- France

- /

- Oil and Gas

- /

- ENXTPA:WAGA

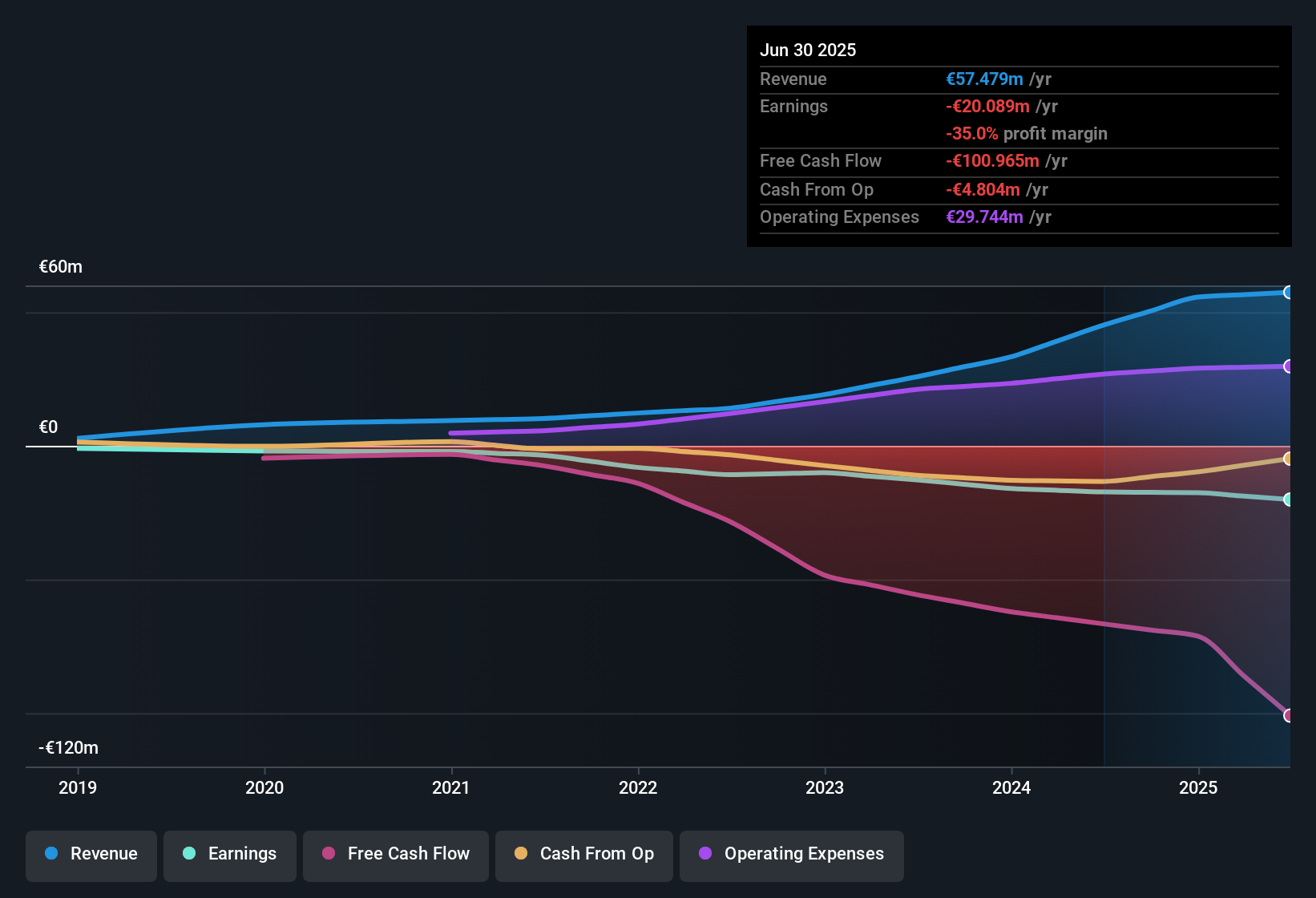

Waga Energy (ENXTPA:WAGA): Losses Escalate 33% Annually Despite Sector-Leading 59.3% Revenue Growth Forecast

Reviewed by Simply Wall St

Waga Energy (ENXTPA:WAGA) is expected to deliver rapid revenue growth of 59.3% per year, far ahead of the French market's forecasted 5.4% per year. Still, the company remains unprofitable, with losses having increased at a rate of 33% annually over the past five years and profit margins showing no sign of recovery. This combination of high growth, ongoing lack of profitability, and a premium Price-To-Sales ratio of 9.7x positions Waga Energy as a high-risk, high-reward play for investors focused on expansion stories.

See our full analysis for Waga Energy.Next, we’ll see how these headline numbers compare to the widely held narratives about Waga Energy, where investor expectations match up with reality, and where the data tells a different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Escalate 33% Per Year

- Waga Energy's annual losses have climbed at a rate of 33% per year over the past five years, underscoring just how steep the climb to profitability may be from this point.

- Large and fast-growing annual losses directly challenge bulls’ optimism about the company’s momentum translating to income, since mounting costs and stagnant profit margins remain major headwinds.

- Despite headline revenue growth, these negative margins have not shown improvement, which clouds the path to break-even.

- Persistent losses reinforce the risk that even sector tailwinds may not be enough to achieve sustained bottom-line gains without a change in cost discipline.

Valuation Far Above Industry Norms

- With a Price-To-Sales ratio of 9.7x, Waga Energy trades at a clear premium compared to the European oil and gas industry average. This sets steep expectations for future performance.

- What stands out is that while rapid growth can justify some premium, this high multiple creates a genuine test for the bullish belief that the company’s leadership in clean tech will continue to secure market share and margin expansion.

- Any slip in growth or delays in reaching profitability could pressure this valuation sharply relative to sector alternatives.

- Industry peers with similar growth backdrops often command lower sales multiples. The current price builds in significant confidence in both execution and sector momentum.

Share Price Trailing Analyst Targets

- Waga Energy's current share price of €21.70 sits well below the average analyst price target of €26.33. This highlights that the market remains cautious even with analyst optimism.

- This gap illustrates a tension. Prevailing market analysis emphasizes strong revenue forecasts and sector buzz, but persistent operating losses and a lack of profit margin progress temper expectations for a rerating.

- Ongoing unprofitability means that even a sector-wide push for renewables will not automatically close the price gap unless there is movement on costs or margins.

- While analyst targets suggest upside, the current discount reflects investor demand for clearer evidence of a profitable growth path.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Waga Energy's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Waga Energy’s rapid top-line growth is overshadowed by escalating losses, weak profit margins, and a lofty valuation. This combination raises doubts about sustaining momentum.

If you want lower volatility and steadier performance, focus on stable growth stocks screener to discover companies that consistently grow revenue and earnings with fewer surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waga Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:WAGA

Waga Energy

Develops and produces biomethane from landfill gas for the renewable natural gas industry worldwide.

Limited growth with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives