- Norway

- /

- Energy Services

- /

- OB:AQUIL

European Penny Stocks: Cyberoo And 2 Others Worth Watching

Reviewed by Simply Wall St

As European markets experience a boost in sentiment following the de-escalation of trade tensions between the U.S. and China, investors are keenly observing how these developments might influence various sectors. In this context, penny stocks—often representing smaller or newer companies—continue to attract attention for their potential to offer unique growth opportunities. Despite being considered a niche investment area today, these stocks can still provide value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.29 | SEK2.19B | ✅ 4 ⚠️ 1 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.72 | SEK466.39M | ✅ 3 ⚠️ 4 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.74 | SEK246.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.72 | SEK278.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.50 | SEK212.94M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.75 | PLN127.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.67 | €56.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.97 | €32.48M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.74 | €17.72M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.175 | €300.29M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 446 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cyberoo (BIT:CYB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cyberoo S.p.A. offers managed and cybersecurity services in Italy with a market cap of €57.71 million.

Operations: The company's revenue is primarily derived from Cyber Security & Device Security (€17.97 million), followed by Managed Services (€4.70 million) and Digital Transformation (€0.16 million).

Market Cap: €57.71M

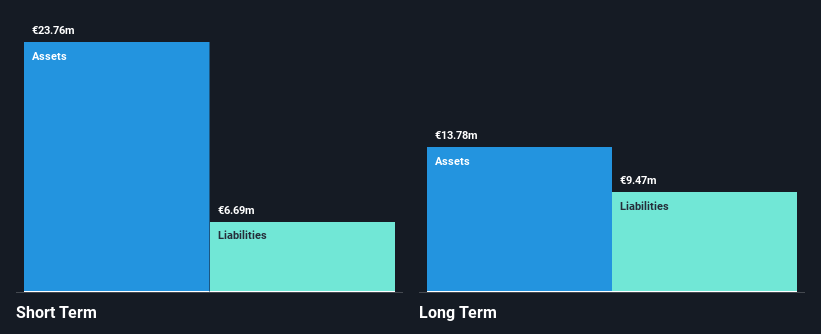

Cyberoo S.p.A., with a market cap of €57.71 million, has shown steady growth in its cybersecurity services, reporting revenue of €25.01 million for 2024, up from €22.02 million the previous year. The company's earnings grew by 10.4% over the past year, surpassing industry averages and demonstrating solid financial health with short-term assets exceeding both short and long-term liabilities. Cyberoo's debt is well covered by operating cash flow and it holds more cash than total debt, indicating prudent financial management despite a low return on equity of 17.6%.

- Click here and access our complete financial health analysis report to understand the dynamics of Cyberoo.

- Understand Cyberoo's earnings outlook by examining our growth report.

Euroland Société anonyme (ENXTPA:MLERO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Euroland Société anonyme provides fundraising services for listed companies in France and has a market cap of €9.91 million.

Operations: Revenue Segments: No specific revenue segments have been reported.

Market Cap: €9.91M

Euroland Société anonyme, with a market cap of €9.91 million, reported revenue of €3.54 million for 2024, marking an increase from the previous year. Despite being pre-revenue in some segments, its net income saw a substantial rise to €0.72 million from €0.14 million previously. The company maintains a debt-free status and has high-quality earnings with short-term assets exceeding liabilities, reflecting sound financial positioning for a penny stock. However, its share price remains highly volatile and its dividend history is unstable despite announcing an annual dividend of €0.173 per share payable in May 2025.

- Get an in-depth perspective on Euroland Société anonyme's performance by reading our balance sheet health report here.

- Evaluate Euroland Société anonyme's historical performance by accessing our past performance report.

Aquila Holdings (OB:AQUIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aquila Holdings ASA manages a seismic ocean bottom node multi-client data library with assets in Norway, Egypt, and the United States, and has a market cap of NOK186.44 million.

Operations: The company's revenue segments include investments amounting to -$1.45 million and segment adjustments of $1.65 million.

Market Cap: NOK186.44M

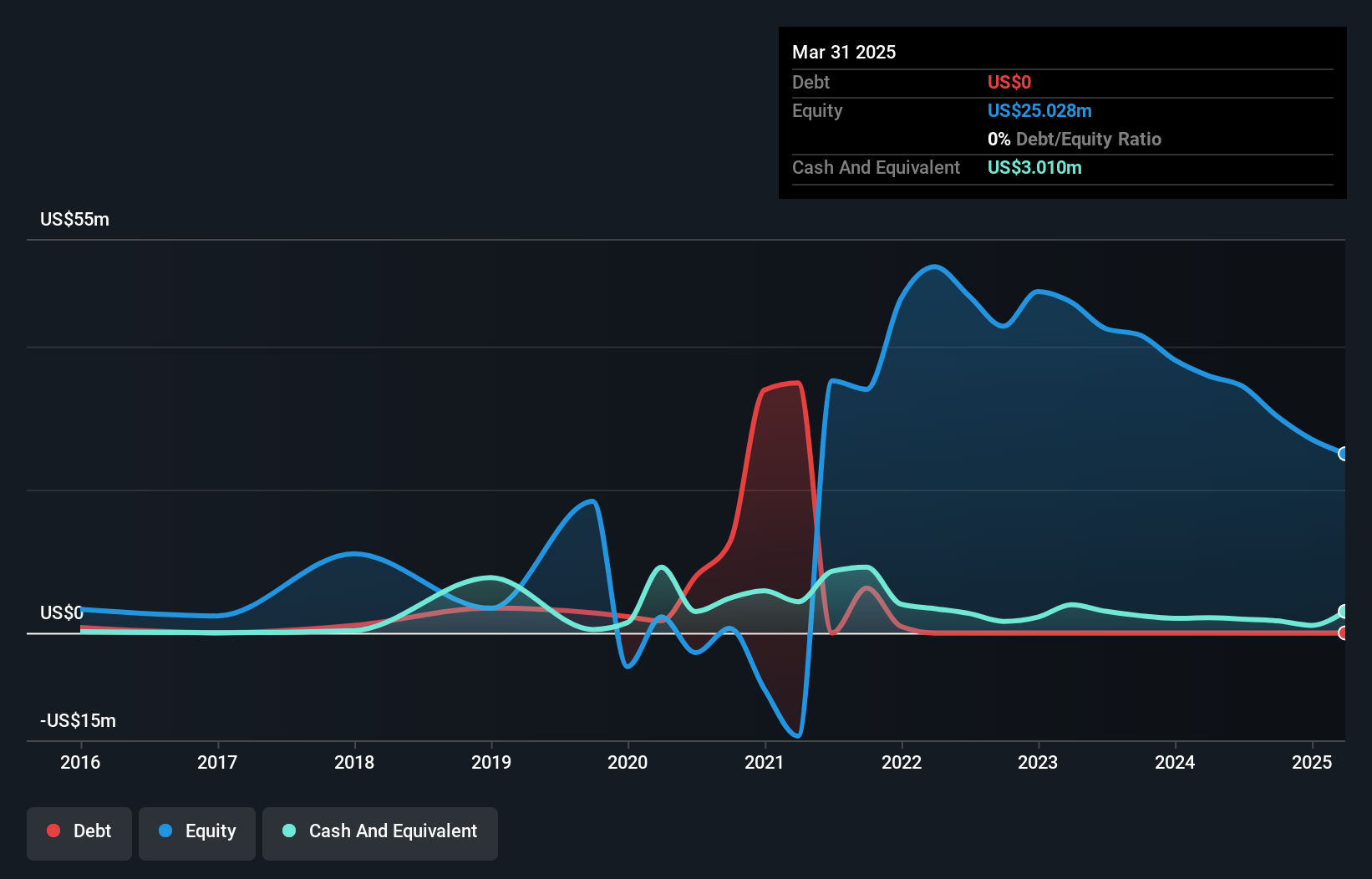

Aquila Holdings ASA, with a market cap of NOK186.44 million, operates a seismic data library and is currently pre-revenue, generating less than US$1 million in revenue. The company remains debt-free and has successfully reduced its losses over the past five years by 29.7% annually. Despite being unprofitable with a negative Return on Equity of -42.34%, Aquila's short-term assets of $3.1 million exceed its short-term liabilities of $2.2 million, providing some financial stability for this penny stock. Recent buyback activities have not significantly diluted shareholders' interests, while its cash runway extends beyond three years based on current free cash flow levels.

- Click here to discover the nuances of Aquila Holdings with our detailed analytical financial health report.

- Explore historical data to track Aquila Holdings' performance over time in our past results report.

Summing It All Up

- Gain an insight into the universe of 446 European Penny Stocks by clicking here.

- Seeking Other Investments? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AQUIL

Aquila Holdings

Manages a seismic ocean bottom node multi-client data library with assets in Norway, Egypt, and the United States.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives