Are Laurent-Perrier S.A.'s (EPA:LPE) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

With its stock down 10.0% over the past month, it is easy to disregard Laurent-Perrier (EPA:LPE). However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. Specifically, we decided to study Laurent-Perrier's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Laurent-Perrier

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Laurent-Perrier is:

5.6% = €25m ÷ €455m (Based on the trailing twelve months to March 2021).

The 'return' refers to a company's earnings over the last year. So, this means that for every €1 of its shareholder's investments, the company generates a profit of €0.06.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Laurent-Perrier's Earnings Growth And 5.6% ROE

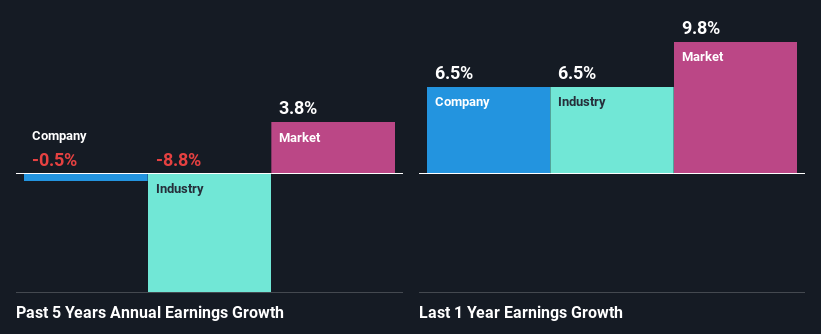

When you first look at it, Laurent-Perrier's ROE doesn't look that attractive. However, the fact that the its ROE is quite higher to the industry average of 2.3% doesn't go unnoticed by us. Having said that, Laurent-Perrier's net income growth over the past five years is more or less flat. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. Hence, this goes some way in explaining the flat earnings growth.

Next, we compared Laurent-Perrier's performance against the industry and found that the industry shrunk its earnings at 8.8% in the same period, which suggests that the company's earnings have been shrinking at a slower rate than its industry, While this is not particularly good, its not particularly bad either.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for LPE? You can find out in our latest intrinsic value infographic research report.

Is Laurent-Perrier Making Efficient Use Of Its Profits?

Despite having a normal three-year median payout ratio of 28% (implying that the company keeps 72% of its income) over the last three years, Laurent-Perrier has seen a negligible amount of growth in earnings as we saw above. So there could be some other explanation in that regard. For instance, the company's business may be deteriorating.

In addition, Laurent-Perrier has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 21% over the next three years. The fact that the company's ROE is expected to rise to 7.2% over the same period is explained by the drop in the payout ratio.

Summary

On the whole, we do feel that Laurent-Perrier has some positive attributes. Although, we are disappointed to see a lack of growth in earnings even in spite of a moderate ROE and and a high reinvestment rate. We believe that there might be some outside factors that could be having a negative impact on the business. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you decide to trade Laurent-Perrier, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:LPE

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026