- France

- /

- Basic Materials

- /

- ENXTPA:ALHGR

Is Hoffmann Green Cement Technologies Société anonyme (EPA:ALHGR) A Risky Investment?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Hoffmann Green Cement Technologies Société anonyme (EPA:ALHGR) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Our analysis indicates that ALHGR is potentially overvalued!

How Much Debt Does Hoffmann Green Cement Technologies Société anonyme Carry?

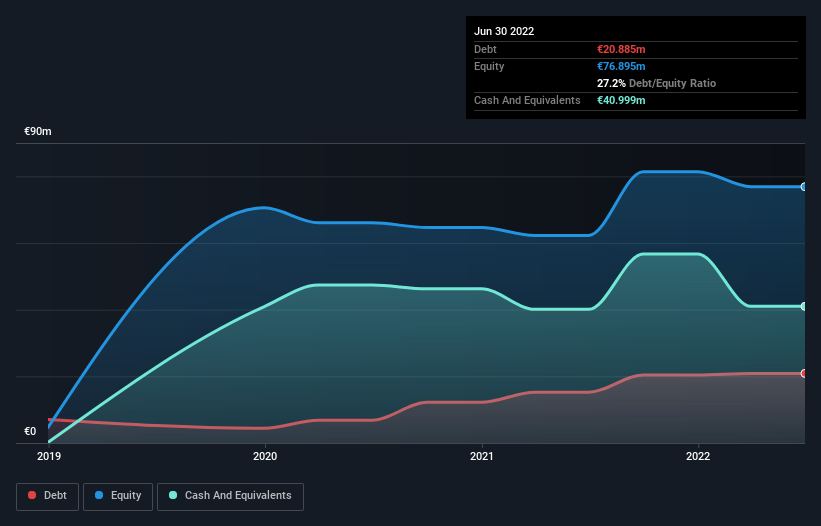

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Hoffmann Green Cement Technologies Société anonyme had €20.9m of debt, an increase on €15.3m, over one year. But on the other hand it also has €41.0m in cash, leading to a €20.1m net cash position.

A Look At Hoffmann Green Cement Technologies Société anonyme's Liabilities

Zooming in on the latest balance sheet data, we can see that Hoffmann Green Cement Technologies Société anonyme had liabilities of €8.65m due within 12 months and liabilities of €22.3m due beyond that. Offsetting this, it had €41.0m in cash and €4.03m in receivables that were due within 12 months. So it can boast €14.1m more liquid assets than total liabilities.

This short term liquidity is a sign that Hoffmann Green Cement Technologies Société anonyme could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Hoffmann Green Cement Technologies Société anonyme boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Hoffmann Green Cement Technologies Société anonyme can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Hoffmann Green Cement Technologies Société anonyme wasn't profitable at an EBIT level, but managed to grow its revenue by 151%, to €2.4m. So there's no doubt that shareholders are cheering for growth

So How Risky Is Hoffmann Green Cement Technologies Société anonyme?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Hoffmann Green Cement Technologies Société anonyme lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through €22m of cash and made a loss of €7.4m. With only €20.1m on the balance sheet, it would appear that its going to need to raise capital again soon. The good news for shareholders is that Hoffmann Green Cement Technologies Société anonyme has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. High growth pre-profit companies may well be risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Hoffmann Green Cement Technologies Société anonyme has 3 warning signs we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Hoffmann Green Cement Technologies Societe anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALHGR

Hoffmann Green Cement Technologies Societe anonyme

Designs, produces, distributes, and markets clinker-free decarbonized cement products in France.

Low with limited growth.

Market Insights

Community Narratives