- France

- /

- Capital Markets

- /

- ENXTPA:TKO

Rainbows and Unicorns: Tikehau Capital (EPA:TKO) Analysts Just Became A Lot More Optimistic

Tikehau Capital (EPA:TKO) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. The stock price has risen 8.5% to €24.15 over the past week, suggesting investors are becoming more optimistic. Could this big upgrade push the stock even higher?

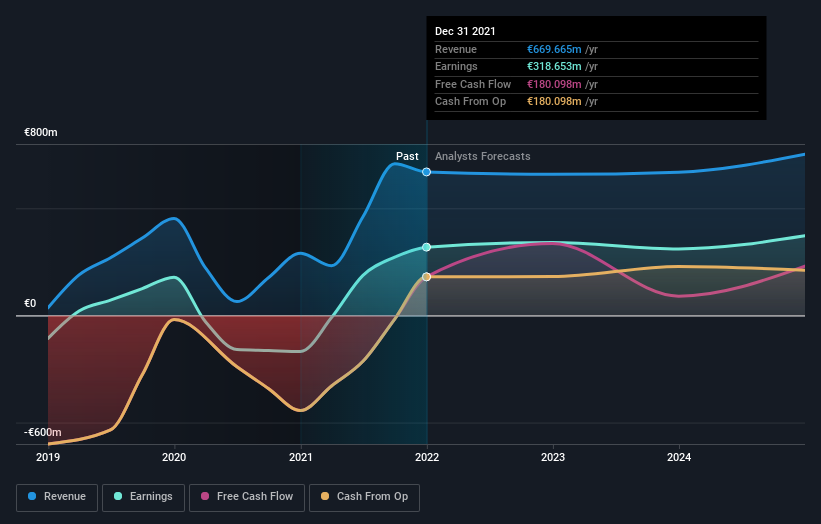

Following the latest upgrade, Tikehau Capital's six analysts currently expect revenues in 2022 to be €658m, approximately in line with the last 12 months. Per-share earnings are expected to rise 5.2% to €1.95. Before this latest update, the analysts had been forecasting revenues of €542m and earnings per share (EPS) of €1.22 in 2022. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

View our latest analysis for Tikehau Capital

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of €28.20, suggesting that the forecast performance does not have a long term impact on the company's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Tikehau Capital analyst has a price target of €34.00 per share, while the most pessimistic values it at €21.60. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 3.4% by the end of 2022. This indicates a significant reduction from annual growth of 131% over the last year. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 2.2% per year. It's pretty clear that Tikehau Capital's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Fortunately, they also upgraded their revenue estimates, and are forecasting revenues to grow slower than the wider market. Some investors might be disappointed to see that the price target is unchanged, but we feel that improving fundamentals are usually a positive - assuming these forecasts are met! So Tikehau Capital could be a good candidate for more research.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple Tikehau Capital analysts - going out to 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Tikehau Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:TKO

Tikehau Capital

An alternative asset management group with €46.1 billion of assets under management (as of 30 June 2024).

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives