- France

- /

- Diversified Financial

- /

- ENXTPA:WLN

Investors Don't See Light At End Of Worldline SA's (EPA:WLN) Tunnel And Push Stock Down 26%

The Worldline SA (EPA:WLN) share price has fared very poorly over the last month, falling by a substantial 26%. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

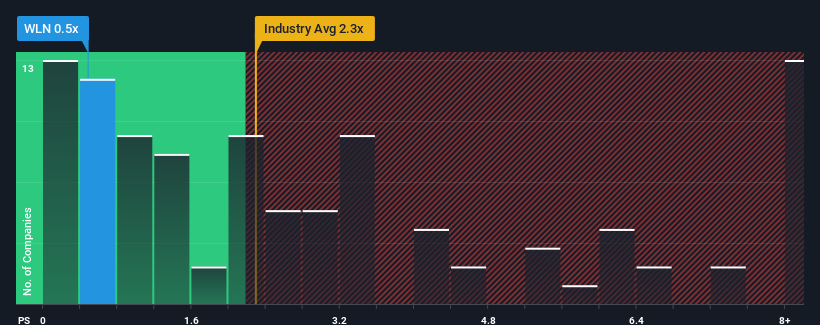

Following the heavy fall in price, Worldline's price-to-sales (or "P/S") ratio of 0.5x might make it look like a strong buy right now compared to the wider Diversified Financial industry in France, where around half of the companies have P/S ratios above 2.7x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Worldline

How Worldline Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Worldline has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Worldline.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Worldline's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 52% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 5.4% each year over the next three years. That's shaping up to be materially lower than the 32% each year growth forecast for the broader industry.

In light of this, it's understandable that Worldline's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Having almost fallen off a cliff, Worldline's share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Worldline's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Worldline that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Worldline might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:WLN

Worldline

Provides payments and transactional services for financial institutions, merchants, corporations, and government agencies in Northern Europe, Central and Eastern Europe, Southern Europe, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives