Has Laurent-Perrier S.A. (EPA:LPE) Stock's Recent Performance Got Anything to Do With Its Financial Health?

Laurent-Perrier's (EPA:LPE) stock up by 8.1% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to investigate if the company's decent financials had a hand to play in the recent price move. Specifically, we decided to study Laurent-Perrier's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for Laurent-Perrier

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Laurent-Perrier is:

4.6% = €20m ÷ €438m (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. Another way to think of that is that for every €1 worth of equity, the company was able to earn €0.05 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Laurent-Perrier's Earnings Growth And 4.6% ROE

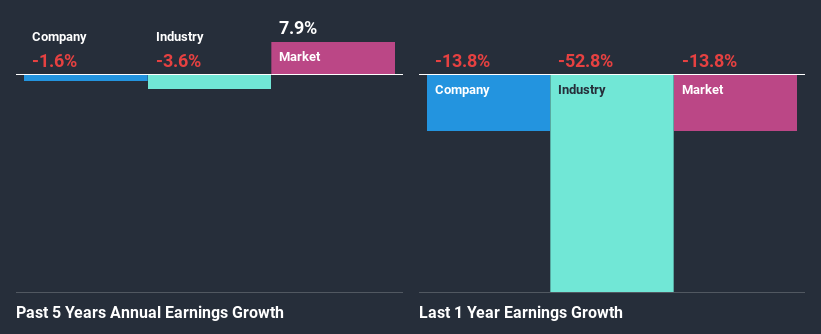

When you first look at it, Laurent-Perrier's ROE doesn't look that attractive. However, the fact that the company's ROE is higher than the average industry ROE of 2.8%, is definitely interesting. However, Laurent-Perrier has seen a flattish net income growth over the past five years, which is not saying much. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. Therefore, the low to flat growth in earnings could also be the result of this.

We then compared Laurent-Perrier's performance with the industry and found that the company has shrunk its earnings at a slower rate than the industry earnings which has seen its earnings shrink by 3.6% in the same period. This does offer shareholders some relief

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Laurent-Perrier's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Laurent-Perrier Using Its Retained Earnings Effectively?

Despite having a moderate three-year median payout ratio of 29% (meaning the company retains71% of profits) in the last three-year period, Laurent-Perrier's earnings growth was more or les flat. So there could be some other explanation in that regard. For instance, the company's business may be deteriorating.

In addition, Laurent-Perrier has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 25%. Accordingly, forecasts suggest that Laurent-Perrier's future ROE will be 4.6% which is again, similar to the current ROE.

Conclusion

In total, it does look like Laurent-Perrier has some positive aspects to its business. Yet, the low earnings growth is a bit concerning, especially given that the company has a respectable rate of return and is reinvesting a huge portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that's preventing growth. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you’re looking to trade Laurent-Perrier, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:LPE

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026