- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

Is Now the Right Moment to Reassess TotalEnergies After Recent Share Price Dip?

Reviewed by Bailey Pemberton

If you are sitting on the fence about what to do with your TotalEnergies stock, you are not alone. The last few weeks have been something of a rollercoaster for the stock, with a 3.3% dip over the past week and a modest 1.0% decline across the last month. Year-to-date, shares are off by 4.5%, and over the last year, the stock has slid 13.9%. But take a step back, and the long-term trajectory paints a much more encouraging picture. Over the last three years, the stock is up nearly 19%, and if you had held for five years, you would be staring at a 134.2% gain. That impressive run is a testament not just to market swings but also to shifting sentiment around global energy demand and the company's strategic moves, including investments in renewables, which have played a role in altering risk perceptions.

With changing energy markets and looming uncertainty, it is no surprise investors feel torn between caution and optimism. Here is the kicker: by crunching the numbers and using six different valuation checks, TotalEnergies stands out with a perfect value score of 6 out of 6, suggesting that by many traditional yardsticks, the stock is undervalued right now. In the next section, let’s break down these key valuation methods, and I will also share an angle that goes beyond the standard metrics for a fuller perspective on the company’s real potential.

Why TotalEnergies is lagging behind its peers

Approach 1: TotalEnergies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its future cash flows and discounting them back to today’s value. For TotalEnergies, the DCF begins with its last twelve months’ Free Cash Flow (FCF), which stands at about $13.4 billion. Analysts project FCF to reach up to $17.6 billion by 2029, and Simply Wall St extrapolates further growth in the years beyond, with FCF estimates climbing as high as $22.8 billion by 2035.

These projections account for anticipated growth in the company’s operations, largely influenced by global energy demand and strategic decisions around renewables and other investments. The full DCF calculation uses a 2 Stage Free Cash Flow to Equity model, reflecting both the near-term analyst outlook and longer-term company trajectory.

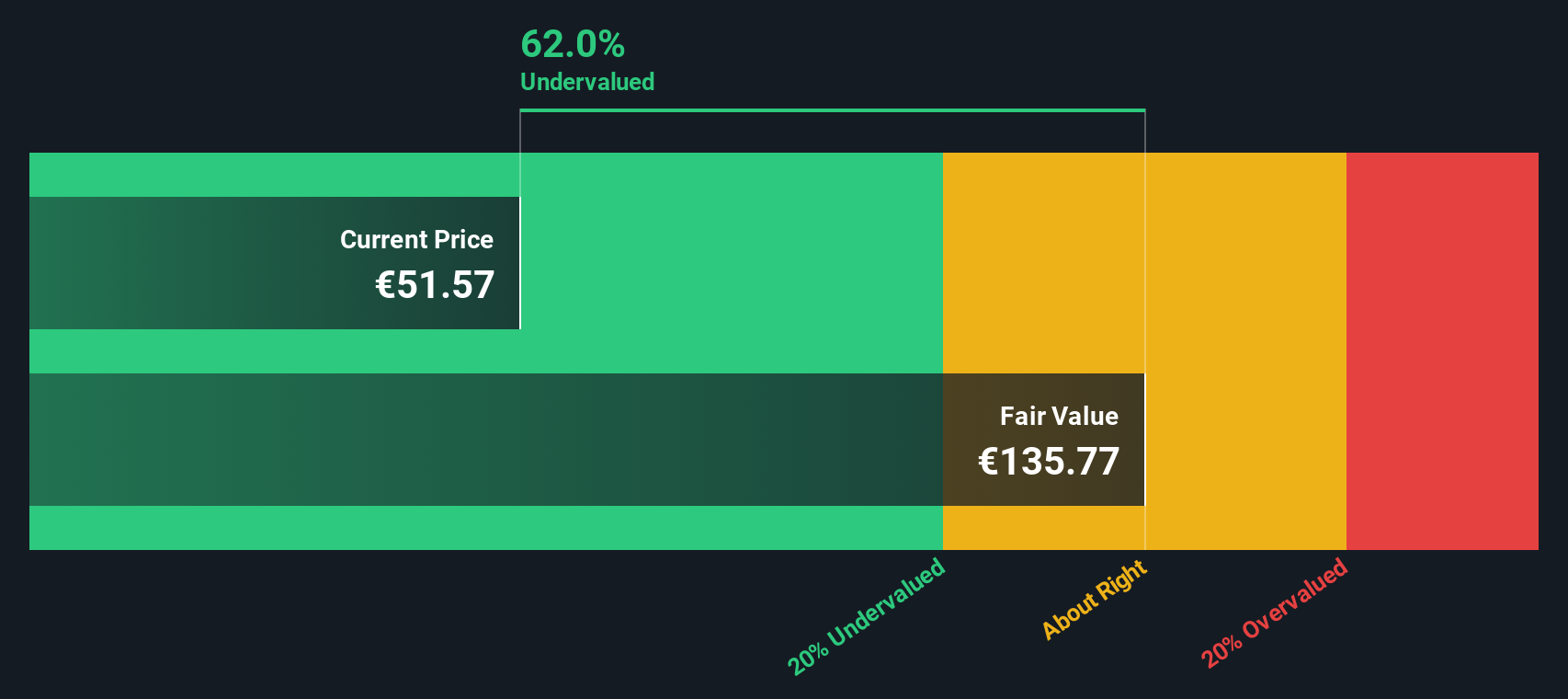

Based on this approach, the estimated intrinsic value for TotalEnergies comes in at €151.12 per share (using discounted cash flows in $). This represents a 66.0% discount to the current market price, which suggests the stock is significantly undervalued according to traditional DCF logic.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TotalEnergies is undervalued by 66.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: TotalEnergies Price vs Earnings

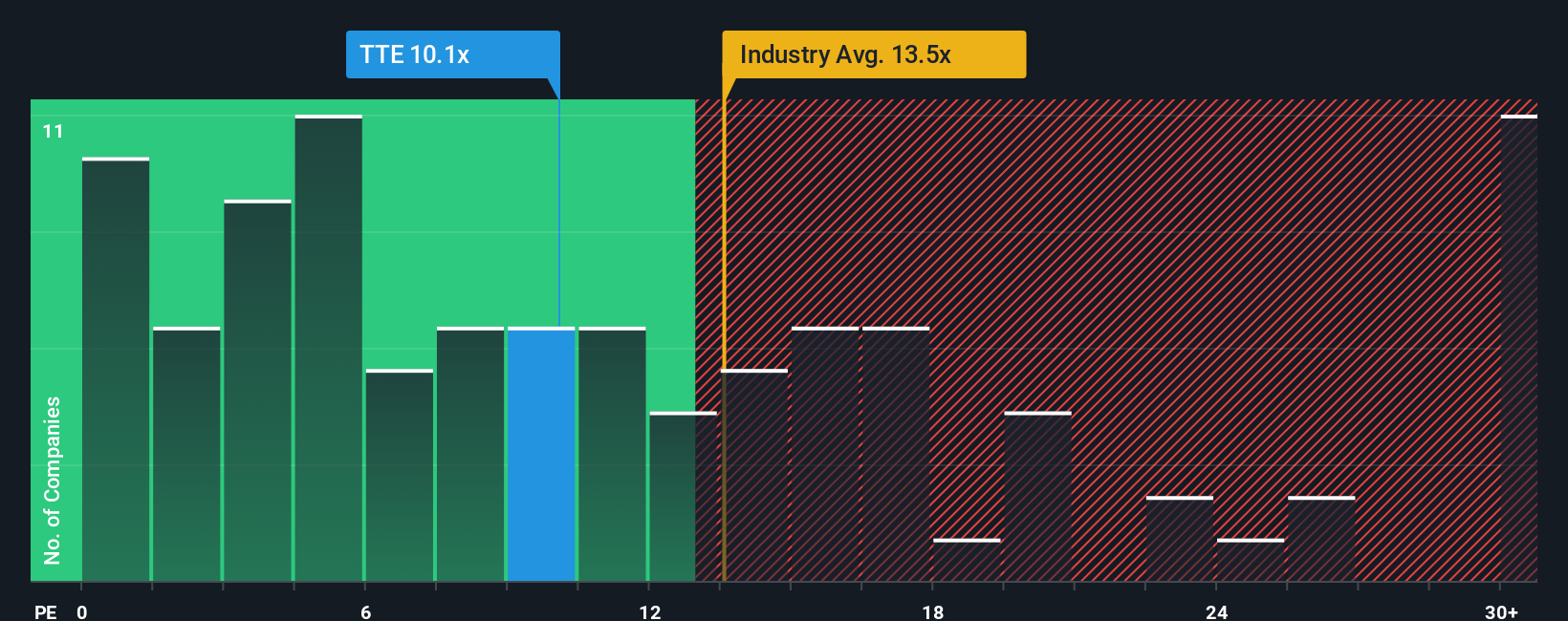

For companies like TotalEnergies that generate consistent profits, the Price-to-Earnings (PE) ratio is often the go-to valuation metric. The PE ratio offers a straightforward gauge of how much investors are willing to pay for a euro of current earnings. Higher growth expectations or lower perceived risk typically push this number higher. On the other hand, uncertainty or slower growth bring it down, making the PE ratio highly responsive to both future potential and present realities.

Currently, TotalEnergies trades at a PE ratio of 10.19x, which is well below the Oil and Gas industry average of 13.06x. Compared to its peer group, where the average is an even loftier 48.60x, TotalEnergies appears much cheaper by this conventional standard. However, raw comparisons can be misleading because they fail to account for each company's unique characteristics.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Unlike benchmarks that only look at sector or peer averages, the Fair Ratio factors in TotalEnergies’ specific earnings growth outlook, profit margins, risk profile, industry dynamics, and size. For TotalEnergies, the Fair PE Ratio is calculated at 15.41x. By measuring the actual 10.19x against this Fair Ratio, there is a meaningful gap. This suggests the shares are undervalued on this metric, even after considering all relevant fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TotalEnergies Narrative

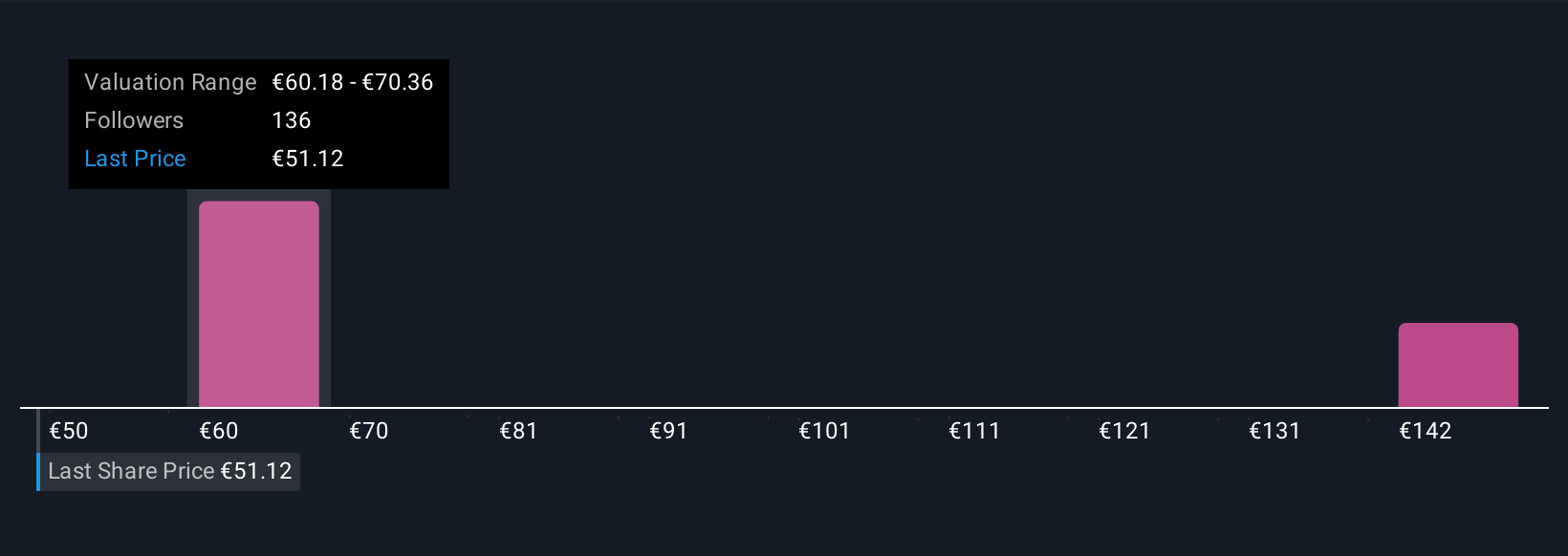

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible way to share your unique perspective on a company, taking into account your own estimates of fair value and assumptions about future revenue, earnings, or profit margins. By connecting the company's story with your financial forecast and a resulting fair value, Narratives empower you to ground investing decisions in both numbers and context.

On Simply Wall St's Community page, used by millions of investors, anyone can create and explore these Narratives in just a few steps. Narratives help you decide when to buy or sell by letting you easily compare your personal Fair Value estimate to the current market price, offering a much clearer view of whether a stock is attractive on your terms.

Because Narratives update automatically as new financial reports and news arrive, your analysis always reflects the latest company developments. For example, some investors see TotalEnergies benefiting from rapid renewables and LNG growth, projecting fair values as high as €77.57, while others focus on risks like oil volatility and global headwinds, arriving at more cautious valuations such as €52.82. This dynamic range is shaped by the stories and expectations behind the numbers.

Do you think there's more to the story for TotalEnergies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives