- China

- /

- Entertainment

- /

- SHSE:603444

3 Leading Dividend Stocks With Up To 5.8% Yield

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data releases, global markets experienced mixed performances, with major U.S. indices finishing mostly lower despite some reaching record highs mid-week. Amidst this backdrop of cautious corporate earnings and complex economic signals, dividend stocks continue to attract investors seeking stable income streams in uncertain times. A good dividend stock typically offers consistent payouts and a strong financial foundation, providing potential resilience against market volatility as seen in the current environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.87% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.92% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Globeride (TSE:7990) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.39% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

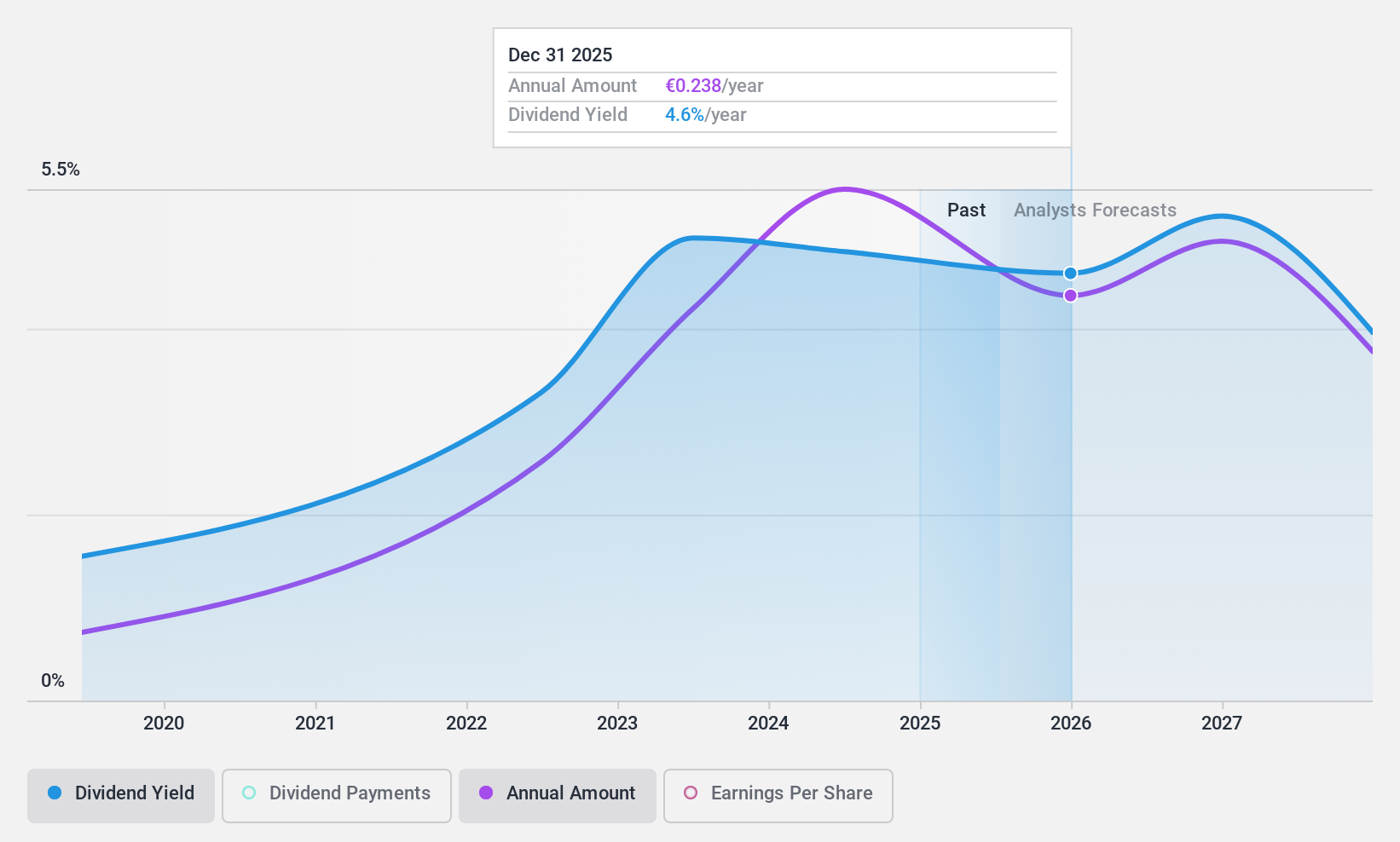

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, Colombia, and France with a market cap of €1.01 billion.

Operations: The company's revenue is primarily derived from its production segment, which accounts for $658.76 million, complemented by $30.57 million from drilling activities.

Dividend Yield: 5.8%

Etablissements Maurel & Prom offers a dividend yield in the top 25% of the French market, with a payout ratio of 25.5%, indicating dividends are well covered by earnings and cash flows. However, its dividend track record is unstable and volatile over the past five years. Despite recent sales growth to $559 million for nine months, earnings are forecasted to decline by an average of 13.4% annually over the next three years.

- Take a closer look at Etablissements Maurel & Prom's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Etablissements Maurel & Prom is trading behind its estimated value.

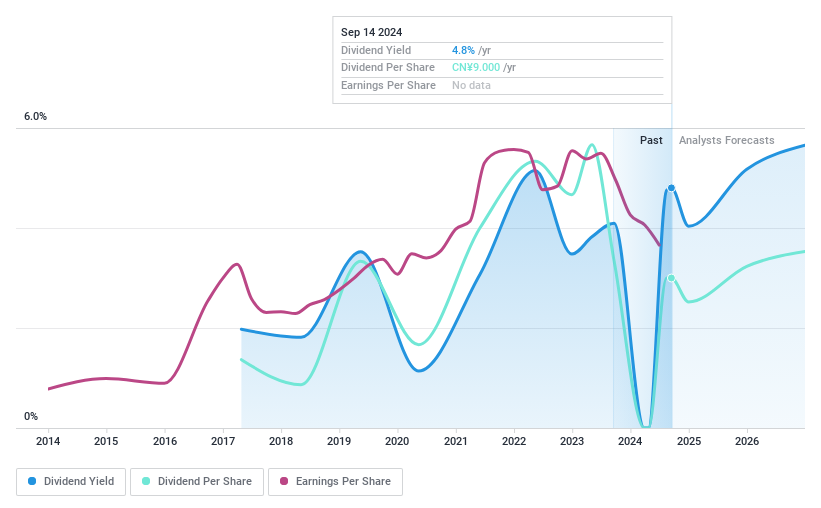

G-bits Network Technology (Xiamen) (SHSE:603444)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G-bits Network Technology (Xiamen) Co., Ltd. is a company engaged in the development and operation of online games, with a market cap of approximately CN¥15.52 billion.

Operations: G-bits Network Technology (Xiamen) Co., Ltd. generates its revenue primarily through the development and operation of online games.

Dividend Yield: 4.2%

G-bits Network Technology's dividend yield ranks in the top 25% of the Chinese market, supported by a payout ratio of 35.2%, indicating coverage by earnings and cash flows. However, its dividend history is less reliable due to volatility over eight years. Recent earnings showed a decline, with net income at CNY 657.5 million for nine months compared to CNY 859.31 million last year, highlighting potential challenges in maintaining stable dividends.

- Click to explore a detailed breakdown of our findings in G-bits Network Technology (Xiamen)'s dividend report.

- The valuation report we've compiled suggests that G-bits Network Technology (Xiamen)'s current price could be quite moderate.

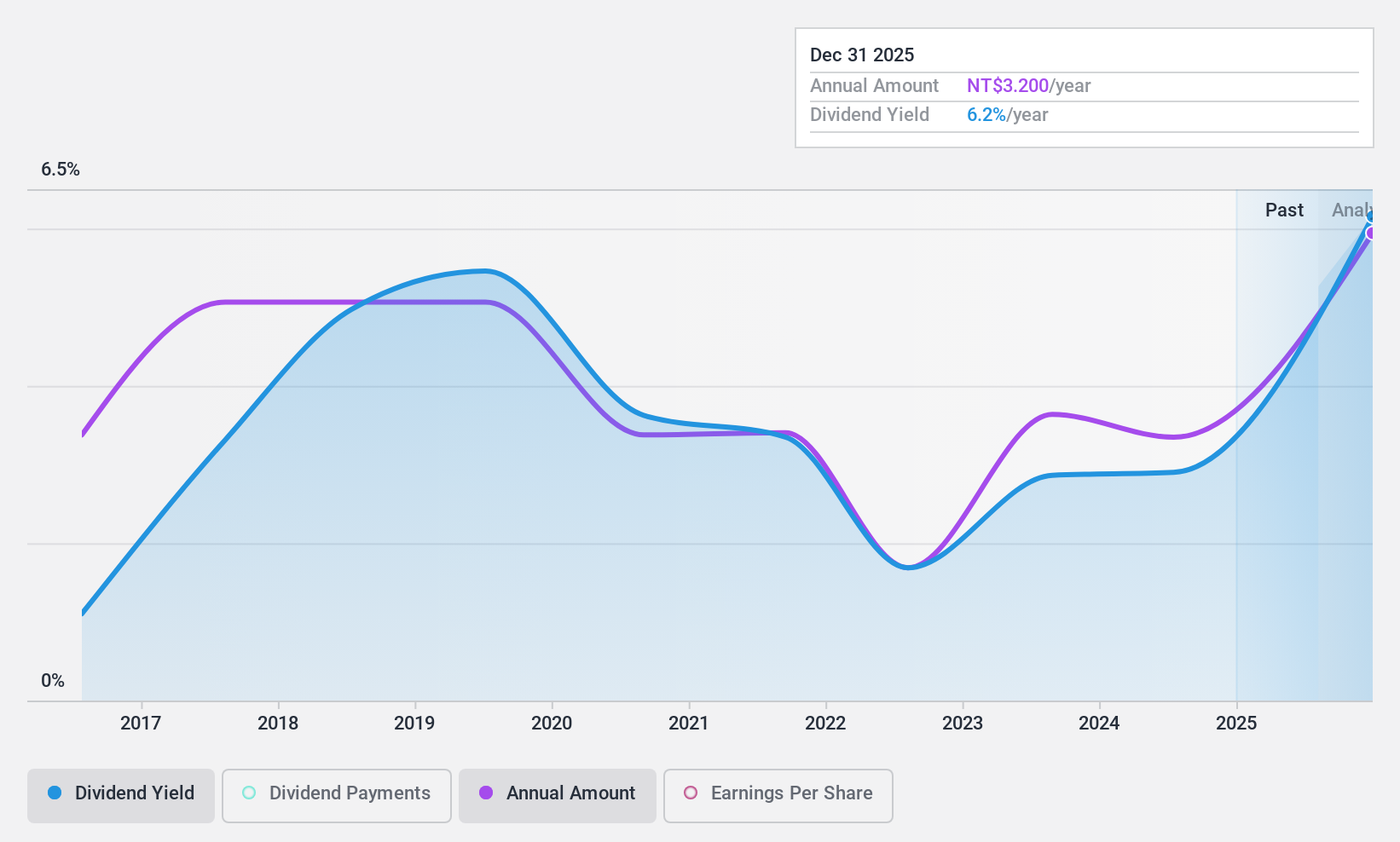

SuperAlloy Industrial (TWSE:1563)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SuperAlloy Industrial Co., Ltd. specializes in engineering and manufacturing lightweight metal products for the automotive industry, with a market cap of NT$14.17 billion.

Operations: SuperAlloy Industrial Co., Ltd. generates its revenue through the engineering and production of lightweight metal components, primarily serving the automotive sector.

Dividend Yield: 3%

SuperAlloy Industrial's dividend yield is below the top 25% in Taiwan, with a payout ratio of 59.2%, indicating coverage by earnings and cash flows. Despite a history of volatility, dividends have increased over the past decade. Recent earnings show improvement, with net income rising to TWD 188.98 million for Q3 compared to last year, suggesting potential stability in payouts. However, past shareholder dilution and high debt levels might pose risks for dividend sustainability.

- Navigate through the intricacies of SuperAlloy Industrial with our comprehensive dividend report here.

- The valuation report we've compiled suggests that SuperAlloy Industrial's current price could be inflated.

Summing It All Up

- Investigate our full lineup of 1928 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603444

G-bits Network Technology (Xiamen)

G-bits Network Technology (Xiamen) Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.