- France

- /

- Basic Materials

- /

- ENXTPA:NK

Imerys (EPA:NK) Has Some Difficulty Using Its Capital Effectively

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. In light of that, from a first glance at Imerys (EPA:NK), we've spotted some signs that it could be struggling, so let's investigate.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Imerys is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.045 = €254m ÷ (€7.2b - €1.6b) (Based on the trailing twelve months to September 2024).

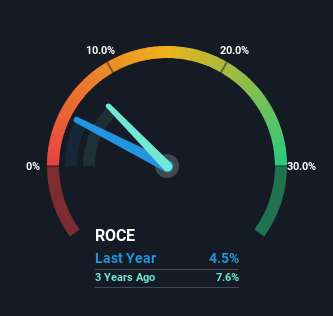

Therefore, Imerys has an ROCE of 4.5%. Ultimately, that's a low return and it under-performs the Basic Materials industry average of 8.7%.

Check out our latest analysis for Imerys

In the above chart we have measured Imerys' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Imerys .

The Trend Of ROCE

We are a bit worried about the trend of returns on capital at Imerys. To be more specific, the ROCE was 8.0% five years ago, but since then it has dropped noticeably. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect Imerys to turn into a multi-bagger.

The Bottom Line

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. Long term shareholders who've owned the stock over the last five years have experienced a 10% depreciation in their investment, so it appears the market might not like these trends either. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

On a final note, we've found 2 warning signs for Imerys that we think you should be aware of.

While Imerys isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:NK

Imerys

Engages in the supply of specialty minerals for various industries across Europe, the Middle East, Africa, Asia Pacific, and America.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Meta Platforms Inc (META): The AI Infrastructure Pivot – Monetizing the Next Frontier in 2026.

Enlight Renewable Energy Ltd. (ENLT): Scaling the Global Green Grid – A 2026 Powerhouse.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks