- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1373

Spotlight On ABC Arbitrage And Two Promising Penny Stocks

Reviewed by Simply Wall St

The global markets have experienced a turbulent week, with U.S. stocks declining due to cautious commentary from the Federal Reserve and political uncertainties surrounding a potential government shutdown. Amid these broader market challenges, investors often look for opportunities in less conventional areas like penny stocks, which can offer unique value propositions despite their small size or newer status. While the term "penny stock" might seem outdated, these companies can provide significant growth potential when supported by robust financials, making them an intriguing area for those seeking hidden value in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.71 | MYR420.07M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,836 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

ABC arbitrage (ENXTPA:ABCA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ABC arbitrage SA, with a market cap of €279.18 million, develops arbitrage strategies for liquid assets globally through its subsidiaries.

Operations: The company's revenue is primarily generated from its arbitrage trading segment, amounting to €42.38 million.

Market Cap: €279.18M

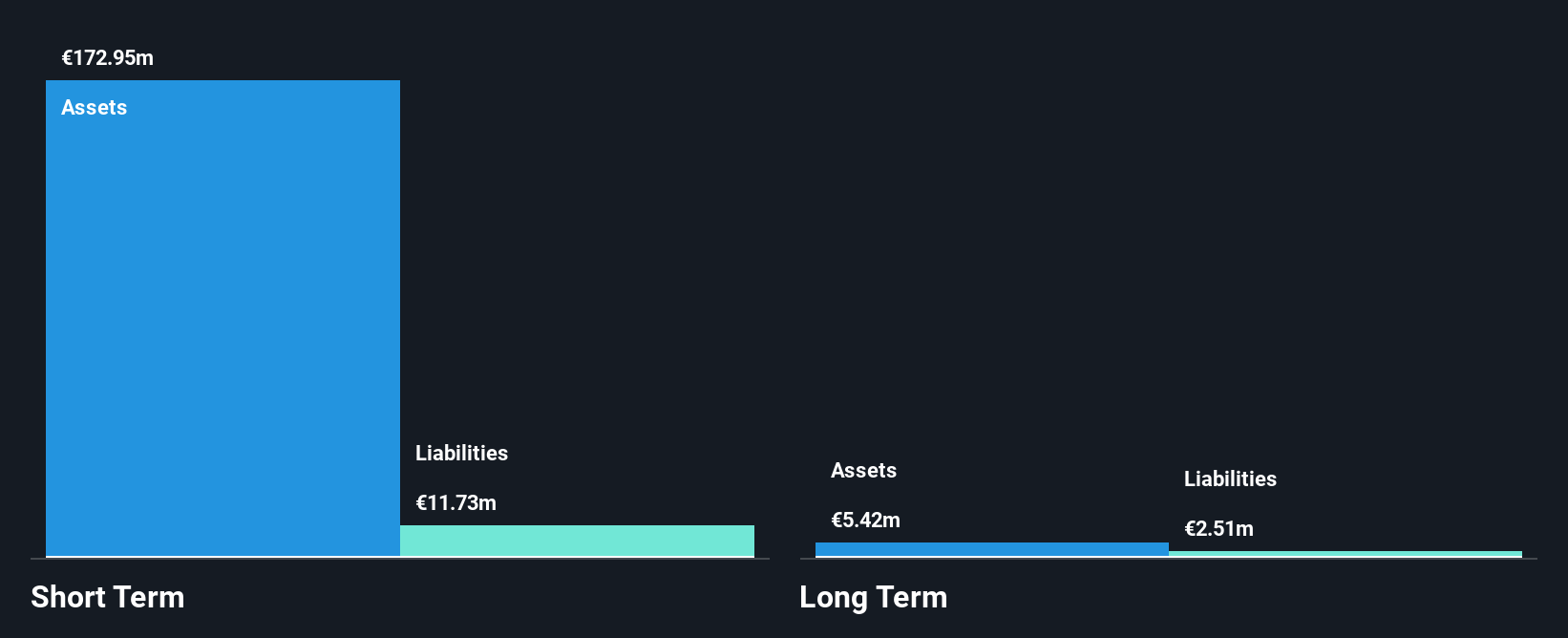

ABC arbitrage SA, with a market cap of €279.18 million, focuses on arbitrage strategies and generates revenue of €42.38 million from its trading segment. The company is debt-free, with short-term assets (€168M) comfortably exceeding both short-term (€12.7M) and long-term liabilities (€3.2M). Despite high-quality earnings, ABC's profit margins have decreased from last year and earnings have declined over five years by 5.8% annually. While the dividend yield of 9.35% isn't well-covered by free cash flows, future earnings are forecasted to grow at 14.74% per year, suggesting potential for recovery in profitability.

- Click here to discover the nuances of ABC arbitrage with our detailed analytical financial health report.

- Learn about ABC arbitrage's future growth trajectory here.

International Housewares Retail (SEHK:1373)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: International Housewares Retail Company Limited is an investment holding company involved in the retail sale and trading of housewares products, with a market capitalization of HK$712.54 million.

Operations: The company's revenue segments include Retail in Hong Kong and Macau at HK$2.31 billion, Retail in Singapore at HK$306.28 million, and Wholesales, Licensing, and Others contributing HK$16.59 million.

Market Cap: HK$712.54M

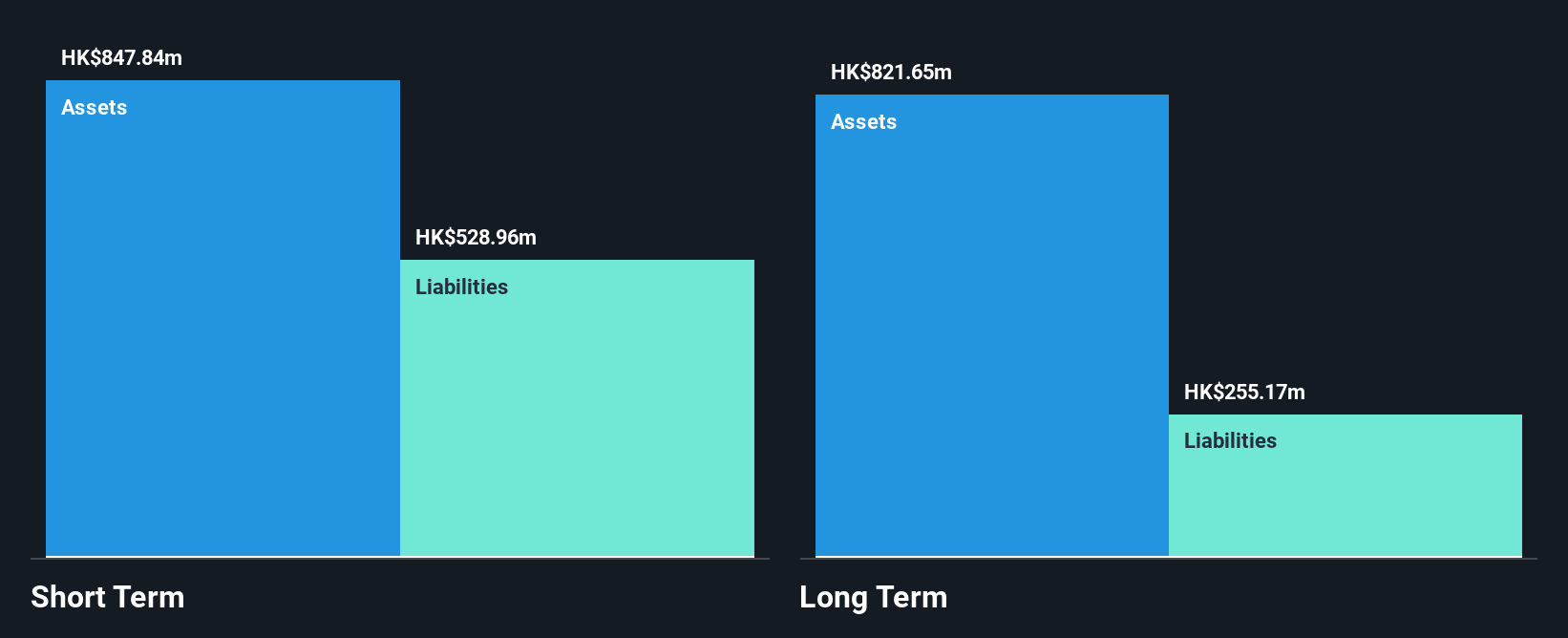

International Housewares Retail, with a market cap of HK$712.54 million, has faced challenges with declining earnings and revenue over the past year. Despite negative earnings growth of 31.7% recently, its interest payments are well-covered by EBIT at 5.9 times coverage, indicating manageable debt levels. The company trades significantly below estimated fair value and maintains strong asset coverage for both short-term and long-term liabilities. Recent results show a decrease in sales to HK$1,270.64 million for the half-year ended October 2024 compared to last year, alongside a reduced interim dividend reflecting ongoing market pressures on profitability and consumer behavior shifts impacting local retail spending.

- Dive into the specifics of International Housewares Retail here with our thorough balance sheet health report.

- Gain insights into International Housewares Retail's past trends and performance with our report on the company's historical track record.

Lajin Entertainment Network Group (SEHK:8172)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lajin Entertainment Network Group Limited is an investment holding company that offers movies, TV programs, and internet content services in Mainland China, with a market cap of HK$210.46 million.

Operations: The company's revenue is primarily derived from Movies, TV Programmes and Internet Contents at HK$19.27 million, followed by the New Media Business generating HK$1.12 million, and Artists Management contributing HK$0.34 million.

Market Cap: HK$210.46M

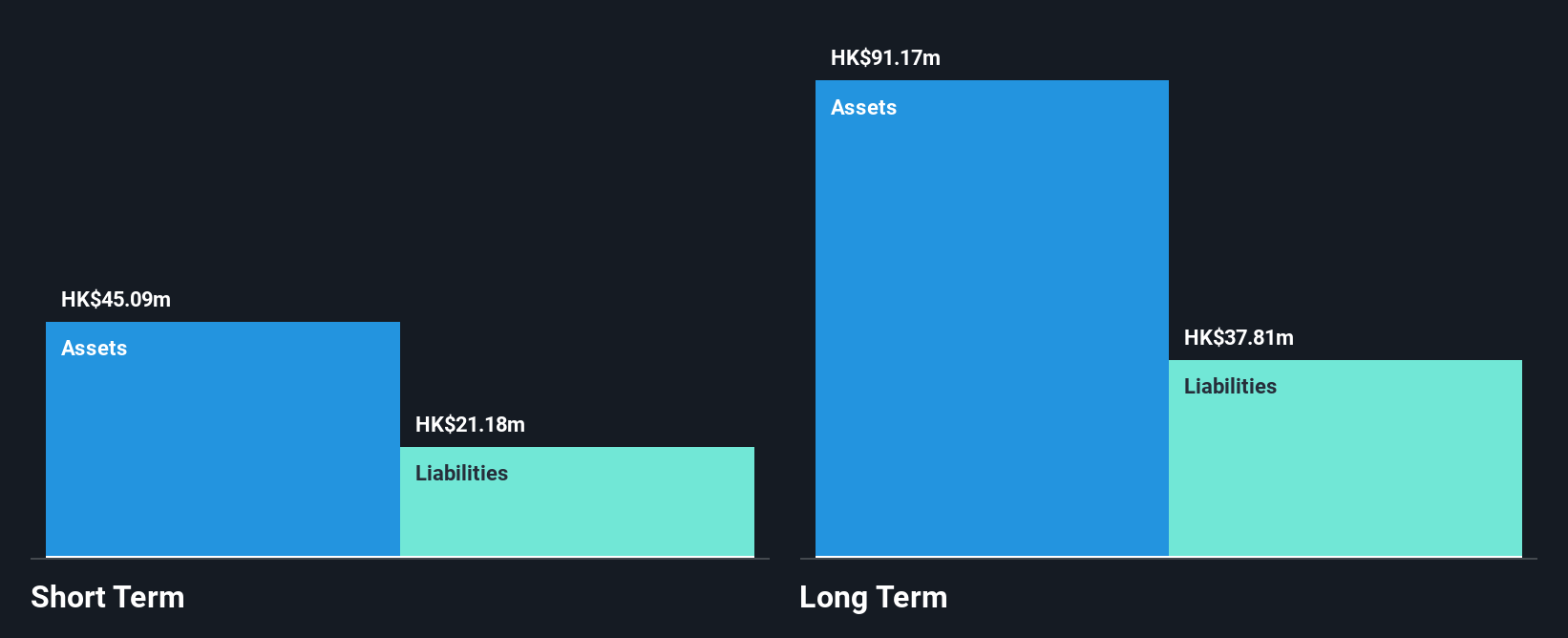

Lajin Entertainment Network Group, with a market cap of HK$210.46 million, is currently unprofitable but has demonstrated resilience by reducing its losses at 13.4% annually over the past five years. Despite lacking meaningful revenue (HK$21 million), it maintains a strong financial position with no debt and sufficient cash runway for over a year, even if growth continues at historical rates. Its short-term assets exceed liabilities, providing stability amidst high share price volatility. The seasoned management and board offer experienced leadership without shareholder dilution in the past year, though negative return on equity remains a concern as profitability challenges persist.

- Navigate through the intricacies of Lajin Entertainment Network Group with our comprehensive balance sheet health report here.

- Explore historical data to track Lajin Entertainment Network Group's performance over time in our past results report.

Turning Ideas Into Actions

- Discover the full array of 5,836 Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1373

International Housewares Retail

An investment holding company, engages in the retail sale and trading of housewares products.

Flawless balance sheet average dividend payer.