Undiscovered Gems in Europe Three Promising Stocks for May 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with the pan-European STOXX Europe 600 Index rising for a fourth consecutive week amid easing trade tensions, investors are increasingly interested in small-cap stocks that could offer unique opportunities. In this environment of cautious optimism and strategic interest rate adjustments by central banks, identifying promising stocks involves looking for companies with strong fundamentals and the potential to capitalize on evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

LU-VE (BIT:LUVE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: LU-VE S.p.A. is involved in producing and marketing heat exchangers and air-cooled equipment both in Italy and internationally, with a market capitalization of approximately €702.83 million.

Operations: LU-VE generates revenue primarily from two segments: Components (€285.02 million) and Cooling Systems (€295.98 million).

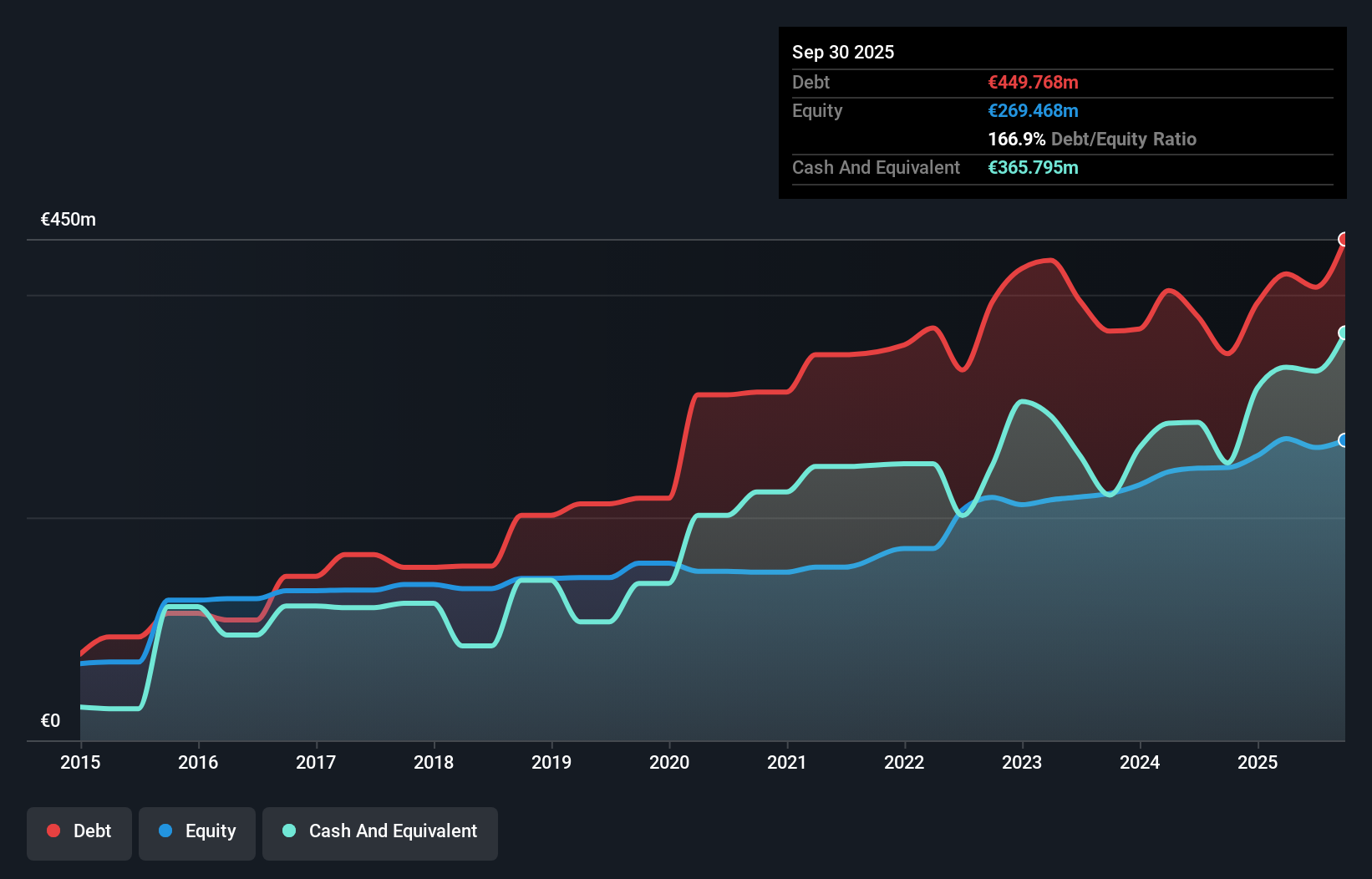

LU-VE, a nimble player in the building industry, has shown strong earnings growth of 16% over the past year, outpacing the industry's -5.9%. With high-quality earnings and a satisfactory net debt to equity ratio of 29.9%, it stands on solid financial ground. The company also boasts a price-to-earnings ratio of 20.4x, which is attractive compared to the industry average of 21.1x. Despite an increase in its debt to equity ratio from 136.7% to 153.7% over five years, LU-VE remains profitable with positive free cash flow and no immediate cash runway concerns as it forecasts nearly 10% annual earnings growth ahead.

- Click here to discover the nuances of LU-VE with our detailed analytical health report.

Examine LU-VE's past performance report to understand how it has performed in the past.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme, is an investment company that offers interdealer broking, online trading, and private banking services across multiple regions including Europe and the Asia-Pacific, with a market capitalization of approximately €896.40 million.

Operations: VIEL & Cie generates revenue primarily from professional intermediation (€1.10 billion) and stock exchange online activities (€75.40 million).

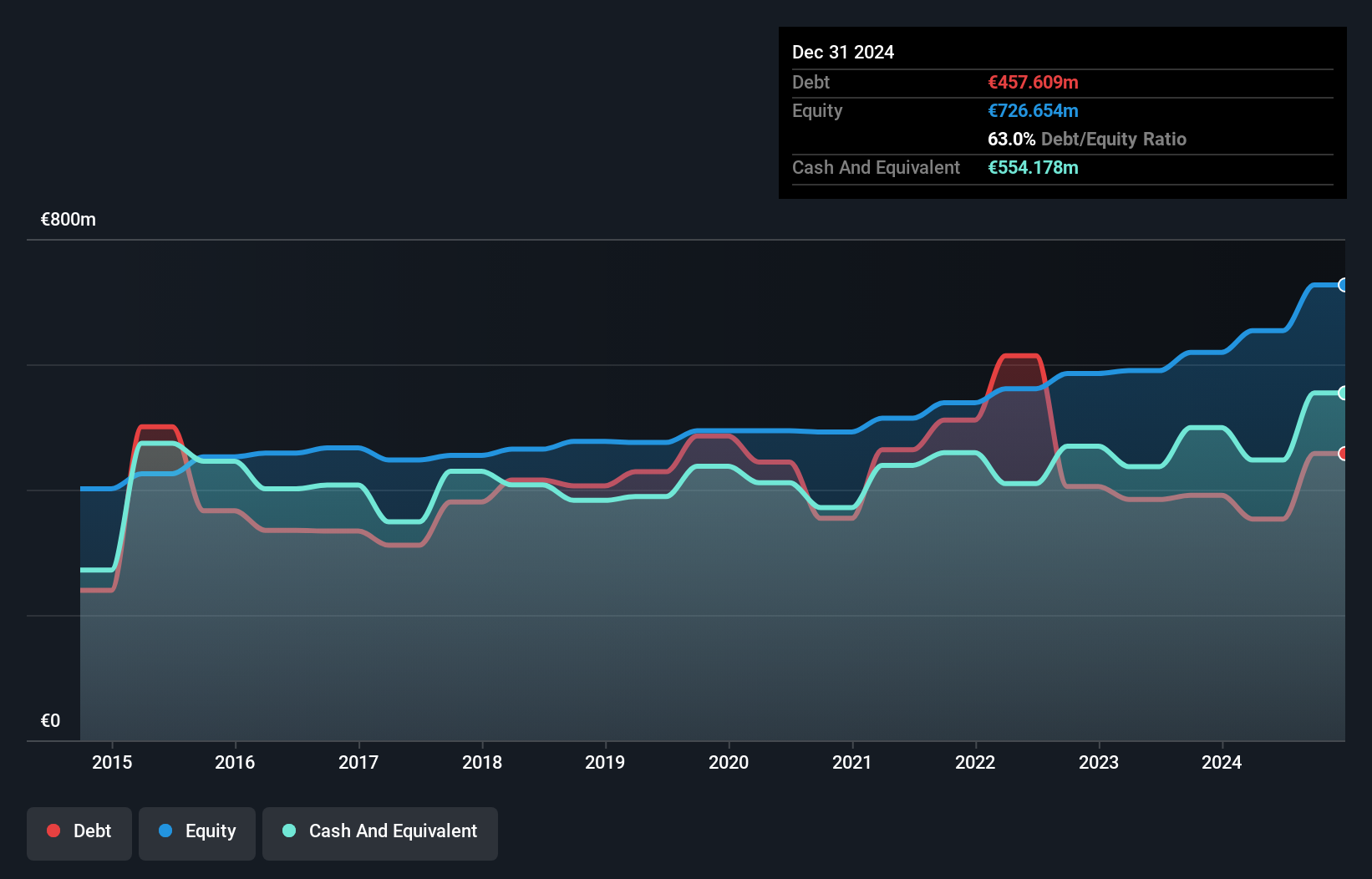

VIEL & Cie, a financial services entity, has shown impressive earnings growth of 23% over the past year, surpassing the Capital Markets industry average of 11.5%. The company is trading at a notable 28.5% below its estimated fair value, indicating potential undervaluation. Over five years, it has effectively managed its debt levels with a reduction in its debt to equity ratio from 98.3% to 62.4%, and currently holds more cash than total debt. Recently, VIEL announced an annual dividend increase to EUR 0.47 per share and reported net income growth from EUR 98 million to EUR 120 million year-over-year.

- Delve into the full analysis health report here for a deeper understanding of VIEL & Cie société anonyme.

Learn about VIEL & Cie société anonyme's historical performance.

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SpareBank 1 Helgeland offers a range of financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway with a market cap of NOK4.65 billion.

Operations: SpareBank 1 Helgeland generates revenue primarily from its retail and corporate market segments, with the retail segment contributing NOK446 million and the corporate market NOK291 million.

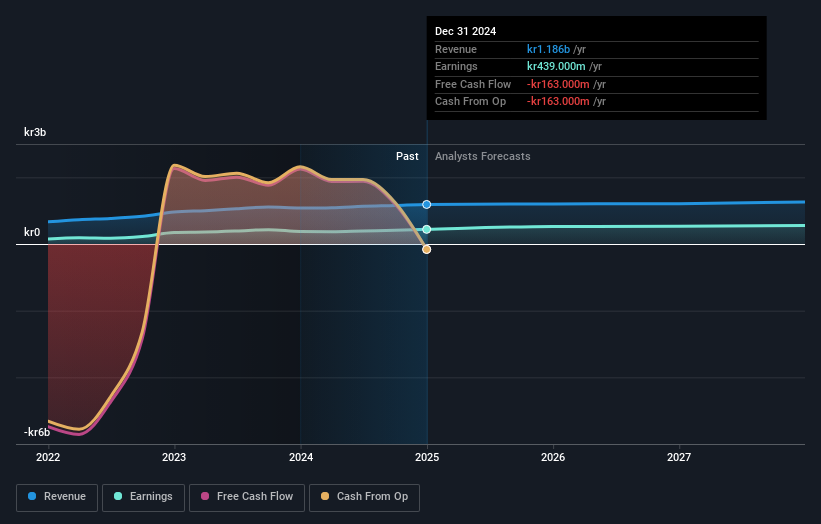

SpareBank 1 Helgeland, with total assets of NOK39 billion and equity of NOK5.2 billion, is a noteworthy player in the banking sector. The bank's earnings grew by 17% last year, outpacing the industry average of 15%, showcasing its strong performance. Trading at nearly a third below its estimated fair value, it presents an attractive investment opportunity for those seeking undervalued stocks. Recently reported net income for Q1 2025 was NOK154 million, up from NOK144 million the previous year. With customer deposits making up 74% of liabilities, it relies on low-risk funding sources to support its operations.

Key Takeaways

- Click through to start exploring the rest of the 322 European Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SpareBank 1 Helgeland, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HELG

SpareBank 1 Helgeland

Provides various financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives