- Italy

- /

- Diversified Financial

- /

- BIT:BFF

Discover 3 European Stocks That May Be Trading Below Their Intrinsic Value Estimates

Reviewed by Simply Wall St

As European markets experience modest gains with the pan-European STOXX Europe 600 Index rising by 1.03%, investors are closely watching how economic policies and global demand shifts might impact future growth. Amidst this cautious optimism, there is a growing interest in identifying stocks that may be trading below their intrinsic value, offering potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK44.00 | SEK85.78 | 48.7% |

| Micro Systemation (OM:MSAB B) | SEK61.40 | SEK122.64 | 49.9% |

| Gofore Oyj (HLSE:GOFORE) | €14.88 | €29.64 | 49.8% |

| Echo Investment (WSE:ECH) | PLN5.50 | PLN10.71 | 48.6% |

| DSV (CPSE:DSV) | DKK1364.50 | DKK2692.80 | 49.3% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.46 | €6.82 | 49.3% |

| Brockhaus Technologies (XTRA:BKHT) | €9.64 | €19.22 | 49.8% |

| Atea (OB:ATEA) | NOK141.80 | NOK280.62 | 49.5% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.91 | €3.79 | 49.6% |

| adidas (XTRA:ADS) | €177.00 | €350.52 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

BFF Bank (BIT:BFF)

Overview: BFF Bank S.p.A. specializes in non-recourse factoring and credit management services for public administration bodies and private hospitals across several European countries, with a market cap of €2.09 billion.

Operations: The company's revenue is primarily derived from its Financial Services - Commercial segment, which generated €384.46 million.

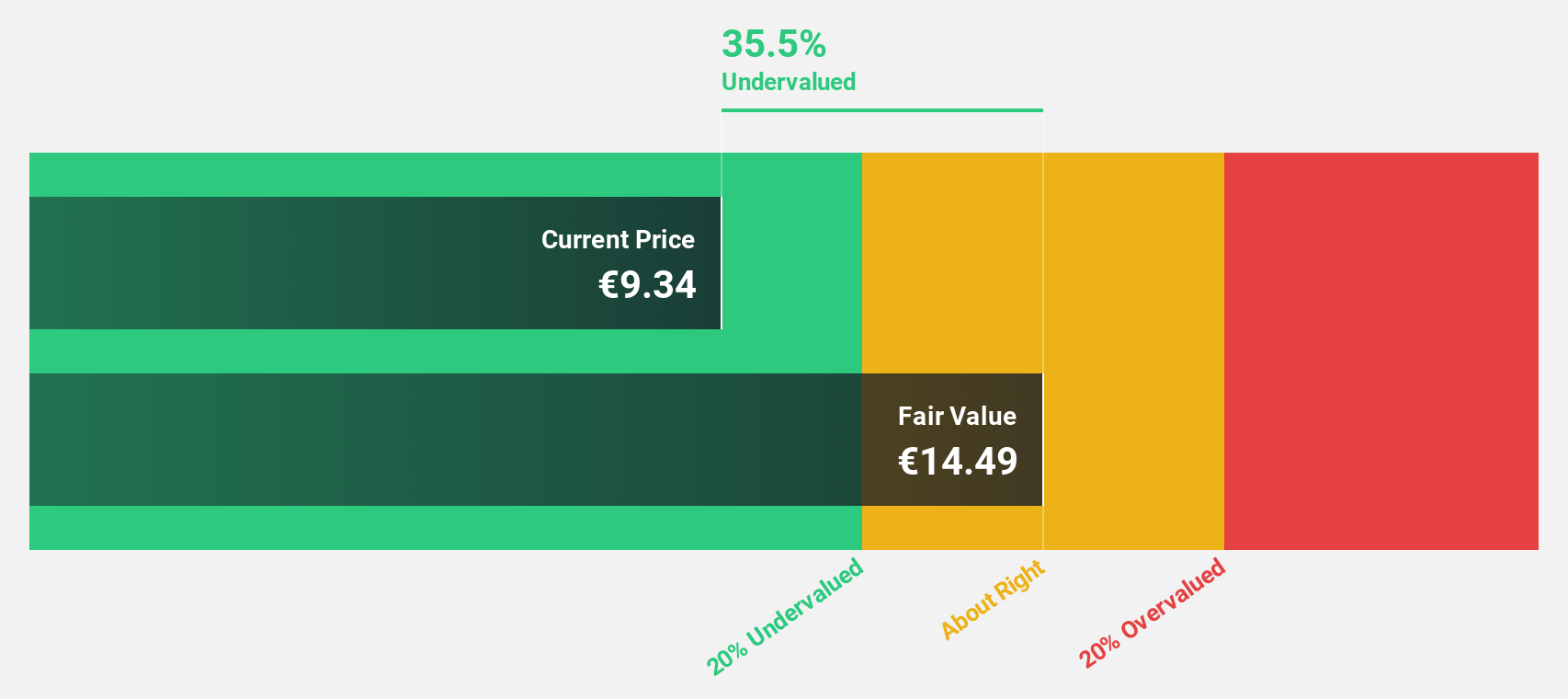

Estimated Discount To Fair Value: 19.3%

BFF Bank is trading at €11.09, below its estimated fair value of €13.75, offering a 19.3% discount. Despite a decline in net income to €70.41 million for H1 2025 from the previous year's €161.78 million, earnings are projected to grow at 16.5% annually—outpacing the Italian market's growth rate of 9%. However, profit margins have decreased from last year and the company carries a high level of debt with an unstable dividend track record.

- Our expertly prepared growth report on BFF Bank implies its future financial outlook may be stronger than recent results.

- Take a closer look at BFF Bank's balance sheet health here in our report.

eDreams ODIGEO (BME:EDR)

Overview: eDreams ODIGEO S.A. is an online travel company operating in France, Southern Europe, Northern Europe, and internationally with a market cap of €927.50 million.

Operations: The company generates revenue primarily from its Prime segment, which accounts for €487.31 million, and its Non-Prime segment, contributing €196.51 million.

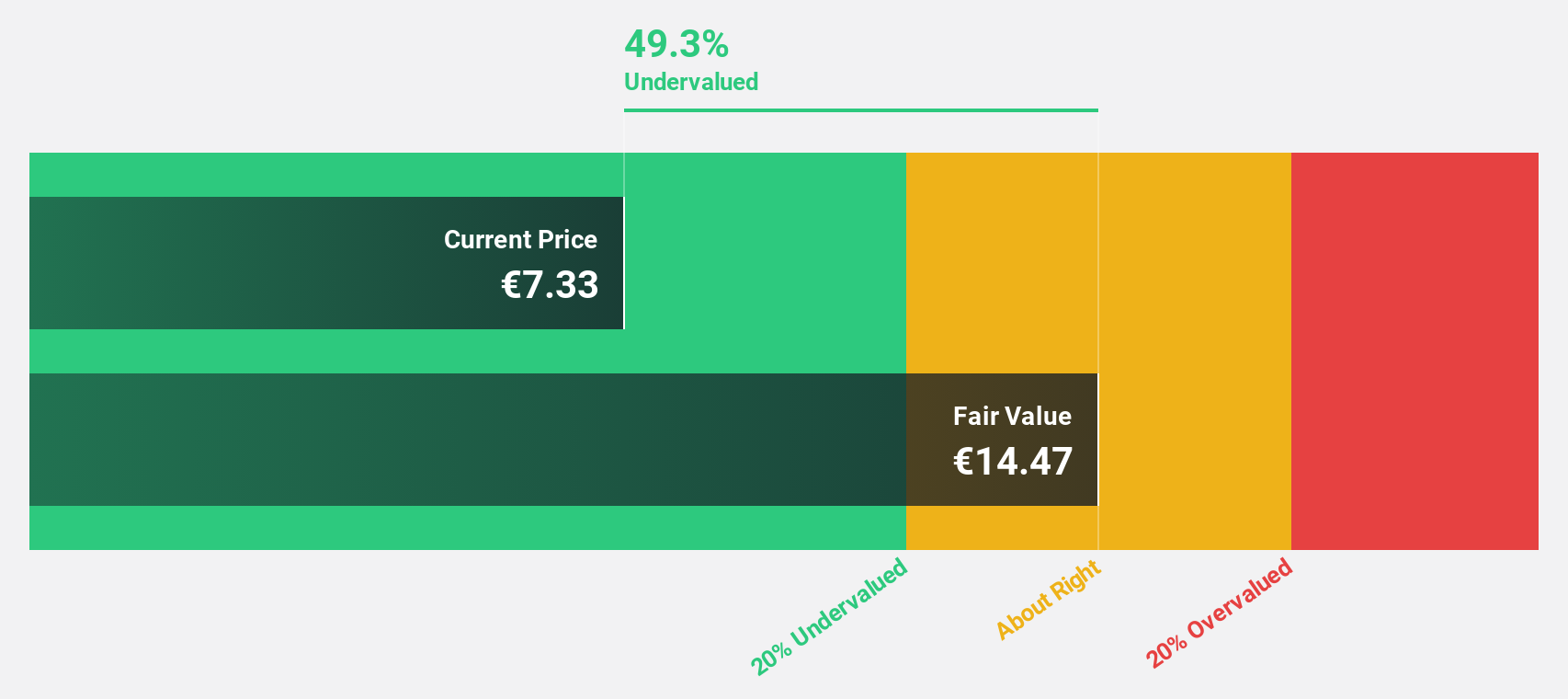

Estimated Discount To Fair Value: 40.1%

eDreams ODIGEO is trading at €8.27, significantly below its estimated fair value of €13.81, representing a discount of over 20%. The company has shown strong earnings growth, with net income rising to €13.57 million in Q1 2025 from a loss last year and earnings projected to grow faster than the Spanish market at 18.1% annually. Despite high debt levels and recent share price volatility, it presents good relative value compared to peers and industry standards.

- The growth report we've compiled suggests that eDreams ODIGEO's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of eDreams ODIGEO stock in this financial health report.

Tikehau Capital (ENXTPA:TKO)

Overview: Tikehau Capital is an alternative asset management group with €46.1 billion in assets under management and a market capitalization of approximately €3.32 billion.

Operations: The company's revenue is derived from two main segments: €240.19 million from investment activities and €371.55 million from asset management activities.

Estimated Discount To Fair Value: 20.3%

Tikehau Capital is trading at €19.24, below its estimated fair value of €24.15, indicating a discount of over 20%. Earnings are forecast to grow significantly at 27.4% annually, outpacing the French market's 12.1% growth rate. Despite lower net income in the first half of 2025 and debt not well covered by operating cash flow, Tikehau's strategic initiatives in defense and cybersecurity sectors could bolster future cash flows and enhance long-term value.

- Our comprehensive growth report raises the possibility that Tikehau Capital is poised for substantial financial growth.

- Get an in-depth perspective on Tikehau Capital's balance sheet by reading our health report here.

Taking Advantage

- Dive into all 213 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BFF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BFF

BFF Bank

Engages in non-recourse factoring and credit management activities towards public administration bodies and private hospitals in Italy, Croatia, the Czech Republic, France, Greece, Poland, Portugal, Slovakia, and Spain.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives