- France

- /

- Auto Components

- /

- ENXTPA:ML

European Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the European markets navigate a mixed landscape with the pan-European STOXX Europe 600 Index inching higher amidst dovish signals from the U.S. Federal Reserve and easing U.S.-China trade tensions, investors are keenly observing the economic indicators that could influence dividend stock performance. In such a climate, a good dividend stock is often characterized by a strong balance sheet and consistent dividend payouts, offering a potential buffer against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.43% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 3.99% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.77% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.18% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.20% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 11.66% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.71% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.01% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.94% | ★★★★★☆ |

Click here to see the full list of 226 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

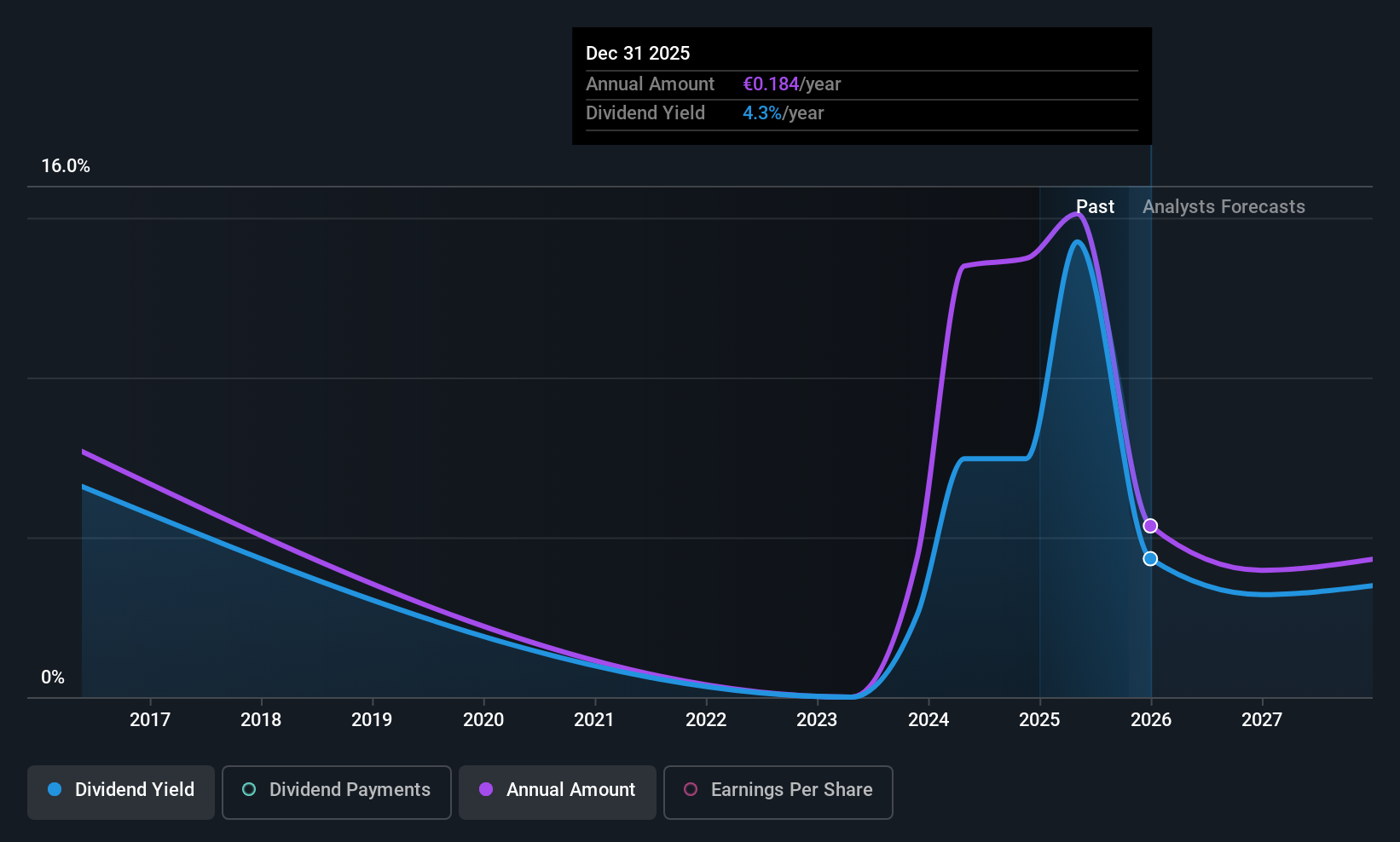

d'Amico International Shipping (BIT:DIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: d'Amico International Shipping S.A. operates as a marine transportation company globally through its subsidiaries and has a market cap of €514.89 million.

Operations: d'Amico International Shipping S.A. generates revenue of $395.38 million from its product tankers segment, providing marine transportation services globally through its subsidiaries.

Dividend Yield: 11.7%

d'Amico International Shipping offers a high dividend yield of 11.66%, placing it among the top 25% in Italy. However, this yield is not well-supported by cash flows, with a cash payout ratio of 135.8%. Despite stable and growing dividends over the past decade, recent earnings and revenues have declined significantly, impacting sustainability. The stock trades at a significant discount to its estimated fair value but faces challenges with declining profit margins and forecasted earnings decreases.

- Unlock comprehensive insights into our analysis of d'Amico International Shipping stock in this dividend report.

- Our valuation report unveils the possibility d'Amico International Shipping's shares may be trading at a discount.

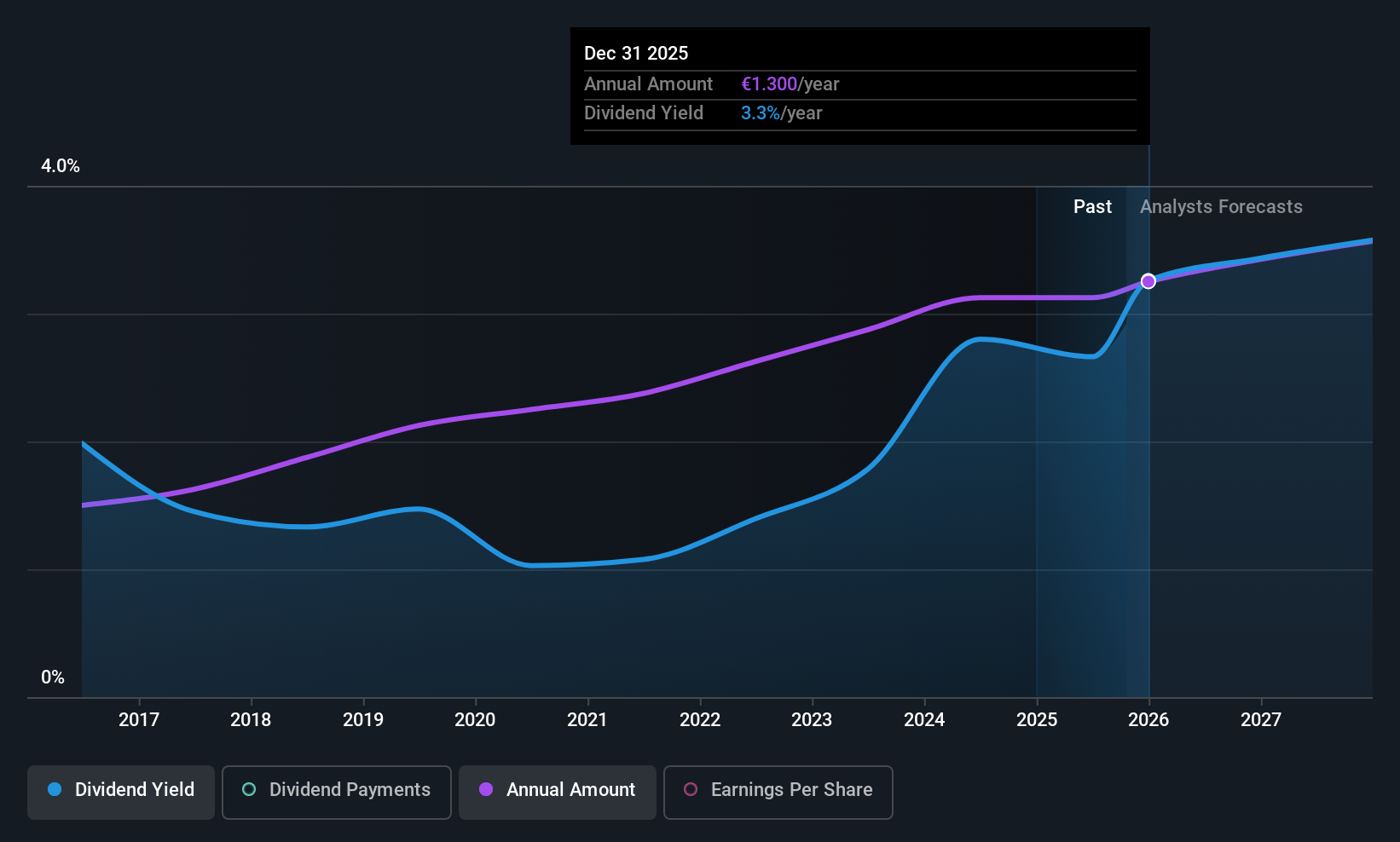

Equasens Société anonyme (ENXTPA:EQS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Equasens Société anonyme offers healthcare IT solutions across Europe and has a market cap of €608.76 million.

Operations: Equasens Société anonyme generates revenue through its segments, with Pharmagest contributing €167.36 million and Axigate Link adding €33.16 million.

Dividend Yield: 3.1%

Equasens Société anonyme offers a reliable dividend yield of 3.09%, though it is below the top 25% in France. Dividends have been stable and growing for a decade, supported by earnings and cash flows with payout ratios of 51.8% and 53.5%, respectively, indicating sustainability. The stock trades at a significant discount to its fair value, suggesting good relative value despite the lower yield compared to peers. Recent earnings reports show steady income growth with EUR 115.97 million in sales for H1 2025.

- Get an in-depth perspective on Equasens Société anonyme's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Equasens Société anonyme is priced lower than what may be justified by its financials.

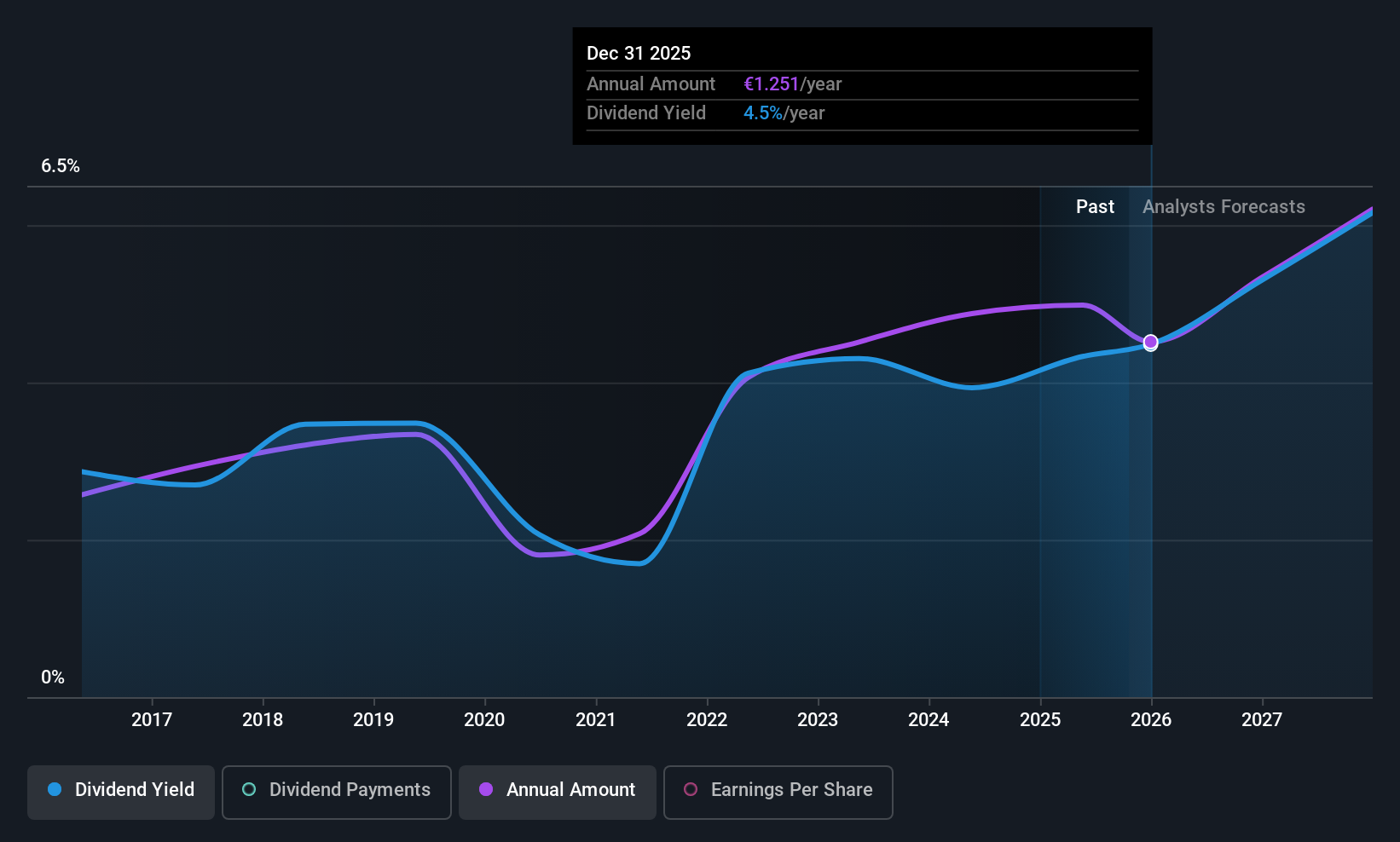

Compagnie Générale des Établissements Michelin Société en commandite par actions (ENXTPA:ML)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Générale des Établissements Michelin Société en commandite par actions manufactures and sells tires globally, with a market cap of €19.17 billion.

Operations: Compagnie Générale des Établissements Michelin Société en commandite par actions generates revenue from three main segments: Road Transportation and Related Distribution (€6.37 billion), Specialty Business and Related Distribution (€5.74 billion), and Automotive, Two-wheel and Related Distribution (€14.63 billion).

Dividend Yield: 5.1%

Compagnie Générale des Établissements Michelin Société en commandite par actions has a volatile dividend history, with payments increasing over the past decade but lacking stability. The payout ratio of 62.5% suggests dividends are covered by earnings, and a cash payout ratio of 78.2% indicates coverage by cash flows as well. However, recent earnings show decreased sales and net income for H1 2025 compared to the previous year, potentially impacting future payouts.

- Take a closer look at Compagnie Générale des Établissements Michelin Société en commandite par actions' potential here in our dividend report.

- The analysis detailed in our Compagnie Générale des Établissements Michelin Société en commandite par actions valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 223 more companies for you to explore.Click here to unveil our expertly curated list of 226 Top European Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Engages in the manufacture and sale of tires worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives