- France

- /

- Consumer Durables

- /

- ENXTPA:RBO

Undiscovered Gems In France To Watch This September 2024

Reviewed by Simply Wall St

As European markets continue to rally, driven by slowing inflation and potential interest rate cuts by the European Central Bank, investors are increasingly turning their attention to promising small-cap stocks. With France's CAC 40 Index showing steady gains and economic sentiment on the rise, this September is an opportune time to explore some lesser-known French companies that could offer significant growth potential. In such a dynamic market environment, identifying strong stocks often involves looking for companies with solid fundamentals, innovative business models, and resilience in fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

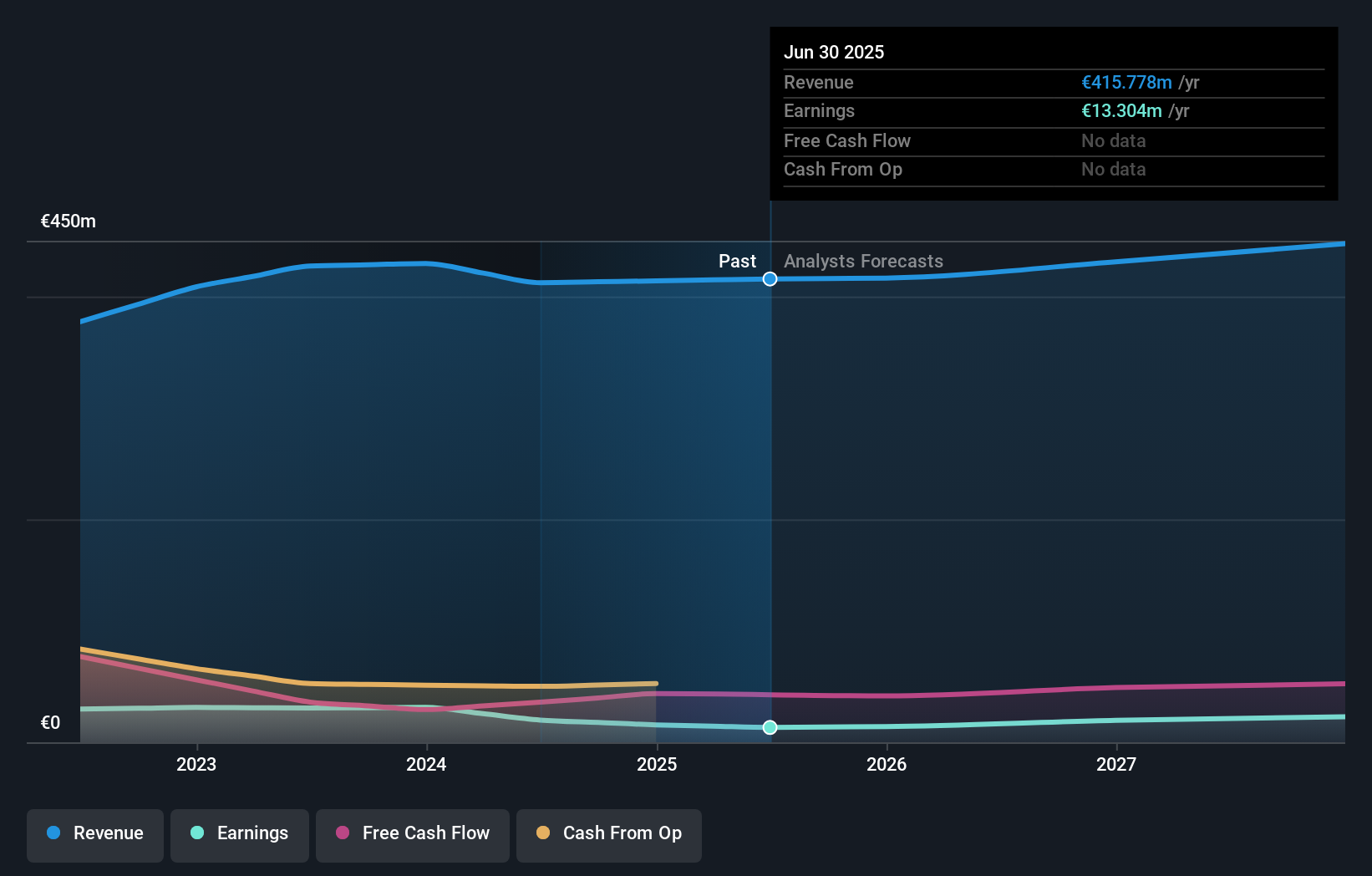

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative (ENXTPA:CRAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative offers a range of banking products and services in France and has a market cap of approximately €556.66 million.

Operations: The company's primary revenue stream is from retail banking, generating €434.27 million.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative, with total assets of €26.2B and equity of €3.3B, shows promise as an undiscovered gem in France. The bank's net income for the first half of 2024 was €92.26M, up from €81.18M last year. Its earnings growth over the past year was 5.3%, surpassing the industry average of -11%. Additionally, it has a sufficient allowance for bad loans at 109% and appropriate bad loans ratio at 1.7%.

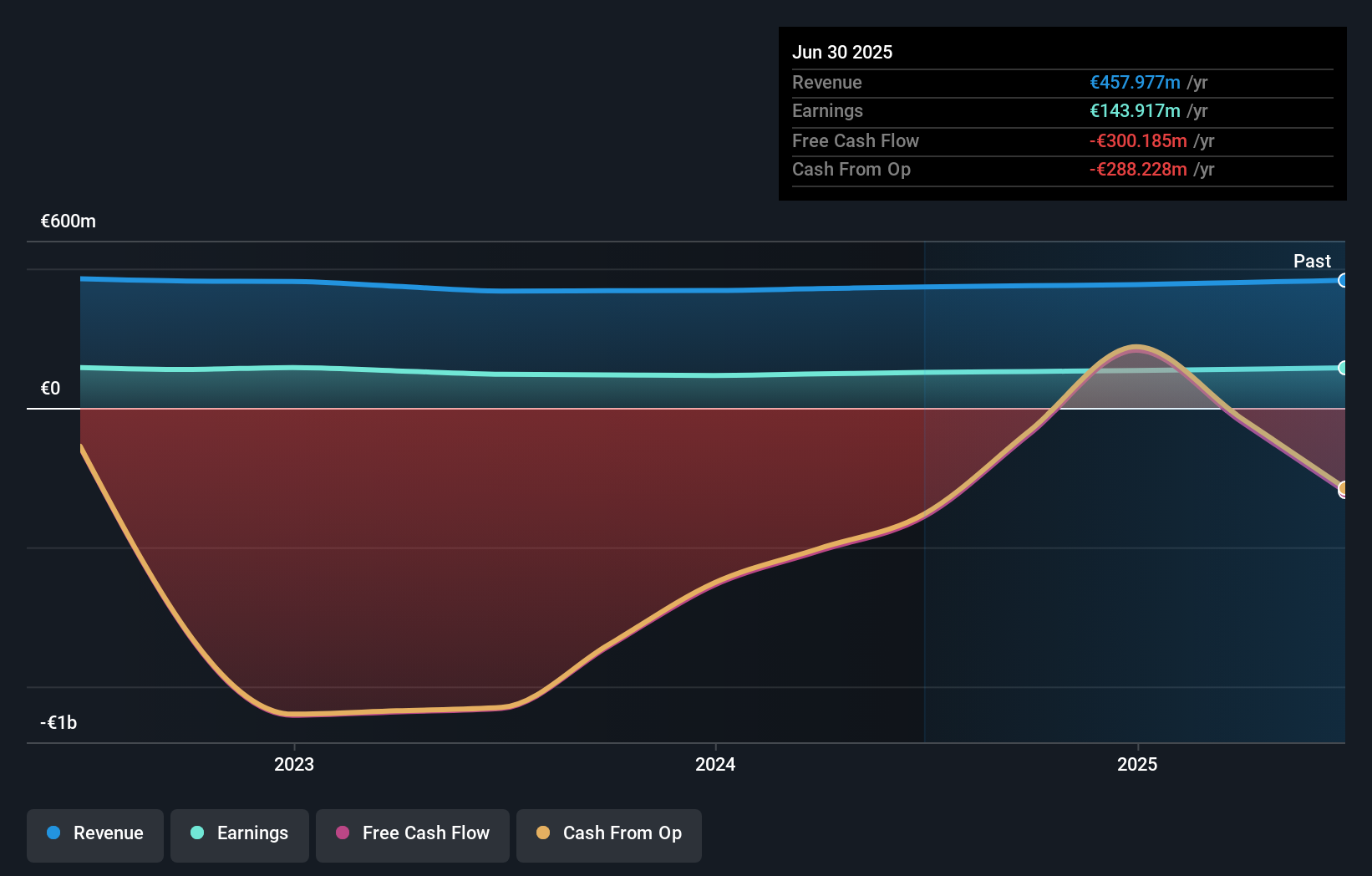

Roche Bobois (ENXTPA:RBO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Roche Bobois S.A. operates in the global furniture design and distribution industry, with a market cap of €488.07 million.

Operations: Roche Bobois generates revenue from various segments, including Roche Bobois USA/Canada (€150.21 million), Roche Bobois France (€118.72 million), and Roche Bobois Europe (excluding France) (€105.94 million). The company also derives income from Cuir Center (€43.39 million) and other overseas operations (€7.23 million).

Roche Bobois, a notable player in the luxury furniture market, has demonstrated high-quality earnings with a robust EBIT interest coverage of 13.7x. Over the past five years, its earnings have grown impressively by 34.9% annually while reducing its debt to equity ratio from 39.5% to 33.4%. Trading at 50.2% below estimated fair value, it seems undervalued despite only modest growth of 0.2% last year compared to the industry’s 28%.

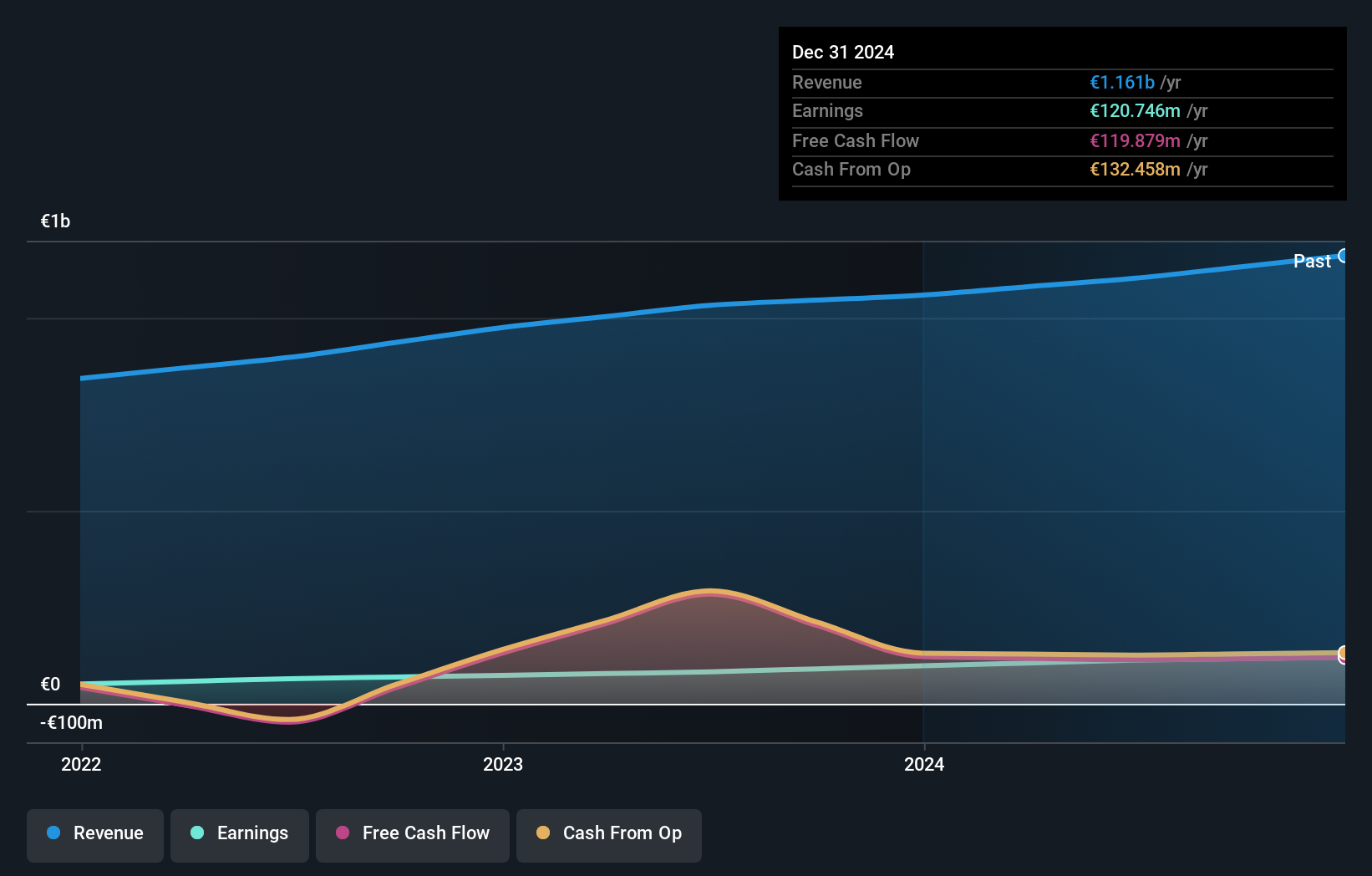

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme, is an investment company offering interdealer broking, online trading, and private banking services across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region with a market cap of €631.92 million.

Operations: VIEL & Cie, société anonyme, generates revenue primarily from professional intermediation (€1006.77 million) and stock exchange online activities (€65.12 million). The company also has minor contributions from holdings (€0.21 million) and incurs a small loss in property and other activities (-€0.14 million).

VIEL & Cie société anonyme, a notable player in the financial sector, has demonstrated robust performance with earnings growing by 33.4% over the past year, surpassing the Capital Markets industry’s 29.3%. The company repurchased shares recently and trades at 37.7% below its estimated fair value. VIL's debt to equity ratio improved from 85.1% to 63.2% over five years, reflecting prudent financial management and high-quality earnings that bolster investor confidence in this small-cap stock's potential.

Where To Now?

- Click through to start exploring the rest of the 33 Euronext Paris Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RBO

Roche Bobois

Engages in the furniture design and distribution business worldwide.

Excellent balance sheet, good value and pays a dividend.