- France

- /

- Diversified Financial

- /

- ENXTPA:EDEN

Could Boardroom Turnover at Edenred (ENXTPA:EDEN) Reveal Shifting Priorities in Leadership Strategy?

Reviewed by Sasha Jovanovic

- Following the recent appointment of Thierry Delaporte as Chief Executive Officer of Sodexo, he resigned from Edenred's Board of Directors with immediate effect, and the Board expressed appreciation for his service while indicating a potential new co-opted director in the coming weeks.

- This immediate board change highlights a period of transition for Edenred, with governance adjustments occurring as the company faces heightened sector-specific risks.

- We'll examine how changing board composition, amid ongoing regulatory uncertainty and cost pressures, could affect Edenred's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Edenred Investment Narrative Recap

To be a shareholder in Edenred, you need to believe that expanding adoption of digital employee benefits and payments platforms in both underpenetrated and growing international markets can outpace regulatory and cost headwinds. The immediate board change, following Thierry Delaporte’s resignation, is unlikely to materially affect the near-term outlook; the bigger short-term catalyst remains Edenred’s ability to sustain digital growth momentum, while the most critical risk persists around regulatory pressures and rising operational costs in key markets.

Among recent announcements, the September 2025 appointment of Mrs. Kelly Richdale to the board stands out, bringing added experience in artificial intelligence and operational risk management. This move is pertinent given that digital innovation and platform security are core to Edenred’s efforts to maintain competitive advantages and support earnings growth in a period marked by sector-specific challenges.

By contrast, investors should be aware that regulatory and political changes in Europe and Latin America could quickly...

Read the full narrative on Edenred (it's free!)

Edenred's narrative projects €3.5 billion revenue and €706.1 million earnings by 2028. This requires 9.3% yearly revenue growth and a €199.1 million earnings increase from €507.0 million today.

Uncover how Edenred's forecasts yield a €36.88 fair value, a 75% upside to its current price.

Exploring Other Perspectives

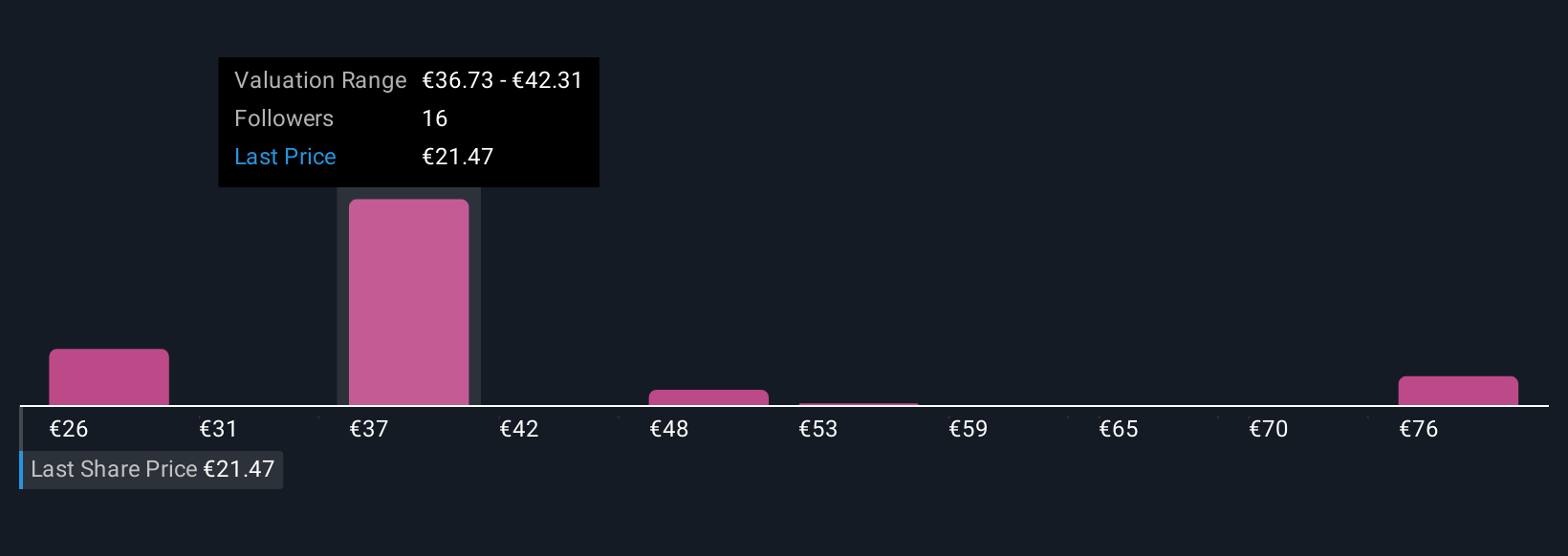

Eight individual fair value estimates from the Simply Wall St Community put Edenred’s range between €25.56 and €80.48. Diverse expectations reflect how regulatory uncertainty and margin pressures may shape future performance, inviting you to compare different outlooks on the business.

Explore 8 other fair value estimates on Edenred - why the stock might be worth over 3x more than the current price!

Build Your Own Edenred Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edenred research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Edenred research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edenred's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edenred might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EDEN

Edenred

Provides digital platform for services and payments for companies, employees, and merchants worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives