- France

- /

- Medical Equipment

- /

- ENXTPA:GBT

Further Upside For Guerbet SA (EPA:GBT) Shares Could Introduce Price Risks After 48% Bounce

The Guerbet SA (EPA:GBT) share price has done very well over the last month, posting an excellent gain of 48%. Looking back a bit further, it's encouraging to see the stock is up 55% in the last year.

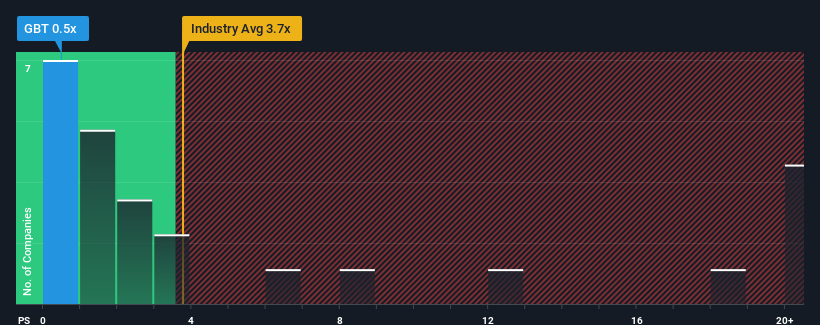

Even after such a large jump in price, Guerbet's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a buy right now compared to the Medical Equipment industry in France, where around half of the companies have P/S ratios above 2x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Guerbet

What Does Guerbet's Recent Performance Look Like?

Guerbet's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think Guerbet's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Guerbet would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 4.0% gain to the company's revenues. Still, lamentably revenue has fallen 1.3% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 5.8% as estimated by the four analysts watching the company. That's shaping up to be similar to the 5.2% growth forecast for the broader industry.

With this information, we find it odd that Guerbet is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Guerbet's P/S

Despite Guerbet's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Guerbet's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Having said that, be aware Guerbet is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:GBT

Guerbet

Engages in the development and marketing of contrast media products, delivery systems, medical devices, and related solutions.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives