- France

- /

- Oil and Gas

- /

- ENXTPA:MAU

3 Top Dividend Stocks On Euronext Paris Yielding Up To 7.8%

Reviewed by Simply Wall St

Amidst escalating Middle East tensions and cautious investor sentiment, the French CAC 40 Index recently experienced a decline of 3.21%, reflecting broader European market challenges. However, in this environment of uncertainty, dividend stocks on Euronext Paris stand out as attractive options for investors seeking stable income streams; these stocks offer the potential for consistent returns even when markets are volatile.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.57% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.81% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.00% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.12% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.72% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.85% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.97% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.69% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.87% | ★★★★★☆ |

| Eiffage (ENXTPA:FGR) | 4.74% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

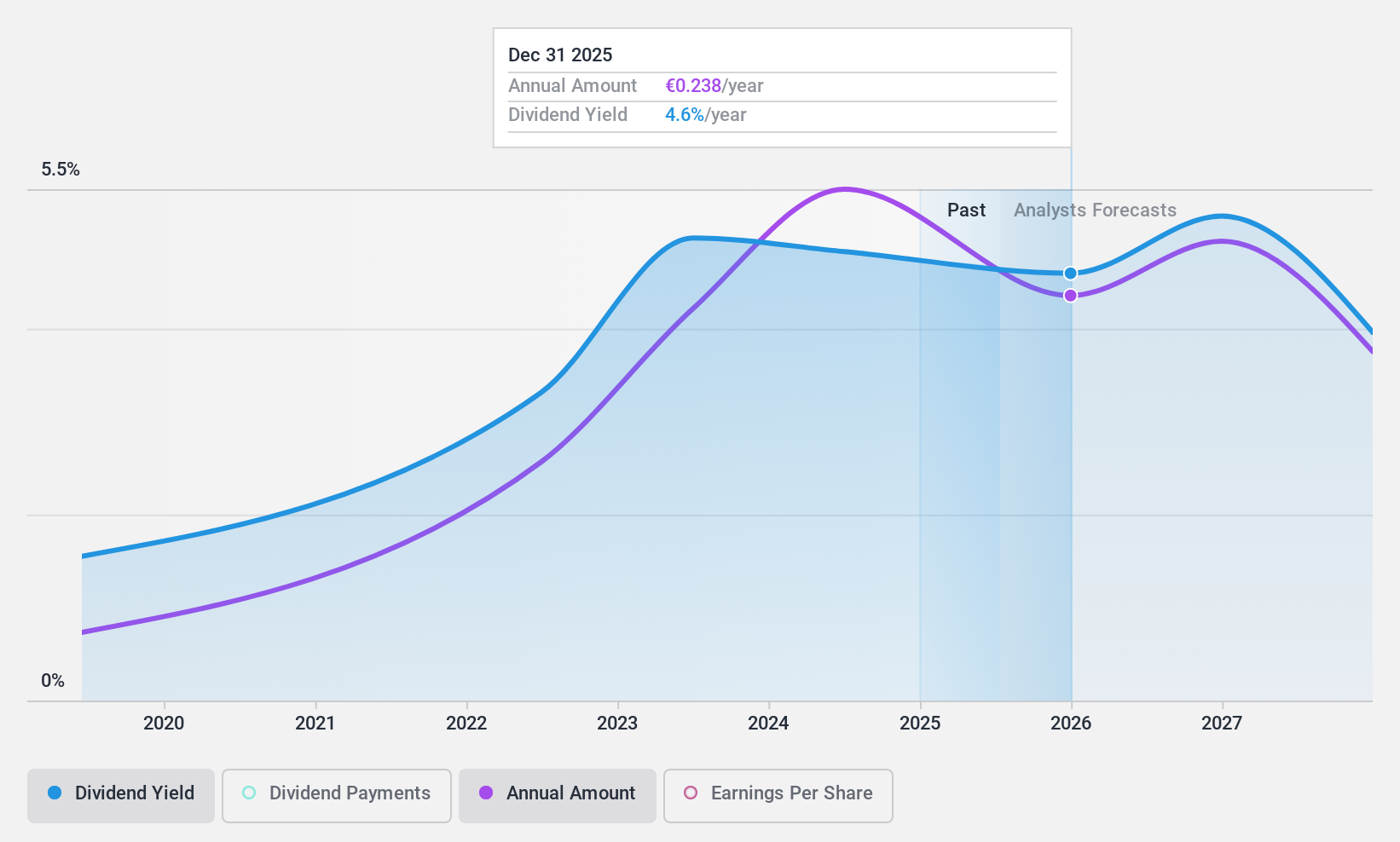

Fleury Michon (ENXTPA:ALFLE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fleury Michon SA is a company that produces and sells food products both in France and internationally, with a market cap of €104.71 million.

Operations: Fleury Michon's revenue is primarily derived from its Division GMS France, which contributes €679.59 million, and its International Division, which adds €91.20 million.

Dividend Yield: 5.2%

Fleury Michon's dividend payments are well-covered by both earnings (payout ratio: 34.1%) and cash flows (cash payout ratio: 12.6%), despite a history of volatility over the past decade. The dividend yield of 5.18% is below the top quartile in France, and while dividends have grown over ten years, they remain unreliable due to fluctuations. Recent earnings show net income at €46.7 million for H1 2024, significantly up from €1.2 million last year, though sales declined to €399.1 million from €422.3 million.

- Click to explore a detailed breakdown of our findings in Fleury Michon's dividend report.

- Upon reviewing our latest valuation report, Fleury Michon's share price might be too pessimistic.

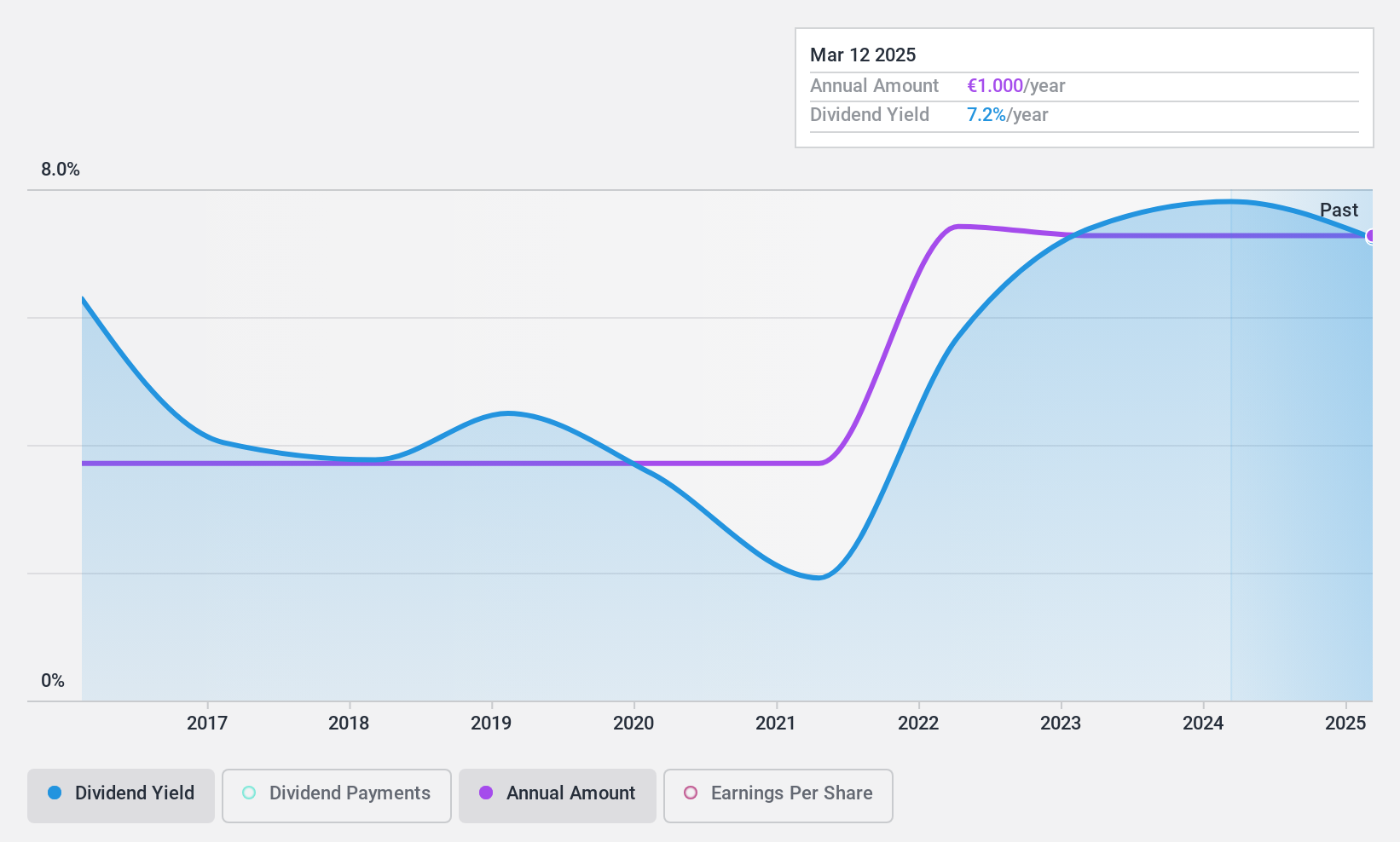

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA designs, manufactures, and markets swimming pools and related products both in France and internationally, with a market cap of €113.98 million.

Operations: Piscines Desjoyaux SA generates its revenue through the design, manufacturing, and marketing of swimming pools and related products across domestic and international markets.

Dividend Yield: 7.9%

Piscines Desjoyaux's dividend payments have been reliable and stable over the past decade, with a notable increase in dividends. However, the high cash payout ratio of 486.2% indicates that dividends are not well covered by free cash flows, raising concerns about sustainability despite being covered by earnings with a payout ratio of 72.5%. The dividend yield stands at 7.87%, placing it among the top quartile in France but potentially unsustainable long-term without better cash flow coverage.

- Take a closer look at Piscines Desjoyaux's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Piscines Desjoyaux shares in the market.

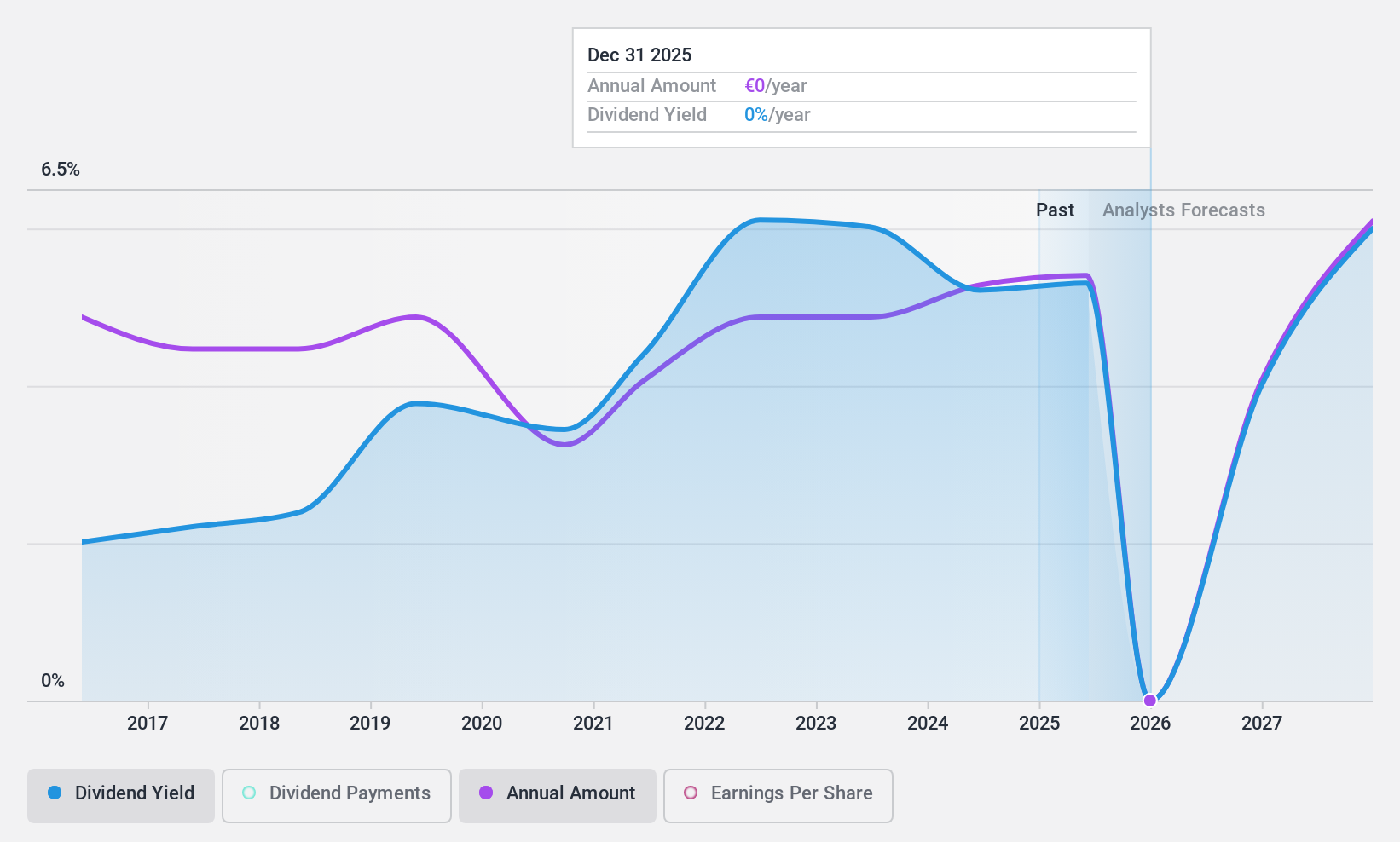

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, Colombia, and France with a market cap of €1.03 billion.

Operations: Etablissements Maurel & Prom S.A.'s revenue primarily comes from its production activities, generating $658.76 million, with additional income of $30.57 million from drilling operations.

Dividend Yield: 5.7%

Etablissements Maurel & Prom's dividend payments have been volatile over the past five years, and while they are well covered by earnings and cash flows with payout ratios of 25.5% and 37.3%, respectively, the sustainability remains uncertain due to an unstable track record. Despite this, its dividend yield of 5.74% ranks in the top quartile in France. Recent earnings growth—net income rose to US$100.93 million for H1 2024—may support future payouts but does not guarantee stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Etablissements Maurel & Prom.

- The valuation report we've compiled suggests that Etablissements Maurel & Prom's current price could be quite moderate.

Where To Now?

- Get an in-depth perspective on all 32 Top Euronext Paris Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etablissements Maurel & Prom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MAU

Etablissements Maurel & Prom

Engages in exploration and production of oil and gas, and hydrocarbons in Gabon, Tanzania, Angola, and Venezuela.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives