- France

- /

- Hospitality

- /

- ENXTPA:PARP

Here's Why It's Unlikely That Groupe Partouche SA's (EPA:PARP) CEO Will See A Pay Rise This Year

The results at Groupe Partouche SA (EPA:PARP) have been quite disappointing recently and CEO Fabrice Paire bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 14 April 2021. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for Groupe Partouche

Comparing Groupe Partouche SA's CEO Compensation With the industry

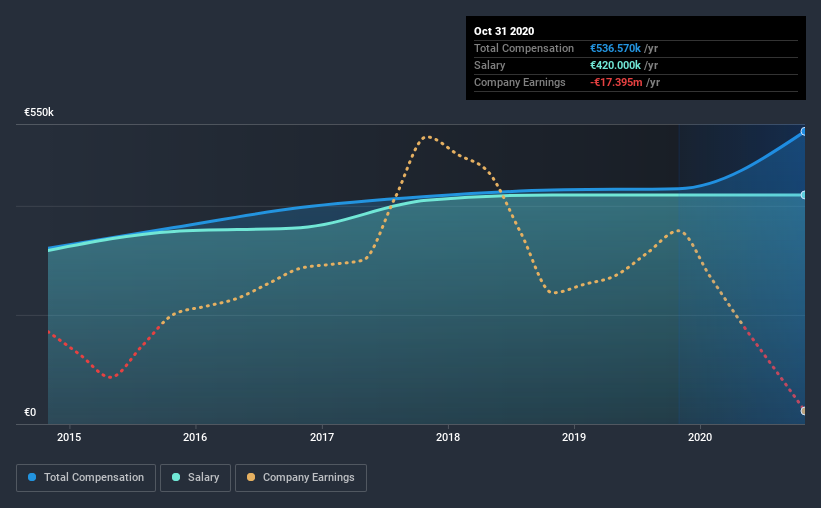

At the time of writing, our data shows that Groupe Partouche SA has a market capitalization of €220m, and reported total annual CEO compensation of €537k for the year to October 2020. We note that's an increase of 24% above last year. We note that the salary portion, which stands at €420.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between €84m and €338m, we discovered that the median CEO total compensation of that group was €385k. Hence, we can conclude that Fabrice Paire is remunerated higher than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €420k | €420k | 78% |

| Other | €117k | €11k | 22% |

| Total Compensation | €537k | €431k | 100% |

On an industry level, around 78% of total compensation represents salary and 22% is other remuneration. Although there is a difference in how total compensation is set, Groupe Partouche more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Groupe Partouche SA's Growth

Groupe Partouche SA has reduced its earnings per share by 89% a year over the last three years. In the last year, its revenue is down 21%.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Groupe Partouche SA Been A Good Investment?

With a three year total loss of 14% for the shareholders, Groupe Partouche SA would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 2 warning signs for Groupe Partouche (1 is potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Groupe Partouche or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:PARP

Groupe Partouche

Through its subsidiaries, operates casinos, hotels, restaurants, dancehalls, leisure facilities, and bars in France, other European countries, and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

UnitedHealth Stock: Why Scale, Data, and Integration Still Matter in U.S. Healthcare

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)