Assessing Air Liquide (ENXTPA:AI) Valuation After Major Madrid Healthcare Contract Win

Reviewed by Kshitija Bhandaru

L'Air Liquide (ENXTPA:AI) just secured a five-year contract with the Community of Madrid to provide home respiratory care to 70,000 patients, highlighting its expanding presence in Spain's healthcare sector.

See our latest analysis for L'Air Liquide.

L'Air Liquide's latest contract in Madrid builds on a year where momentum has stayed steady. The share price recently held at €171.68, with a one-year total shareholder return of 4.3%. A string of healthcare partnership wins and continued innovation in patient care signal that investors still see long-term value, even as short-term trading has been more subdued.

If healthcare innovation stories like this are on your radar, discover other standout names with See the full list for free.

With steady growth and a robust pipeline of contracts, is Air Liquide's current stock price an entry point for investors, or is the market already reflecting expectations of its future gains?

Most Popular Narrative: 12.7% Undervalued

L'Air Liquide's narrative-driven fair value estimate suggests there may be a double-digit upside from the last close of €171.68. This valuation is grounded in accelerating growth and profitability drivers, setting expectations high for future performance.

Major long-term contracts and new investments in the global Electronics and semiconductor sector are set to drive double-digit growth from carrier gases and advanced materials, directly bolstering revenue and sustaining higher margins as secular demand for high-tech manufacturing outpaces other segments.

Want to know the blueprint behind this ambitious valuation? The calculation isn’t just about market trends, but centers on aggressive long-term growth assumptions, expanding margins, and a risk premium that is higher than most investors expect. The details here could change your outlook on L'Air Liquide’s future. Uncover the narrative powering this price now.

Result: Fair Value of €196.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in key industrial demand or regulatory delays in major hydrogen projects could quickly challenge Air Liquide’s positive growth outlook.

Find out about the key risks to this L'Air Liquide narrative.

Another View: Is the Market Paying Too Much?

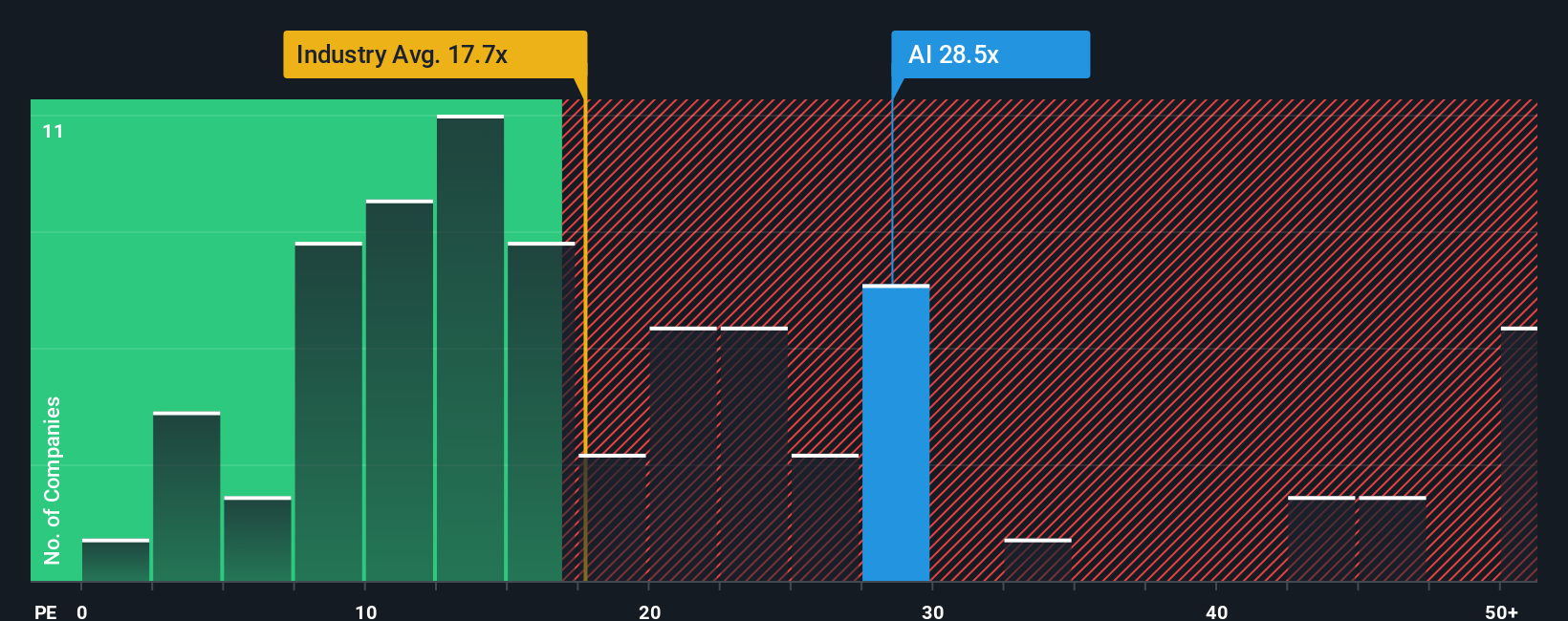

While the fair value estimate highlights upside potential, a traditional price-to-earnings comparison tells another story. At 28.9x earnings, L'Air Liquide trades well above both the industry average (17.6x) and the peer group (27.3x), and is significantly above its fair ratio of 24.6x. This premium signals that investors may be anticipating a lot of future growth, which heightens the risk that results might not keep pace with expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L'Air Liquide Narrative

If you see the numbers differently or want to dig deeper on your own, you can craft a personalized view in just a few minutes with Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding L'Air Liquide.

Looking for your next smart investing move?

Opportunities are everywhere, but the right screener will help you spot winners that others miss. Here’s where savvy investors like you find their edge:

- Unlock potential growth by tapping into companies generating high yields and reliable payouts with these 19 dividend stocks with yields > 3%.

- Seize your advantage in cutting-edge innovation by targeting these 24 AI penny stocks poised to lead the future of artificial intelligence.

- Boost your strategy now with these 901 undervalued stocks based on cash flows, revealing stocks priced below their intrinsic value and primed for a market catch-up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AI

L'Air Liquide

Provides gases, technologies, and services for the industrial and health sectors in Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives