- France

- /

- Capital Markets

- /

- ENXTPA:TKO

Euronext Paris: 3 Stocks Conceivably Undervalued By Up To 28.9%

Reviewed by Simply Wall St

The French stock market has recently shown resilience, with the CAC 40 Index gaining 1.54% amid an interest rate cut from the European Central Bank. This positive momentum suggests potential opportunities for investors looking to identify undervalued stocks. In this context, a good stock often exhibits strong fundamentals and a solid growth outlook, especially in times of economic adjustments like those currently seen in Europe.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SPIE (ENXTPA:SPIE) | €37.10 | €52.93 | 29.9% |

| NSE (ENXTPA:ALNSE) | €30.60 | €57.78 | 47% |

| Vivendi (ENXTPA:VIV) | €10.125 | €18.09 | 44% |

| Safran (ENXTPA:SAF) | €202.50 | €284.66 | 28.9% |

| Lectra (ENXTPA:LSS) | €28.80 | €53.78 | 46.4% |

| Guillemot (ENXTPA:GUI) | €5.14 | €9.00 | 42.9% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.06 | €5.11 | 40.2% |

| EKINOPS (ENXTPA:EKI) | €4.015 | €5.78 | 30.5% |

| VusionGroup (ENXTPA:VU) | €150.50 | €258.71 | 41.8% |

| OVH Groupe (ENXTPA:OVH) | €6.18 | €8.89 | 30.4% |

We're going to check out a few of the best picks from our screener tool.

Antin Infrastructure Partners SAS (ENXTPA:ANTIN)

Overview: Antin Infrastructure Partners SAS is a private equity firm that focuses on infrastructure investments, with a market cap of approximately €2.26 billion.

Operations: Antin Infrastructure Partners SAS generates revenue primarily through its investments in infrastructure projects.

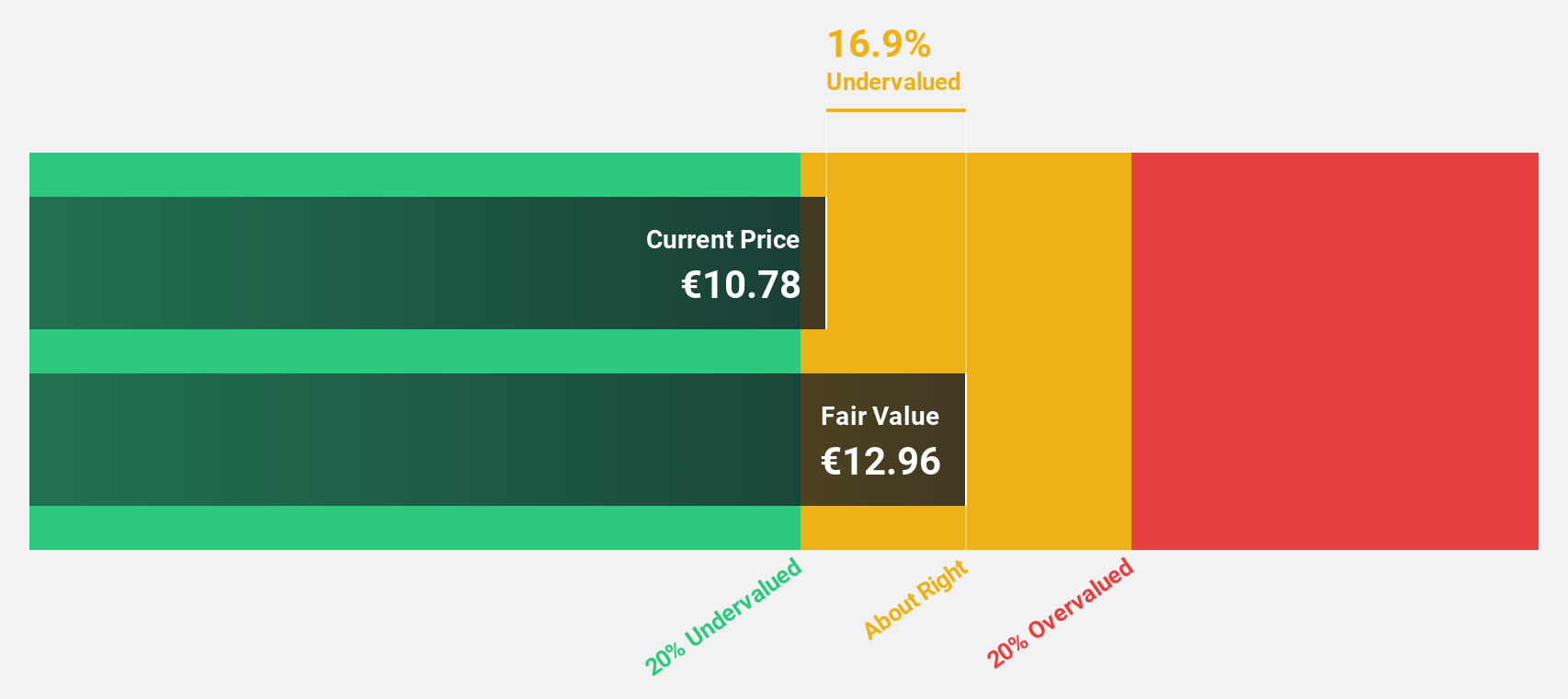

Estimated Discount To Fair Value: 24.6%

Antin Infrastructure Partners SAS is trading at €12.6, 24.6% below its estimated fair value of €16.72, making it highly undervalued based on discounted cash flow analysis. Despite shareholder dilution and a dividend not well covered by earnings or free cash flows, Antin's earnings are forecast to grow significantly at 21.31% per year, outpacing the French market's growth rate of 12.3%. Recent half-year results show revenue of €146.91 million and net income of €60.25 million, indicating strong financial performance and potential for future growth through strategic M&A activities.

- Our growth report here indicates Antin Infrastructure Partners SAS may be poised for an improving outlook.

- Take a closer look at Antin Infrastructure Partners SAS' balance sheet health here in our report.

Safran (ENXTPA:SAF)

Overview: Safran SA, with a market cap of €85.13 billion, operates globally in the aerospace and defense sectors through its subsidiaries.

Operations: Safran's revenue segments include Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

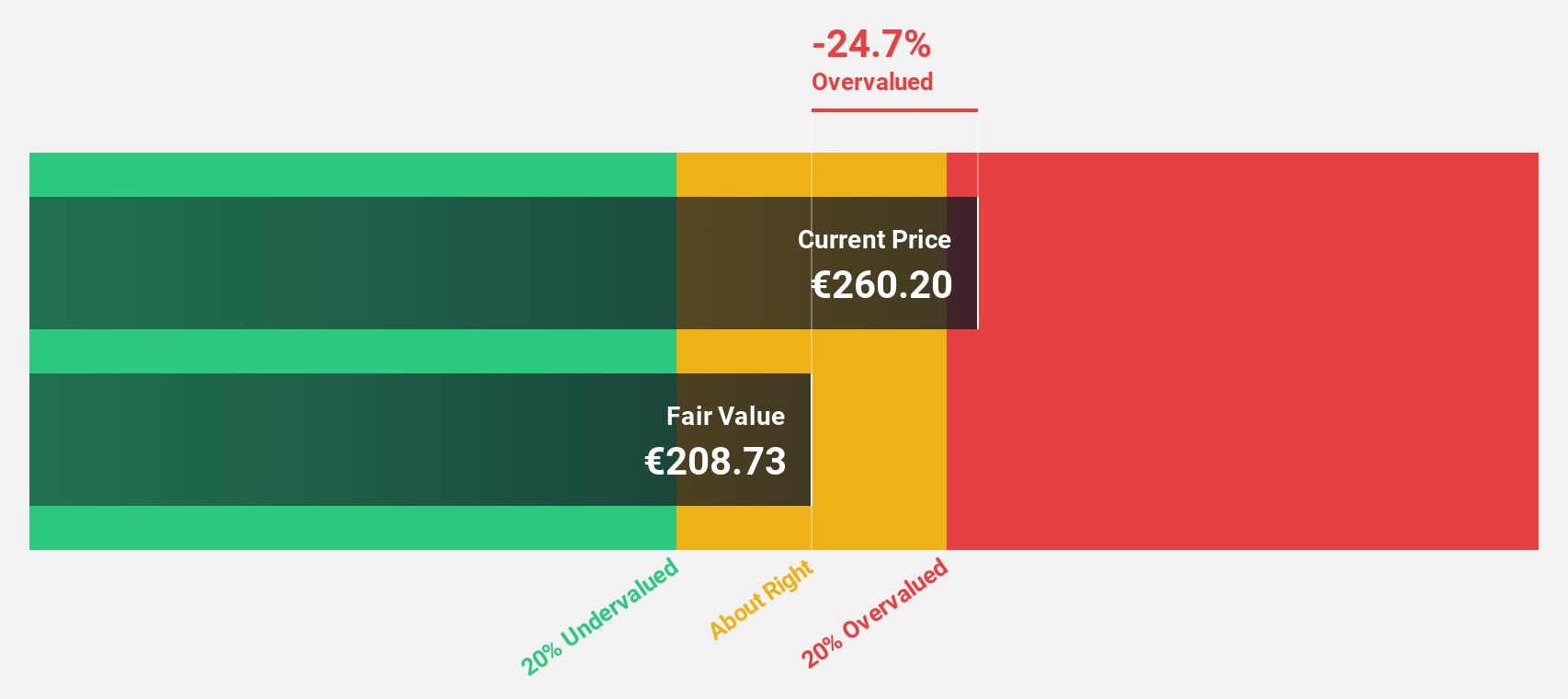

Estimated Discount To Fair Value: 28.9%

Safran SA is trading at €202.5, 28.9% below its estimated fair value of €284.66, indicating it is highly undervalued based on discounted cash flow analysis. Despite a significant drop in net income to €57 million for H1 2024 from €1,863 million a year ago, the company's earnings are forecast to grow significantly at 20.09% per year over the next three years, outpacing both its revenue growth and the broader French market's growth rate.

- Upon reviewing our latest growth report, Safran's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Safran's balance sheet by reading our health report here.

Tikehau Capital (ENXTPA:TKO)

Overview: Tikehau Capital is a private equity and venture capital firm that offers a comprehensive suite of financing products, including senior secured loans, equity, senior debt, unitranche, mezzanine, and preferred shares, with a market cap of €4.18 billion.

Operations: The company's revenue segments include €173.11 million from Investment Activities and €322.94 million from Asset Management Activities.

Estimated Discount To Fair Value: 25.9%

Tikehau Capital is trading at €24.3, significantly below its estimated fair value of €32.77, suggesting it is highly undervalued based on discounted cash flow analysis. Despite a decline in net income to €57.55 million for H1 2024 from €71.99 million a year ago, earnings are forecast to grow at 41.45% per year over the next three years, outpacing both revenue growth and the broader French market's growth rate.

- The growth report we've compiled suggests that Tikehau Capital's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Tikehau Capital stock in this financial health report.

Summing It All Up

- Explore the 17 names from our Undervalued Euronext Paris Stocks Based On Cash Flows screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tikehau Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TKO

Tikehau Capital

An alternative asset management group with €46.1 billion of assets under management (as of 30 June 2024).

High growth potential with solid track record.