- France

- /

- Personal Products

- /

- ENXTPA:OR

Are L'Oréal Shares Still Worth Holding After a 9% Decline and Mixed 2025 Outlook?

Reviewed by Bailey Pemberton

Thinking about what to do with your L'Oréal shares, or whether this beauty giant fits your next move? You're not alone. The past month has brought some fresh debate about L'Oréal's outlook, thanks to a nearly 9% dip over 30 days, even as the company remains up a solid 8.5% for the year. That kind of swing can leave investors wondering whether the market is waking up to higher risks or quietly setting the stage for a comeback.

In the bigger picture, L'Oréal’s five-year climb of 40.4% certainly hints at strong growth potential for patient investors. However, the recent 1-year return sits at -8%. Part of this shift lines up with broader worries about inflation and shifting consumer sentiment, which have made even the best-loved consumer staples a little more volatile. With L'Oréal, the latest moves seem less about business fundamentals and more about a re-rating of valuations in Europe as investors reassess where the best value lies post-pandemic.

On paper, L'Oréal's current value score is 0 out of 6, meaning it's not flagged as undervalued by any of the traditional checks analysts use. But numbers rarely tell the whole story. In the next section, we'll dig into what those main valuation approaches say about L'Oréal and hint at a smarter way to think about what the shares are actually worth.

L'Oréal scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: L'Oréal Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular way to estimate a company's intrinsic value by projecting its future cash flows and then discounting those back to their value today. This approach gives a sense of what the business is really worth if you base it on its ability to generate cash over time.

For L'Oréal, analysts estimate that the company generated €7.44 billion in Free Cash Flow (FCF) over the last twelve months. Looking ahead, forecasts suggest FCF could reach €9.37 billion by 2029, with several years of steady growth expected along the way. While analysts typically provide projections covering the next five years, additional estimates for 2030 and beyond are extrapolated by Simply Wall St, hinting at continued expansion.

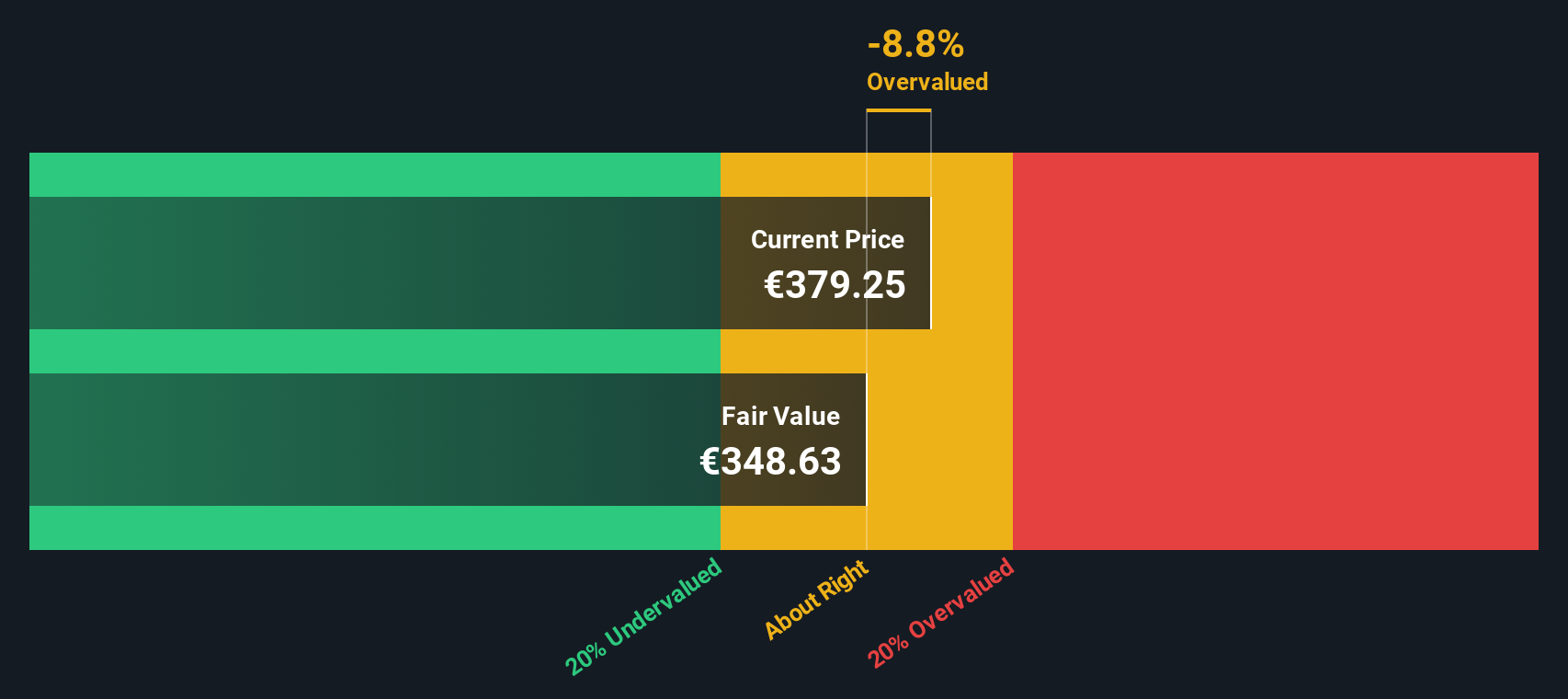

After crunching the numbers from these projections, the DCF model calculates an intrinsic value of €343.55 per share. Compared to the current market price, this suggests L'Oréal is trading at a 6.8% premium, which means it is slightly overvalued based on this approach.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for L'Oréal.

Approach 2: L'Oréal Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as the go-to metric for valuing profitable companies like L'Oréal. It lets investors quickly grasp how much they are paying for each euro of current earnings, which is especially useful for steady, income-generating firms in established sectors.

A "normal" or fair PE ratio is not set in stone. It shifts depending on what investors expect for future earnings growth and how much risk comes with those expectations. Higher growth or a safer business usually justifies paying a bit more, while sluggish prospects or higher risks mean the PE should be lower.

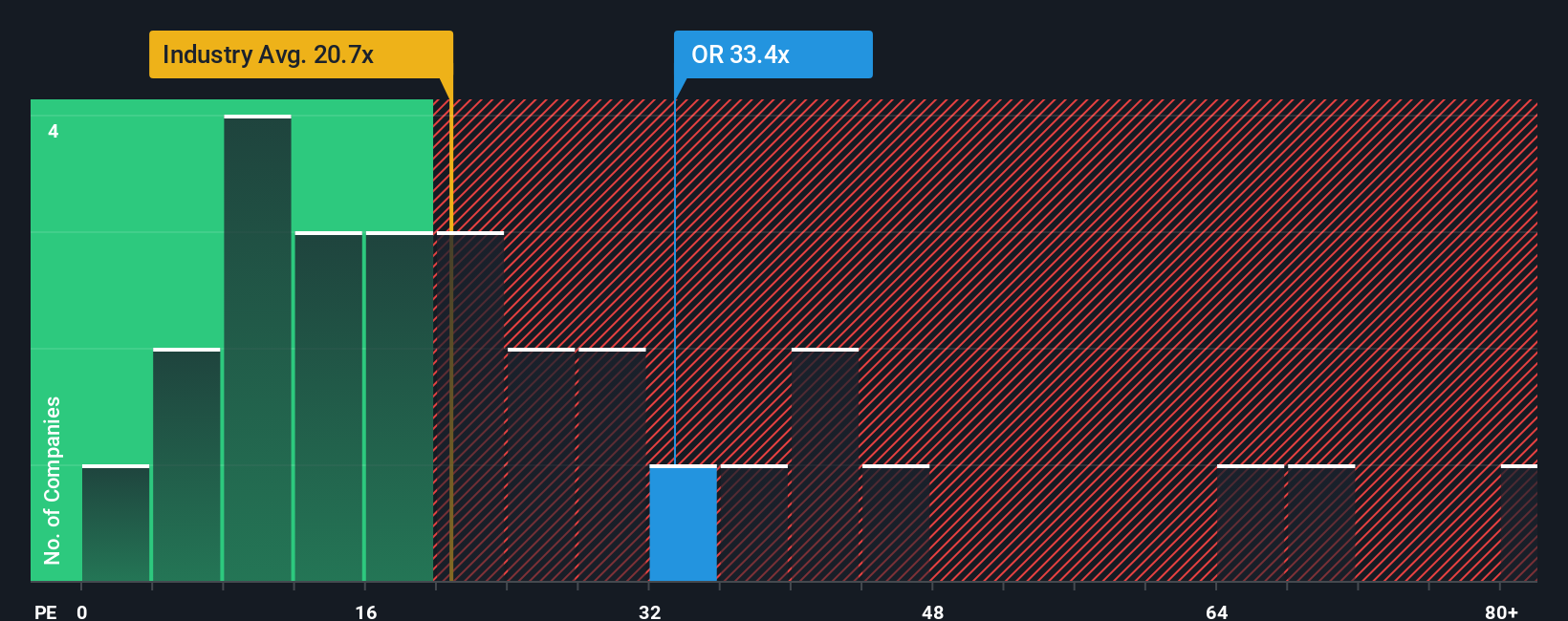

L'Oréal currently trades at a PE ratio of 32x. That is above the industry average of 23x and higher than the average for its peers at 29x. However, instead of stopping with simple comparisons, Simply Wall St's proprietary “Fair Ratio” dives deeper. This metric looks at a company's earnings growth, risk profile, profit margins, industry, and even market capitalization, creating a more tailored benchmark.

For L'Oréal, the Fair Ratio is 31x, a figure nearly identical to its actual PE. Because this approach accounts for the bigger picture, it is a more precise way to assess whether the shares are priced right. L'Oréal's PE aligns almost perfectly with the Fair Ratio, suggesting that its valuation is justified when thinking beyond surface-level market comparisons.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your L'Oréal Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful context-driven approach that brings your investment ideas to life. A Narrative is simply your story about a company, linking what you know and believe about its future (including your own fair value, revenue estimates, and margin assumptions) to a forecast and price tag that reflect your unique perspective.

Narratives connect the dots between a company’s story, your expectations for its growth or challenges, and what you think its shares ought to be worth right now. These tools are freely accessible on Simply Wall St’s Community page, where millions of investors use Narratives to track their evolving outlooks as new news or earnings data rolls in. This helps keep your thesis always up to date.

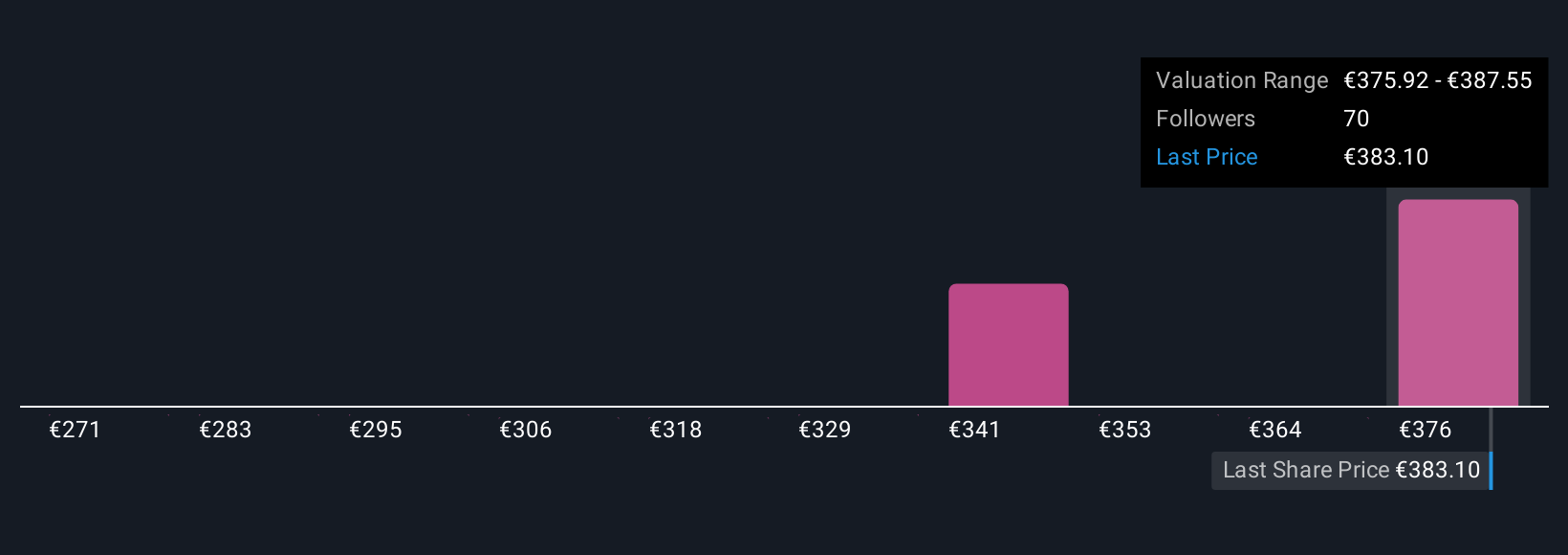

With Narratives, you can see at a glance whether your chosen Fair Value suggests it’s time to buy or sell by comparing your target with the current market price. For instance, some L'Oréal investors expect upside and assign a fair value of €430 per share, while others see more risk and set theirs as low as €325. This shows that the best investment decisions tie numbers to real-world views, not just formulas.

Do you think there's more to the story for L'Oréal? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OR

L'Oréal

Through its subsidiaries, manufactures and sells cosmetic products for women and men worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives