- France

- /

- Diversified Financial

- /

- ENXTPA:EDEN

Vista Energy. de And 2 Other Stocks That May Be Valued Below Their Estimated Worth

Reviewed by Simply Wall St

As global markets experience broad-based gains and U.S. indexes approach record highs, investors are keenly observing the interplay of economic indicators such as jobless claims and home sales, which have recently fueled positive sentiment. In this context of market optimism tempered by geopolitical uncertainties, identifying stocks that may be undervalued can offer potential opportunities for those looking to capitalize on discrepancies between current stock prices and estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.3665 | £0.73 | 49.6% |

| BMC Medical (SZSE:301367) | CN¥68.90 | CN¥137.12 | 49.8% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.87 | CN¥43.43 | 49.6% |

| Winking Studios (Catalist:WKS) | SGD0.27 | SGD0.54 | 49.6% |

| EnomotoLtd (TSE:6928) | ¥1479.00 | ¥2934.35 | 49.6% |

| Equity Bancshares (NYSE:EQBK) | US$49.21 | US$98.42 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| Atlas Arteria (ASX:ALX) | A$4.88 | A$9.67 | 49.5% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €7.88 | €15.63 | 49.6% |

| Chengdu Olymvax Biopharmaceuticals (SHSE:688319) | CN¥10.91 | CN¥21.64 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

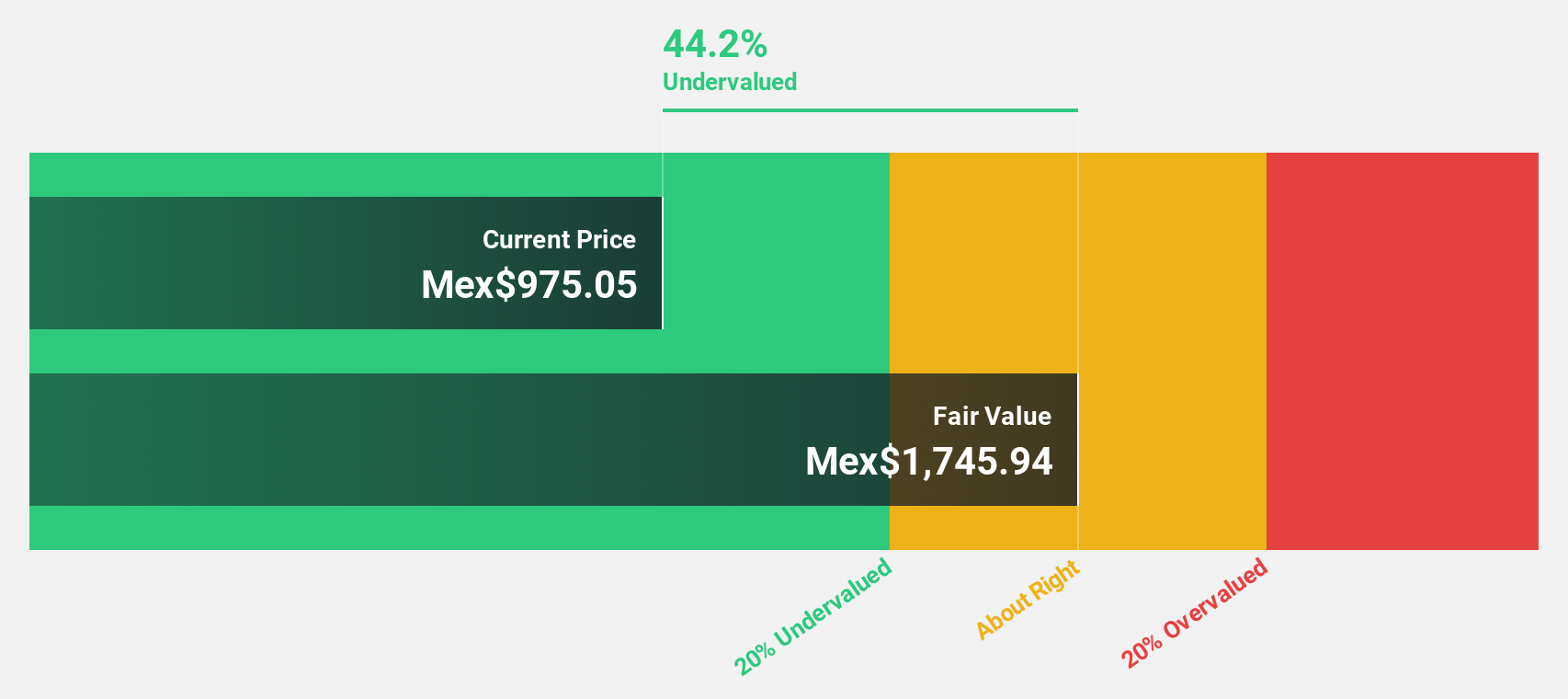

Vista Energy. de (BMV:VISTA A)

Overview: Vista Energy, S.A.B. de C.V. operates in the exploration and production of oil and gas in Latin America, with a market capitalization of MX$109.95 billion.

Operations: The company's revenue is primarily derived from the exploration and production of crude oil, natural gas, and LPG, amounting to $1.49 billion.

Estimated Discount To Fair Value: 26%

Vista Energy is trading 26% below its estimated fair value, with a discounted cash flow valuation indicating a price of MX$1,513.36 versus the current MX$1,120. Despite high debt levels and volatile share prices recently, Vista's revenue is projected to grow at 21.6% annually—outpacing the Mexican market's 7.2%. Recent results show significant production increases and earnings growth: Q3 net income rose to US$165.46 million from US$83.1 million year-over-year.

- Our growth report here indicates Vista Energy. de may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Vista Energy. de stock in this financial health report.

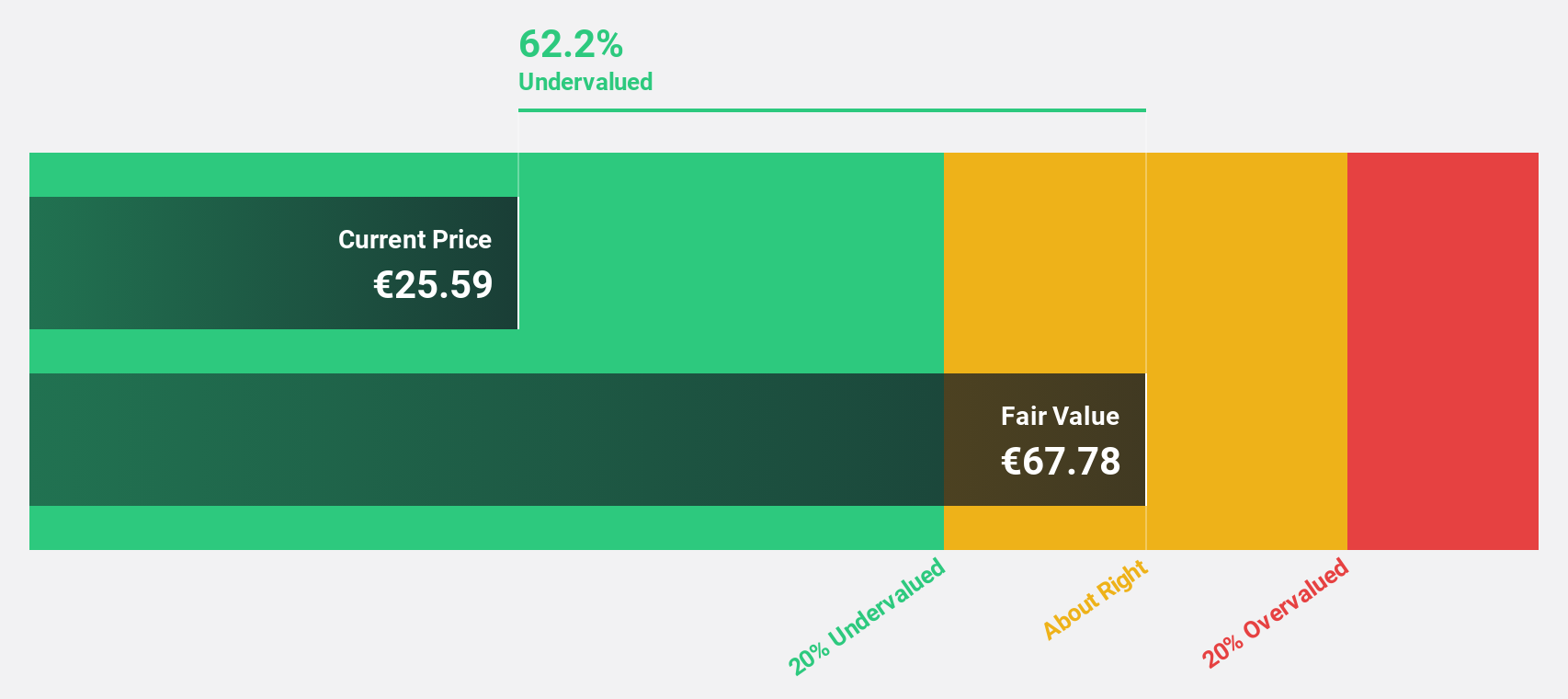

Edenred (ENXTPA:EDEN)

Overview: Edenred SE operates a global digital platform offering services and payment solutions for companies, employees, and merchants, with a market cap of €7.37 billion.

Operations: The company's revenue from Business Services amounts to €2.50 billion.

Estimated Discount To Fair Value: 33.1%

Edenred is trading at €30.19, significantly below its estimated fair value of €45.13, representing a 33.1% discount based on discounted cash flow analysis. Although revenue growth is moderate at 8.5% annually, it surpasses the French market's 5.6%. However, profit margins have declined from last year and the dividend yield of 3.64% isn't well covered by earnings due to high debt levels and negative shareholder equity concerns.

- According our earnings growth report, there's an indication that Edenred might be ready to expand.

- Click to explore a detailed breakdown of our findings in Edenred's balance sheet health report.

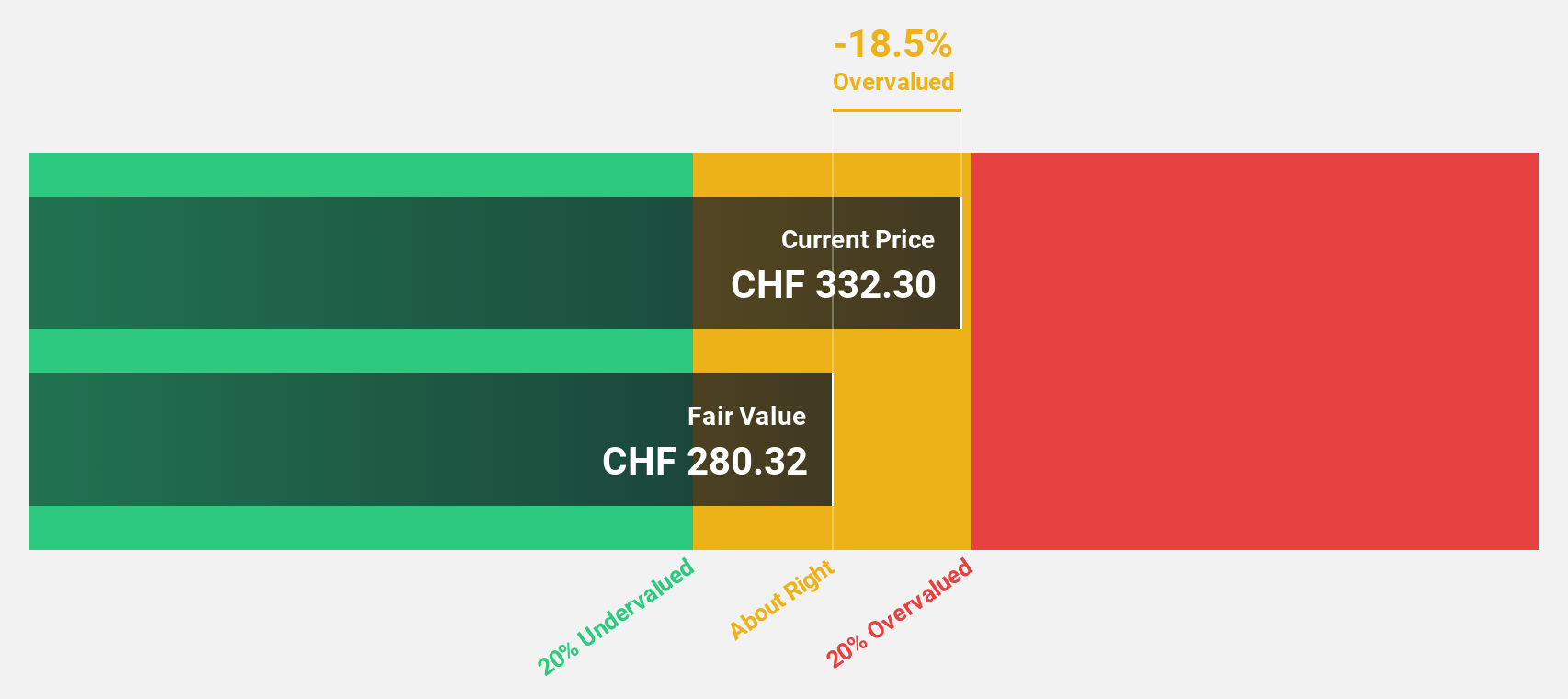

VAT Group (SWX:VACN)

Overview: VAT Group AG develops, manufactures, and supplies vacuum valves and related products across various international markets, with a market cap of CHF10.52 billion.

Operations: The company's revenue segments consist of Valves generating CHF783.51 million and Global Service contributing CHF163.83 million.

Estimated Discount To Fair Value: 34.3%

VAT Group is trading at CHF350.8, significantly below its estimated fair value of CHF533.64, offering a 34.3% discount based on discounted cash flow analysis. The company's earnings are expected to grow significantly at 21.78% annually, outpacing the Swiss market's 11.4%. Despite high share price volatility recently, VAT Group's return on equity is projected to be very high at 41.4% in three years, supporting its potential as an undervalued investment opportunity based on cash flows.

- The analysis detailed in our VAT Group growth report hints at robust future financial performance.

- Navigate through the intricacies of VAT Group with our comprehensive financial health report here.

Where To Now?

- Discover the full array of 923 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edenred might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EDEN

Edenred

Provides digital platform for services and payments for companies, employees, and merchants worldwide.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives