Market Still Lacking Some Conviction On PAULIC Meunerie SA (EPA:ALPAU)

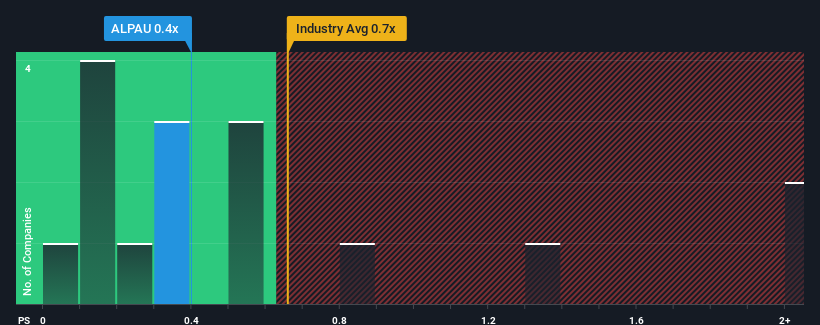

It's not a stretch to say that PAULIC Meunerie SA's (EPA:ALPAU) price-to-sales (or "P/S") ratio of 0.4x seems quite "middle-of-the-road" for Food companies in France, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for PAULIC Meunerie

What Does PAULIC Meunerie's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, PAULIC Meunerie has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PAULIC Meunerie.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, PAULIC Meunerie would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 51%. The strong recent performance means it was also able to grow revenue by 140% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.6% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 0.3%, the company is positioned for a stronger revenue result.

In light of this, it's curious that PAULIC Meunerie's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does PAULIC Meunerie's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, PAULIC Meunerie's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about this 1 warning sign we've spotted with PAULIC Meunerie.

If you're unsure about the strength of PAULIC Meunerie's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALPAU

PAULIC Meunerie

Produces and sells wheat and buckwheat flour for professionals in the bakery, creperie, and food industries in France and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives