- France

- /

- Food and Staples Retail

- /

- ENXTPA:CO

Casino Guichard-Perrachon Société Anonyme's (EPA:CO) Stock Price Has Reduced 43% In The Past Three Years

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Casino, Guichard-Perrachon Société Anonyme (EPA:CO) shareholders have had that experience, with the share price dropping 43% in three years, versus a market return of about 22%. And more recent buyers are having a tough time too, with a drop of 30% in the last year. It's down 2.4% in the last seven days.

See our latest analysis for Casino Guichard-Perrachon Société Anonyme

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

We know that Casino Guichard-Perrachon Société Anonyme has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

We think that the revenue decline over three years, at a rate of 3.9% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

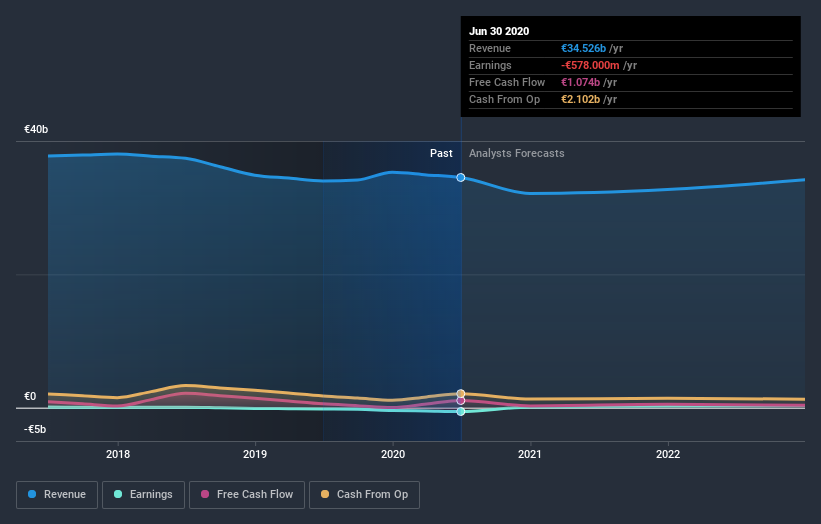

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Casino Guichard-Perrachon Société Anonyme is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We've already covered Casino Guichard-Perrachon Société Anonyme's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Casino Guichard-Perrachon Société Anonyme shareholders, and that cash payout explains why its total shareholder loss of 36%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that Casino Guichard-Perrachon Société Anonyme shareholders are down 30% for the year. Unfortunately, that's worse than the broader market decline of 0.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Casino Guichard-Perrachon Société Anonyme may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you’re looking to trade Casino Guichard-Perrachon Société Anonyme, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:CO

Casino Guichard-Perrachon

Operates as a food retailer in France, Latin America, and internationally.

Moderate and fair value.