- France

- /

- Personal Products

- /

- ENXTPA:OR

Is L'Oréal Fairly Priced After Recent Stock Recovery and Market Volatility in 2025?

Reviewed by Bailey Pemberton

If you are staring at L'Oréal's stock chart and wondering if now is the right moment to buy, sell, or hold, you are not alone. The past month has served up a roller coaster, with the stock price dipping 7.1% over 30 days but recovering 2.5% in the last week. Year-to-date, L'Oréal is still up 10.6%, which might appeal to growth-minded investors. However, the result over the last twelve months is a slight drop of 3.5%. Looking further back, long-term holders have seen the value climb a substantial 40.0% in five years, underscoring L'Oréal's position as a heavyweight in the global beauty sector.

Recently, shifting sentiment in the broader market and ongoing conversations about luxury trends have influenced perceptions of risk and opportunity for companies like L'Oréal. While these swings can tempt action, they also raise a crucial question: Is the stock fairly priced right now? To help answer that, let’s look at valuation. On a simple score, where a company earns a point for each of six valuation checks it passes for being undervalued, L'Oréal currently scores 0. This means it is not considered undervalued according to these common screens.

But everyday investors and seasoned analysts alike know the real story often lies beyond simple checklists. Next, we will dive into the specific valuation methods behind these checks and, later on, discuss the deeper insights that can be uncovered by looking beyond the numbers alone.

L'Oréal scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: L'Oréal Discounted Cash Flow (DCF) Analysis

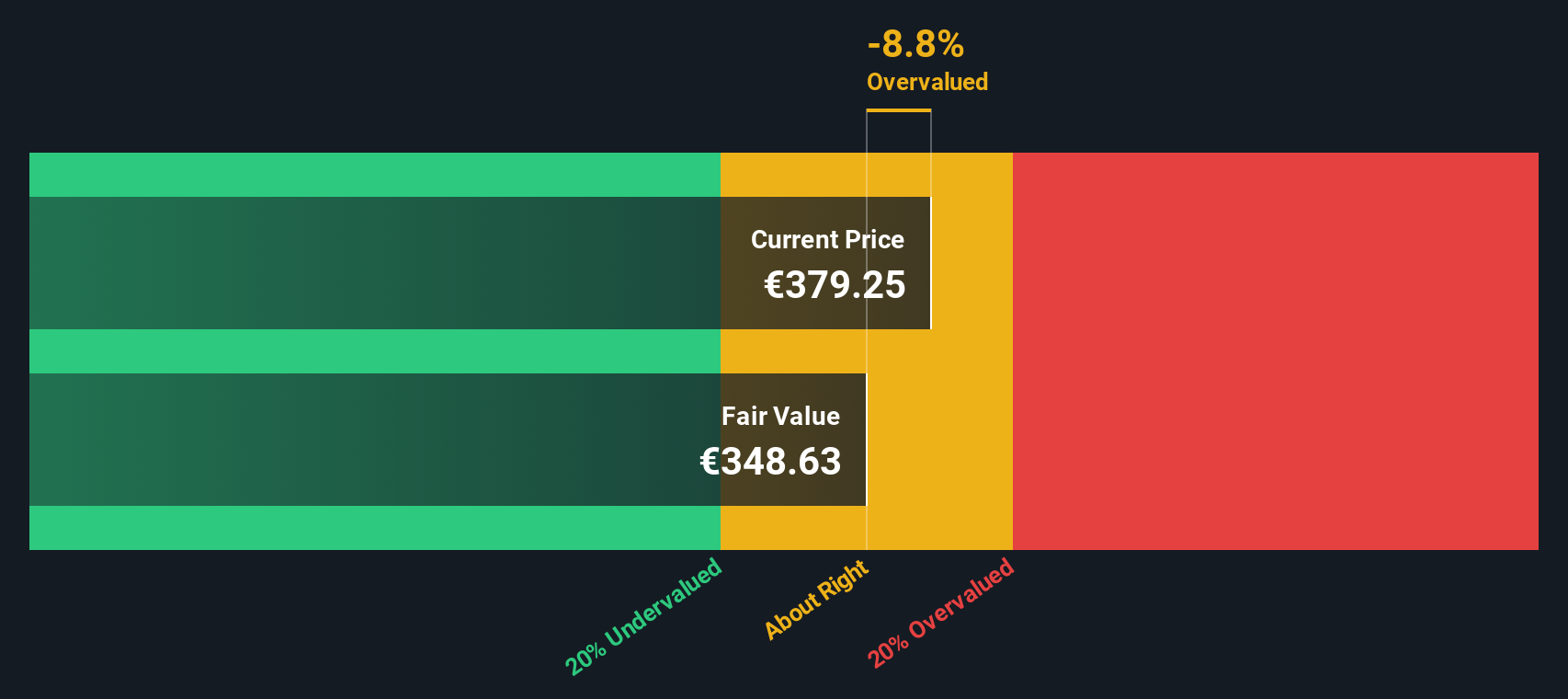

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value, reflecting the time value of money. For L'Oréal, this approach uses projections of Free Cash Flow (FCF), a key measure of how much cash a business generates after expenses and investments.

Currently, L'Oréal reports trailing twelve month FCF of approximately €7.44 billion. Looking ahead, analyst consensus estimates suggest FCF will grow gradually, reaching about €9.34 billion by the end of 2029. Beyond the analyst forecast period, further annual increases are extrapolated. FCF is expected to continue climbing through 2035 based on historical growth patterns and industry assumptions.

Applying the DCF method, these future cash flows are discounted to reflect their value today. This results in an estimated intrinsic value per share of €349.62. When compared to L'Oréal's recent share price, the analysis suggests the stock is trading at a 7.0% premium to its projected fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out L'Oréal's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

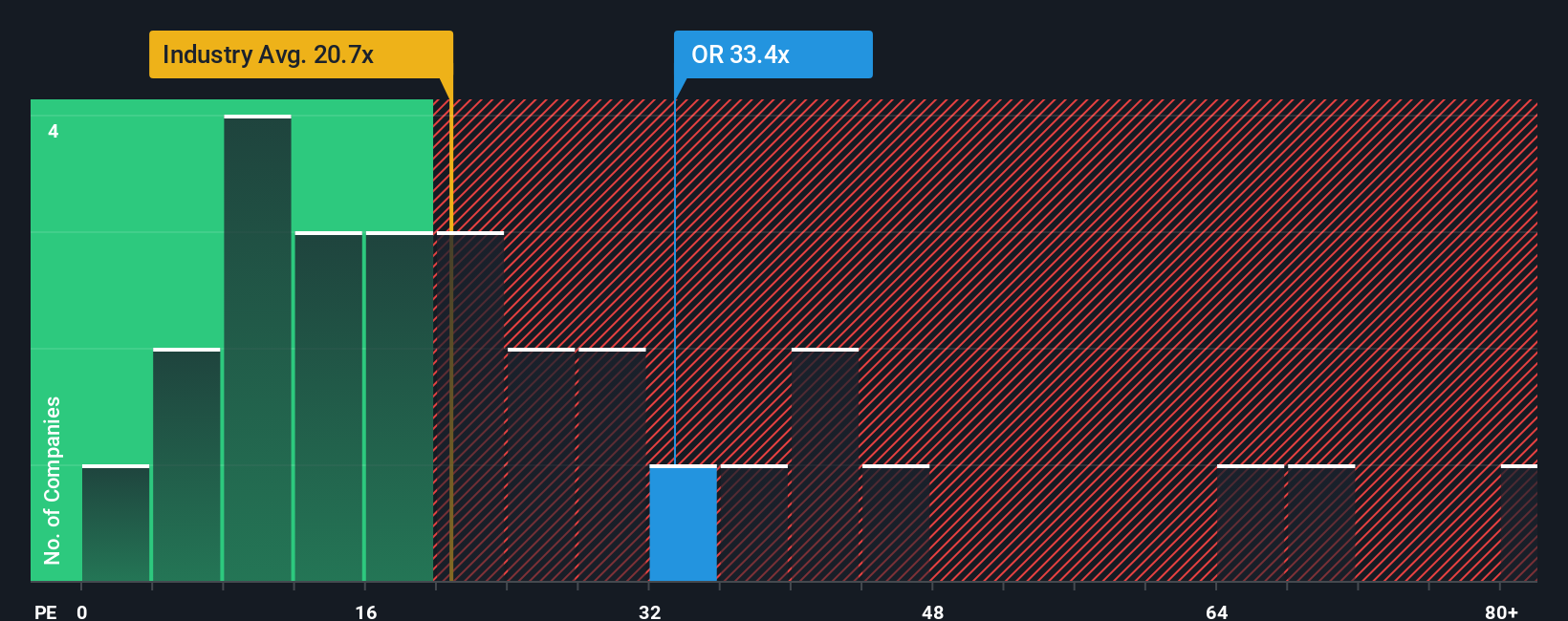

Approach 2: L'Oréal Price vs Earnings (PE Ratio)

For established, profitable companies like L'Oréal, the Price-to-Earnings (PE) ratio is a widely respected and straightforward way to quickly gauge valuation. It measures how much investors are willing to pay for each euro of current earnings, making it especially useful for businesses with predictable profits.

Growth prospects and risk levels both play a role in what counts as a "normal" or "fair" PE ratio. Companies expected to grow earnings rapidly, or those seen as especially stable and resilient, often justify higher multiples. Conversely, slower growth or higher perceived risk warrants a lower ratio.

L'Oréal's current PE ratio stands at 32.6x, higher than the Personal Products industry average of 22.4x as well as the peer average of 29.2x. This premium suggests investors anticipate robust earnings growth or view the company as less risky than its competitors.

To move beyond static peer or industry comparisons, Simply Wall St's proprietary "Fair Ratio" evaluates what a suitable PE should be for L'Oréal individually. This Fair Ratio is based on several factors, including expected growth, profit margins, company size, and risk profile. It is a customized benchmark rather than a one-size-fits-all number.

For L'Oréal, the calculated Fair Ratio is 30.4x. Compared to the actual PE of 32.6x, the stock is trading at a small premium to its fair value, but not by much. Given this close alignment, L'Oréal appears fairly valued on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

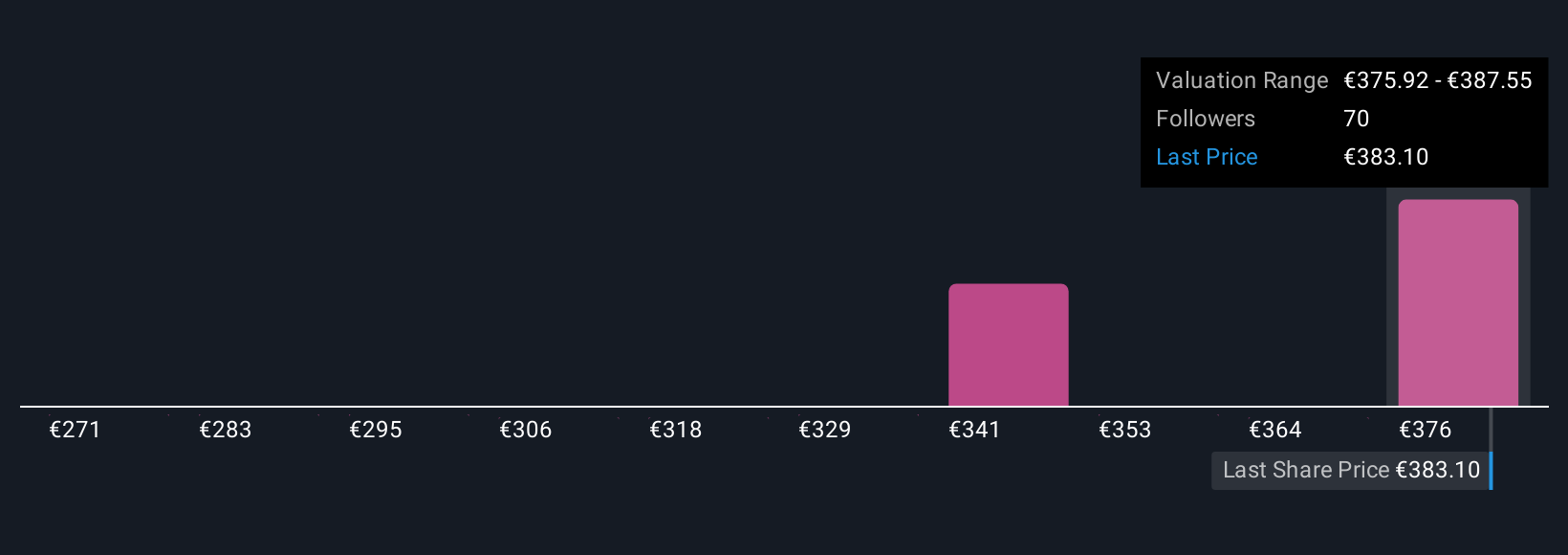

Upgrade Your Decision Making: Choose your L'Oréal Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about what L'Oréal’s future looks like, connecting your assumptions about its growth, profitability, and business trends to clear financial forecasts and a fair value for the company. It goes beyond static numbers by combining what you expect for L'Oréal’s sales, margins, and risks with the context of the market, creating a personalized valuation that reflects your outlook.

Available within the Simply Wall St Community page and used by millions of investors, Narratives are an easy and dynamic tool that helps you structure your thinking and put a number on your perspective. When new information, such as news, earnings, or updated forecasts, becomes available, Narratives update automatically, so your fair value reflects what’s changed.

Narratives also make buy, sell, and hold decisions clearer by showing how your valuation stacks up against today’s price and how differing viewpoints can yield different outcomes. For example, some investors may see L'Oréal’s future value as high as €430 per share based on bullish growth and innovation, while others are more cautious, estimating value closer to €325 per share if competitive or economic risks materialize.

Do you think there's more to the story for L'Oréal? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OR

L'Oréal

Through its subsidiaries, manufactures and sells cosmetic products for women and men worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives