- France

- /

- Real Estate

- /

- ENXTPA:CBOT

3 Euronext Paris Dividend Stocks With Up To 6.8% Yield

Reviewed by Simply Wall St

As the French economy shows resilience with the CAC 40 Index advancing by 2.48%, investors are increasingly looking at dividend stocks as a reliable income source amidst fluctuating market conditions. In this context, selecting stocks with strong fundamentals and attractive yields can be a prudent strategy for those seeking steady returns in uncertain times.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.58% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.04% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.82% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.04% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.40% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.03% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.83% | ★★★★★☆ |

| Rexel (ENXTPA:RXL) | 5.35% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.53% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.23% | ★★★★★☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

CBo Territoria (ENXTPA:CBOT)

Simply Wall St Dividend Rating: ★★★★★★

Overview: CBo Territoria SA is involved in urban planning, property development, and investment activities in France with a market cap of €126.05 million.

Operations: CBo Territoria SA generates revenue from three main segments: Land (€25.51 million), and Promotion (€58.08 million).

Dividend Yield: 6.8%

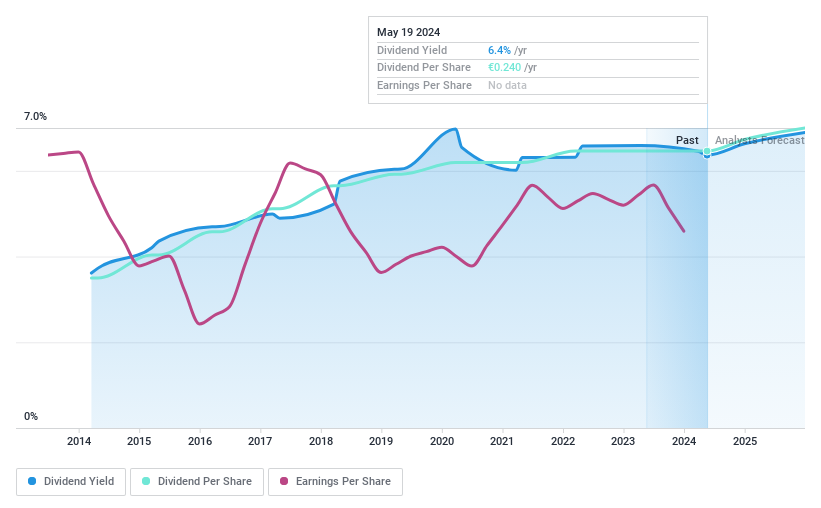

CBo Territoria offers a high and reliable dividend yield of 6.82%, placing it in the top 25% of French dividend payers. The dividends have been stable and growing over the past decade, with a reasonable payout ratio of 61% covered by earnings and a low cash payout ratio of 25.4%. However, the company has a high level of debt. Its price-to-earnings ratio is attractively low at 8.9x compared to the market average of 14.7x.

- Delve into the full analysis dividend report here for a deeper understanding of CBo Territoria.

- According our valuation report, there's an indication that CBo Territoria's share price might be on the expensive side.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Etablissements Maurel & Prom S.A. engages in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, Colombia, and France with a market cap of €1.06 billion.

Operations: Etablissements Maurel & Prom S.A. generates revenue primarily from its Production segment at $658.76 million and Drilling segment at $30.57 million.

Dividend Yield: 5.5%

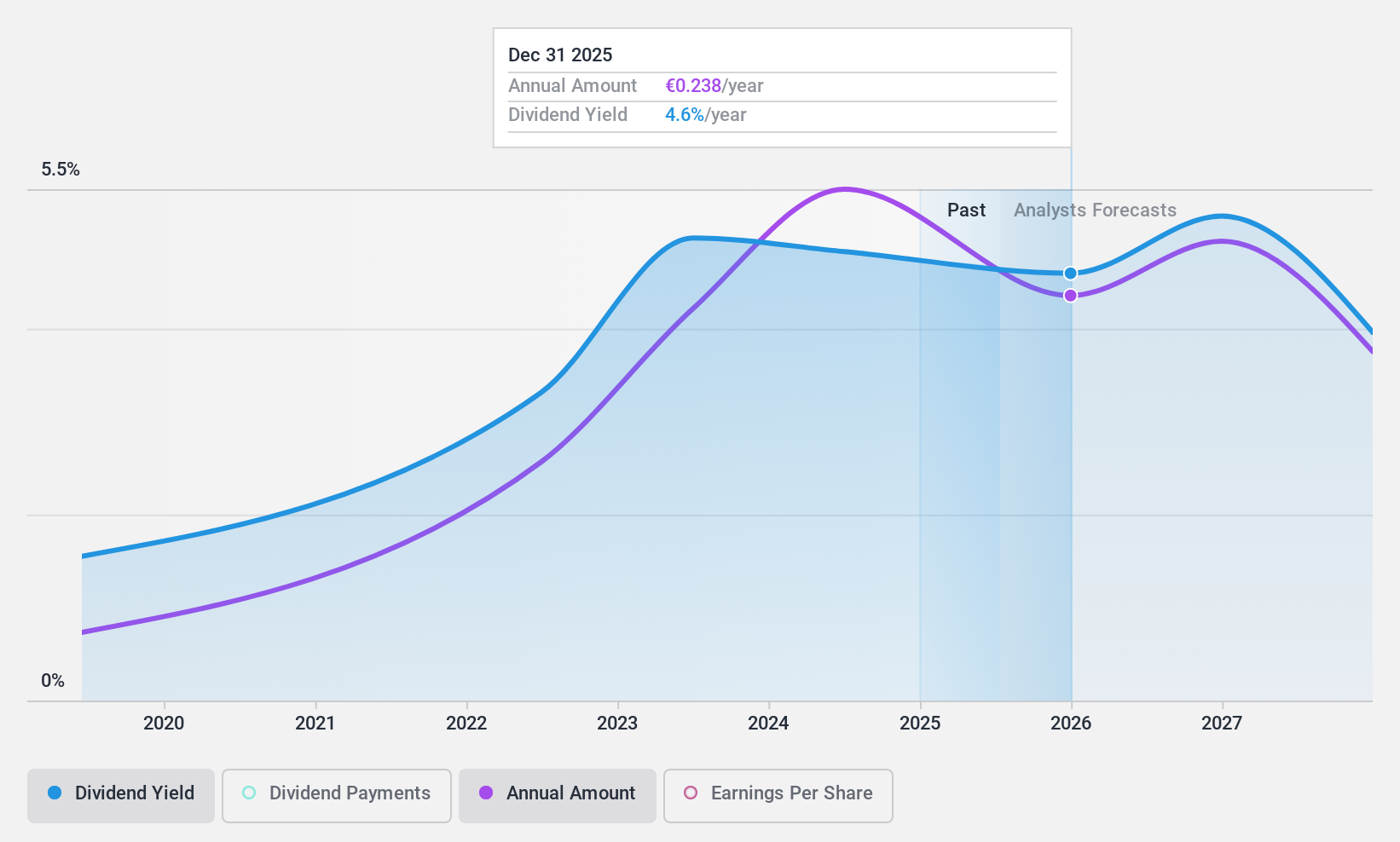

Etablissements Maurel & Prom's recent earnings report showed significant growth, with net income rising to US$100.93 million from US$52.92 million a year ago. The company approved a dividend of €0.30 per share, paid on July 5, 2024. Despite its top-tier dividend yield and low payout ratios indicating good coverage by earnings and cash flows, the dividend history has been volatile and unreliable over the past five years.

- Navigate through the intricacies of Etablissements Maurel & Prom with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Etablissements Maurel & Prom's share price might be too pessimistic.

Samse (ENXTPA:SAMS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samse SA, with a market cap of €567.33 million, distributes building materials and tools across France.

Operations: Samse SA generates its revenue primarily from two segments: Trading (€1.74 billion) and Do-It-Yourself (€431.46 million).

Dividend Yield: 6%

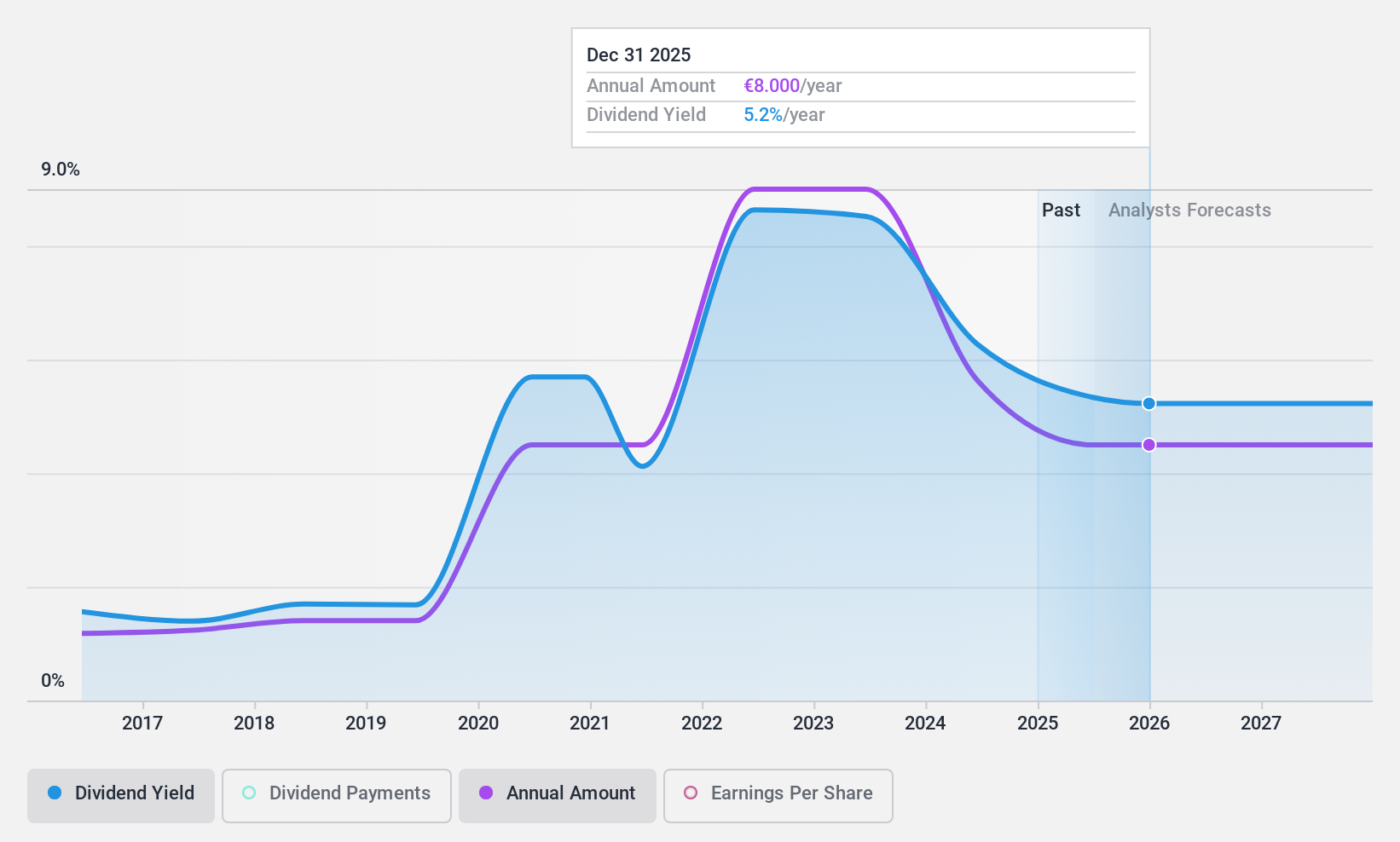

Samse's dividend payments have been volatile over the past decade, despite a low payout ratio of 44.8%, indicating good earnings coverage. The cash payout ratio stands at 36.8%, further supporting dividend sustainability through cash flows. Trading slightly below its estimated fair value, Samse offers a top-tier dividend yield of 6.04%, placing it in the top 25% of French market payers, yet its unstable history raises concerns for consistent income investors.

- Unlock comprehensive insights into our analysis of Samse stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Samse is priced lower than what may be justified by its financials.

Make It Happen

- Dive into all 35 of the Top Euronext Paris Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CBo Territoria, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CBOT

6 star dividend payer with proven track record.

Market Insights

Community Narratives