 million previously reported. With forecasted earnings growth of 15.6% annually and positive free cash flow of PLN 79.64 million as of March, the company is poised for potential upward momentum in the future.

- Click to explore a detailed breakdown of our findings in Synektik Spólka Akcyjna's health report.

Understand Synektik Spólka Akcyjna's track record by examining our Past report.

Next Steps

- Access the full spectrum of 355 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RBT

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)