- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

Is TotalEnergies (ENXTPA:TTE) Undervalued? A Fresh Look at Its Latest Valuation

Reviewed by Kshitija Bhandaru

TotalEnergies (ENXTPA:TTE) might not be making front-page headlines today, but its recent price movements could have left investors pausing and wondering what’s next. There hasn't been a distinct event to push the stock up or down this week. Sometimes, silence says just as much as a big announcement. When a stock stays relatively quiet against a shifting market backdrop, it can be a good prompt to revisit its valuation and fundamentals.

Looking at the bigger picture, TotalEnergies' share price has drifted down 12% over the past year, erasing some of the prior gains that investors enjoyed over the past three and five years. Long-term momentum has rewarded patient holders; however, the past month has seen another 4% slide, and performance this year-to-date remains in the red. The company has also reported some steady revenue and profit growth despite the softer share price.

So does this recent lull present a buying opportunity, or is the market already factoring in any future growth on the horizon?

Most Popular Narrative: 16.4% Undervalued

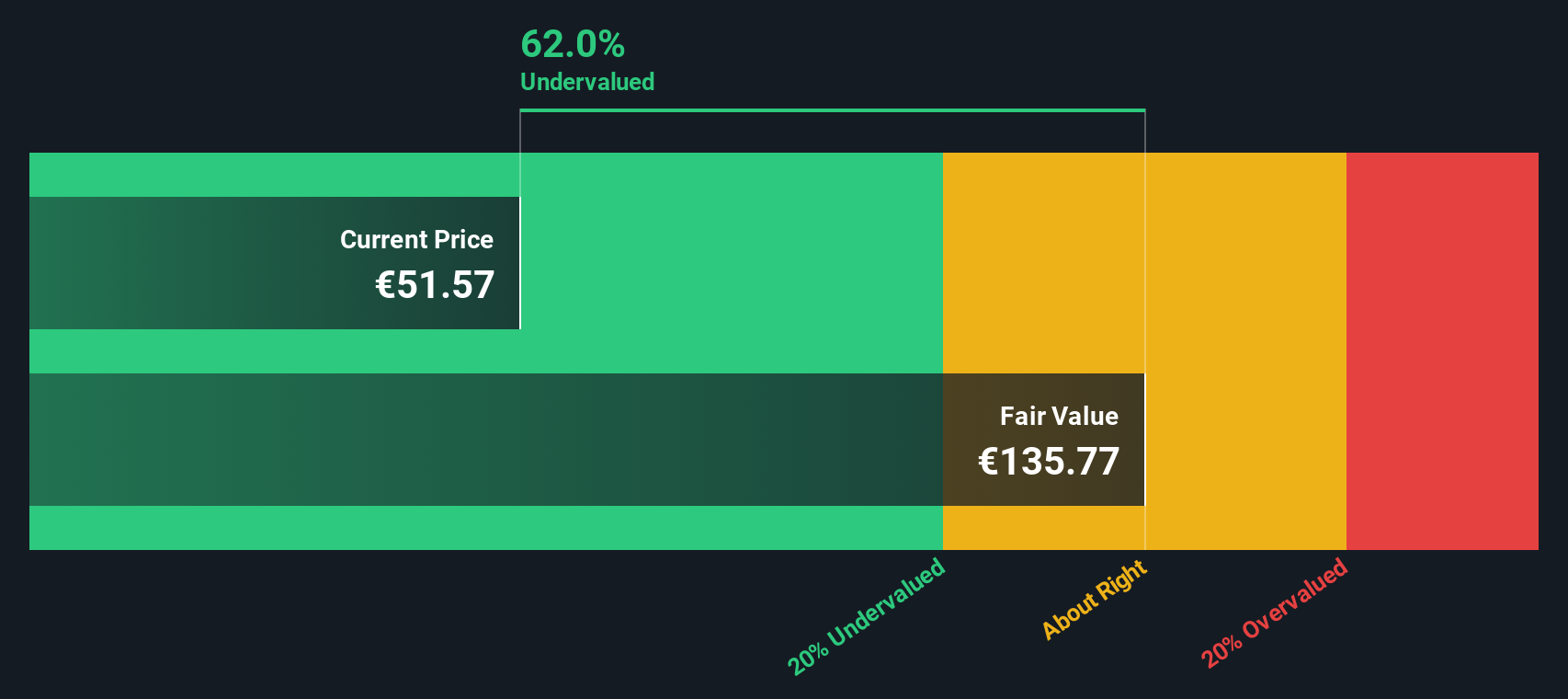

According to the most widely followed narrative, TotalEnergies is currently considered undervalued by the market, with fair value estimates significantly above its prevailing share price.

The company's ongoing expansion in gas and power, including LNG projects in the U.S., Canada, Qatar, and Malaysia as well as its strong position in signing flexible, long-term LNG contracts, positions TotalEnergies to benefit from the global shift toward cleaner energy and the sustained robust demand for natural gas. This is expected to support future top-line revenue growth and margin stability.

Want to know what’s truly fueling this deep discount? This narrative rests on a handful of pivotal assumptions about TotalEnergies’ profit run-rate and how rapidly it’s expected to turn growth investments into sustainable margins. The real story lies in the figures, especially forecasts that diverge sharply from the sector and could rewrite how investors value this multi-energy giant in the next three years.

Result: Fair Value of €62.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, further oil oversupply or weak downstream margins could derail TotalEnergies’ outlook. These factors would challenge growth assumptions and dampen enthusiasm for near-term upside.

Find out about the key risks to this TotalEnergies narrative.Another View: What Does the DCF Model Say?

Taking a step back from market multiples, our SWS DCF model also sees clear signs of undervaluation for TotalEnergies. This alternative approach relies on future cash flow projections. But does it capture the whole picture, or does it miss key risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TotalEnergies Narrative

If you think the analysis so far misses something, or you want to dig into the numbers yourself, you can easily create your own view in just minutes. Do it your way

A great starting point for your TotalEnergies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their portfolio to a single opportunity. Take the lead and explore more handpicked stock ideas to potentially strengthen your strategy and identify tomorrow’s winners ahead of the mainstream.

- Uncover companies riding the AI innovation wave by checking out our AI penny stocks for the sector’s boldest disruptors.

- Capture market bargains by researching our list of undervalued stocks based on cash flows that stand out for their attractive pricing compared to future cash flows.

- Maximize your passive income by reviewing dividend stocks with yields > 3% offering reliable yields above 3 percent for income-focused portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives