- France

- /

- Capital Markets

- /

- ENXTPA:AMUN

A Fresh Look at Amundi (ENXTPA:AMUN) Valuation Following Strong Shareholder Returns

Reviewed by Simply Wall St

Amundi (ENXTPA:AMUN) shares have delivered a steady 21% total return over the past year, drawing attention from investors who are evaluating its performance in relation to recent revenue and net income trends. Its diversified asset management footprint continues to influence perspectives on valuation.

See our latest analysis for Amundi.

Amundi’s share price has climbed steadily this year, with a 10.4% gain over the past month and year-to-date momentum at 7.1%. This suggests growing investor confidence. Its impressive 21.4% total shareholder return over the past year, and an even stronger 53.6% over three years, highlights both resilience and the long-term value the market sees in its asset management platform.

If you’re inspired by Amundi’s momentum, this could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

Despite these strong returns, Amundi’s annual revenue and net income have declined, prompting a deeper look. Are investors missing an undervalued opportunity, or is the current share price already factoring in expectations for recovery and growth?

Most Popular Narrative: 6.5% Undervalued

With Amundi’s widely followed narrative suggesting fair value is slightly above the latest close, there is growing discussion over whether recent momentum can carry forward. The stage is set for catalysts that could sway sentiment and fuel the next big move.

The expansion in Technology & Services, with technology revenues up by 42%, highlights anticipated earnings growth as Amundi diversifies and increases its client base across geographies.

Want the inside track on why the narrative sees more value ahead? One bold assumption underpins these projections: future margins that could surprise the market and a profit outlook shaped by ambitious business moves. If you’re curious how far Amundi’s earnings can stretch, explore the strategy and financial dynamics that set this valuation apart.

Result: Fair Value of €73.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still notable risks, such as new French taxes or outflows from key client segments. These factors could challenge Amundi’s valuation narrative.

Find out about the key risks to this Amundi narrative.

Another View: Discounted Cash Flow Suggests a Different Story

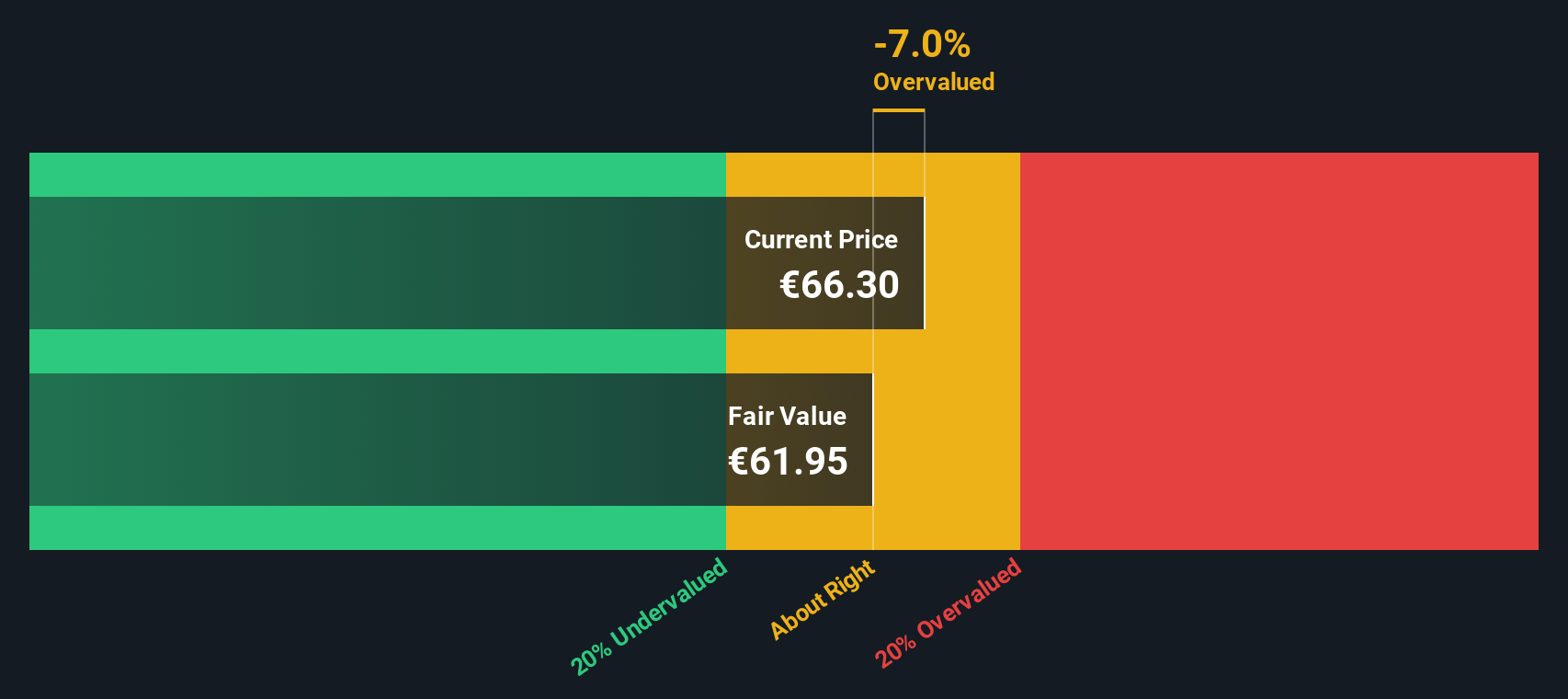

While the current valuation paints Amundi as undervalued, our SWS DCF model takes a more cautious stance. It values the shares at €63.11, which is below the latest trading price. This approach weighs declining revenue forecasts heavily. Are investor expectations running ahead of underlying fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amundi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amundi Narrative

If you want to dig deeper or challenge these views, it only takes a few minutes to explore the data and shape your own perspective. Do it your way

A great starting point for your Amundi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great opportunities rarely linger. Expand your investment universe today and explore what you could be missing with our powerful Screeners from Simply Wall St.

- Capture growth potential by targeting only those businesses with proven AI-driven innovation. Start with these 25 AI penny stocks and fuel your portfolio with technology leaders.

- Enhance your passive income strategy by finding high-yielding opportunities. Access these 15 dividend stocks with yields > 3% and discover returns above 3%.

- Stay ahead of the market by identifying companies trading well below their cash flow potential. Unlock value with these 933 undervalued stocks based on cash flows and uncover tomorrow’s bargains today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AMUN

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.