- Switzerland

- /

- Media

- /

- SWX:APGN

Unearthing Europe's Hidden Stock Gems This March 2025

Reviewed by Simply Wall St

As the European market navigates through a landscape marked by trade policy uncertainties and economic recalibrations, the pan-European STOXX Europe 600 Index recently snapped a 10-week streak of gains, reflecting cautious investor sentiment. However, with Germany and the EU planning increased spending on defense and infrastructure, opportunities abound for discerning investors seeking to identify promising small-cap stocks that could benefit from these strategic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | -2.23% | 6.18% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Gelsenwasser (DB:WWG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gelsenwasser AG operates in the water, wastewater, gas supply, and electricity sectors across Germany, the Czech Republic, and Poland with a market capitalization of €1.75 billion.

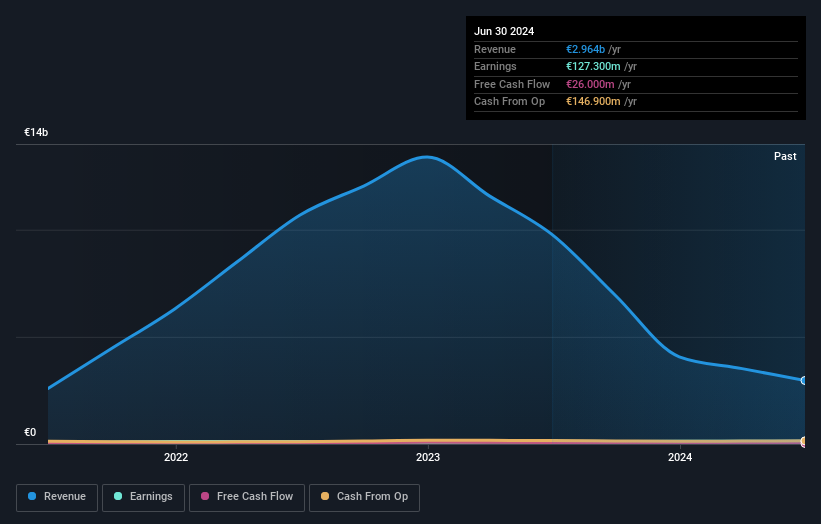

Operations: Gelsenwasser AG generates revenue primarily from energy sales (€3.93 billion) and energy grids (€271.20 million), with additional contributions from water services (€286.30 million) and wastewater management (€39.20 million). The company's net profit margin is a key financial indicator to consider when evaluating its profitability within these sectors.

Gelsenwasser, a notable player in the European utilities sector, showcases impressive financial health with no debt on its books. It has demonstrated robust earnings growth of 32.9% over the past year, outpacing the industry's average of 3.3%. Trading at a significant discount of 86.2% below its estimated fair value, this company seems undervalued given its high-quality earnings profile and positive free cash flow status. The absence of recent financial data might raise some eyebrows but doesn't overshadow its strong performance metrics and potential for future growth in the integrated utilities space.

- Dive into the specifics of Gelsenwasser here with our thorough health report.

Assess Gelsenwasser's past performance with our detailed historical performance reports.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific; it has a market capitalization of approximately €736.82 million.

Operations: VIEL & Cie generates revenue primarily from professional intermediation, which contributes €1.05 billion, and stock exchange online activities amounting to €71.02 million. The company also receives a smaller contribution from holdings at €3.63 million, while real estate and other activities slightly detract with -€0.15 million.

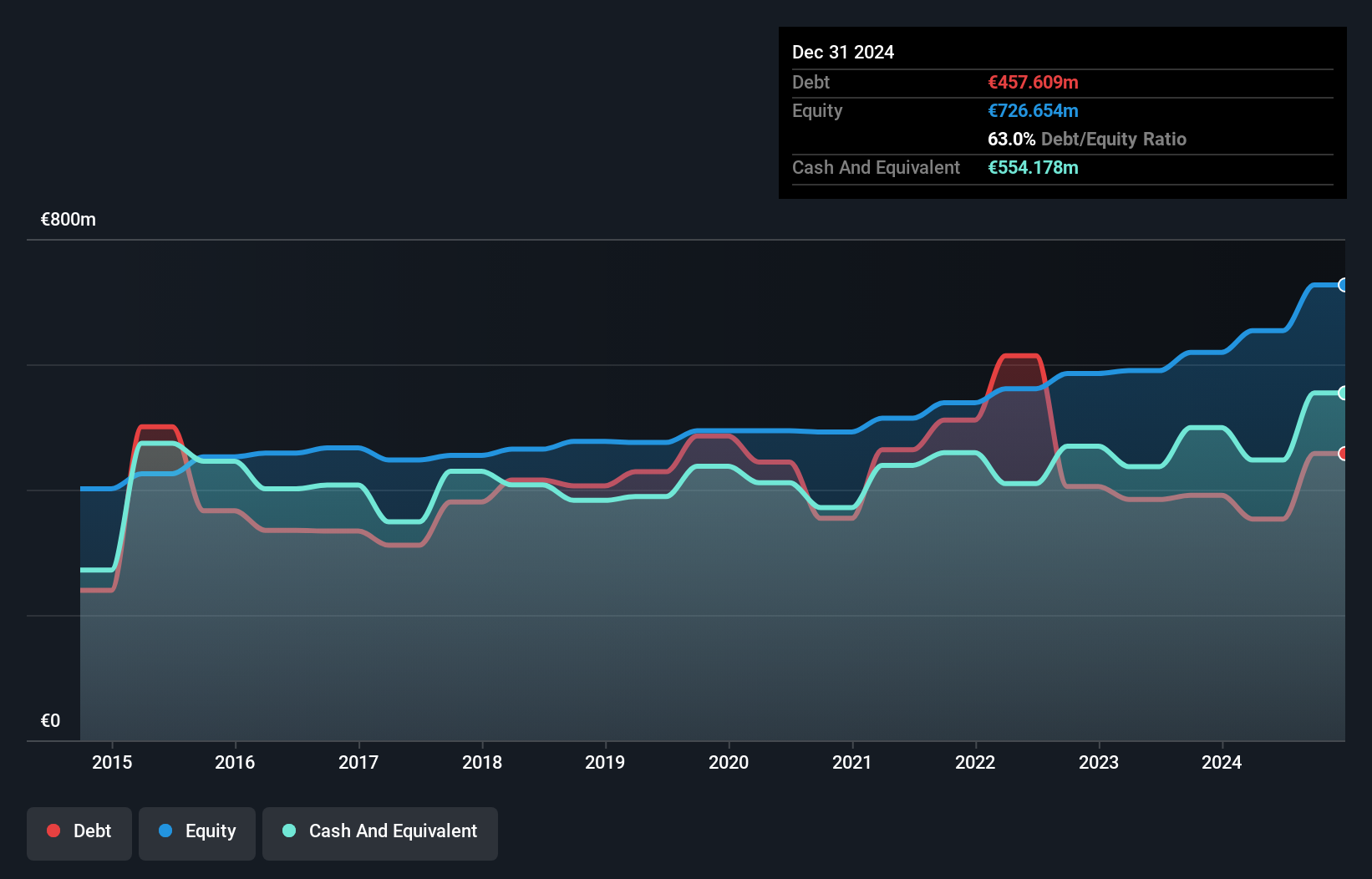

VIEL & Cie, a smaller player in the European market, has shown impressive earnings growth of 36.3% over the past year, outpacing the Capital Markets industry average of 19.3%. Trading at 30.9% below its estimated fair value suggests potential undervaluation. The company is financially sound with more cash than total debt and a reduced debt to equity ratio from 90.2% to 54% over five years, indicating improved financial health. While high-quality earnings are noted, it's unclear if interest payments are well covered by EBIT due to insufficient data on this aspect.

- Unlock comprehensive insights into our analysis of VIEL & Cie société anonyme stock in this health report.

Learn about VIEL & Cie société anonyme's historical performance.

APG|SGA (SWX:APGN)

Simply Wall St Value Rating: ★★★★★☆

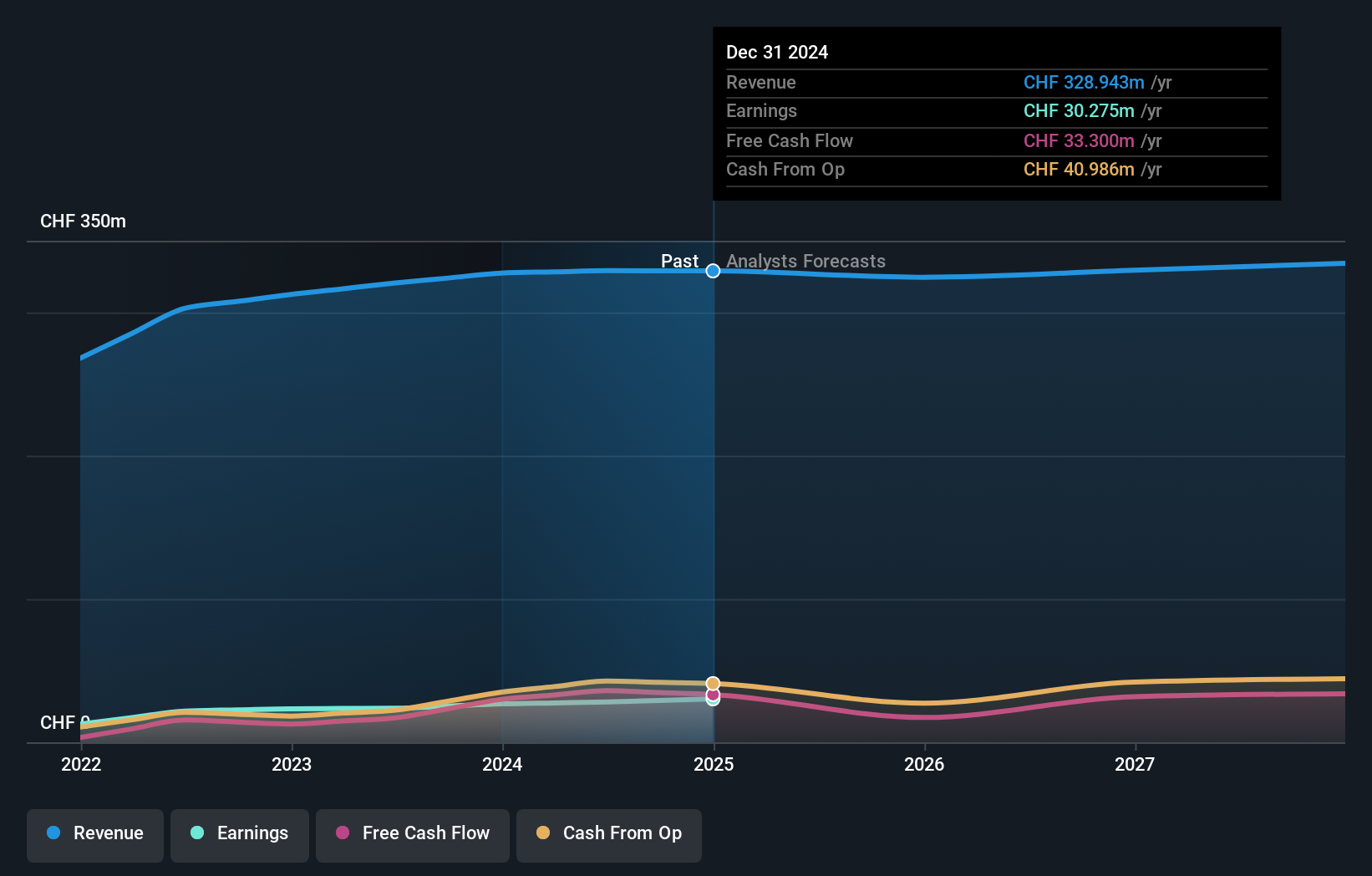

Overview: APG|SGA SA is a company that offers advertising services mainly in Switzerland and Serbia, with a market capitalization of CHF682.89 million.

Operations: APG|SGA generates revenue of CHF329.12 million through the acquisition, sale, and management of advertising spaces.

APG|SGA, a compact player in the media space, shows intriguing potential despite some challenges. The company has no debt and boasts high-quality past earnings, providing a stable footing. Over the last year, its earnings grew by 18.6%, outpacing the media industry's growth of 18.4%. Trading at 72.8% below estimated fair value suggests it might be undervalued by market standards. Recent reports reveal revenue increased to CHF 332.83 million from CHF 328.76 million, with net income rising to CHF 30.28 million from CHF 26.82 million last year, reflecting solid performance amidst industry dynamics.

- Take a closer look at APG|SGA's potential here in our health report.

Gain insights into APG|SGA's past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 355 more companies for you to explore.Click here to unveil our expertly curated list of 358 European Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:APGN

APG|SGA

Provides advertising services primarily in Switzerland and Serbia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives