- France

- /

- Healthcare Services

- /

- ENXTPA:BLC

Bastide Le Confort Médical (EPA:BLC) earnings and shareholder returns have been trending downwards for the last three years, but the stock spikes 10% this past week

Bastide Le Confort Médical SA (EPA:BLC) shareholders should be happy to see the share price up 10% in the last week. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 53% in that period. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Bastide Le Confort Médical

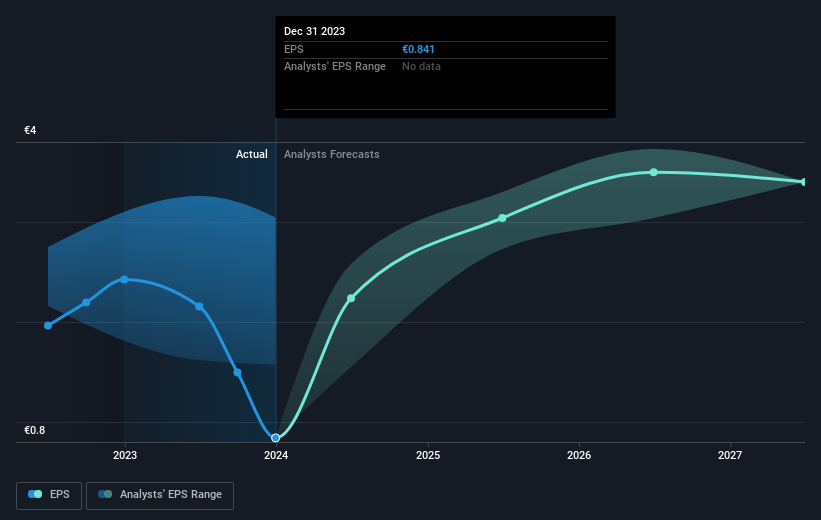

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, Bastide Le Confort Médical's earnings per share (EPS) dropped by 17% each year. The share price decline of 22% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While the broader market gained around 2.9% in the last year, Bastide Le Confort Médical shareholders lost 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Bastide Le Confort Médical better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Bastide Le Confort Médical (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bastide Le Confort Médical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BLC

Bastide Le Confort Médical

Engages in the sale and rental of medical equipment for individuals and health professionals in France and internationally.

High growth potential and fair value.

Market Insights

Community Narratives