David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Etablissements Maurel & Prom S.A. (EPA:MAU) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Etablissements Maurel & Prom

How Much Debt Does Etablissements Maurel & Prom Carry?

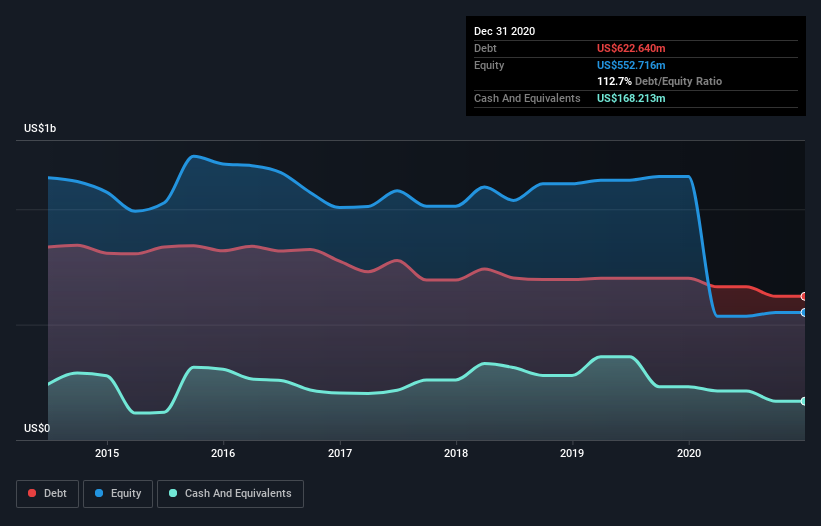

As you can see below, Etablissements Maurel & Prom had US$622.6m of debt at December 2020, down from US$700.7m a year prior. However, it does have US$168.2m in cash offsetting this, leading to net debt of about US$454.4m.

A Look At Etablissements Maurel & Prom's Liabilities

We can see from the most recent balance sheet that Etablissements Maurel & Prom had liabilities of US$302.0m falling due within a year, and liabilities of US$816.1m due beyond that. Offsetting this, it had US$168.2m in cash and US$108.7m in receivables that were due within 12 months. So its liabilities total US$841.2m more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$461.4m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Etablissements Maurel & Prom would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Etablissements Maurel & Prom's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Etablissements Maurel & Prom had a loss before interest and tax, and actually shrunk its revenue by 34%, to US$330m. That makes us nervous, to say the least.

Caveat Emptor

While Etablissements Maurel & Prom's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost US$19m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. It's fair to say the loss of US$589m didn't encourage us either; we'd like to see a profit. In the meantime, we consider the stock to be risky. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Etablissements Maurel & Prom's profit, revenue, and operating cashflow have changed over the last few years.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Etablissements Maurel & Prom, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Etablissements Maurel & Prom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:MAU

Etablissements Maurel & Prom

Engages in exploration and production of oil and gas, and hydrocarbons in Gabon, Tanzania, Angola, Colombia, and France.

Outstanding track record with flawless balance sheet.