Is LVMH Fairly Priced After Flat 2025 Returns and Experiential Luxury Expansion?

Reviewed by Bailey Pemberton

- Wondering whether LVMH Moët Hennessy - Louis Vuitton Société Européenne is still a quality luxury name at a fair price? You are not alone. This stock sits at the crossroads of brand power and valuation discipline.

- After a choppy few years, the shares are up 0.9% over the last week and 3.6% over the last month, but are roughly flat year to date at -0.4%. That makes the 6.4% 1 year and 37.9% 5 year returns look more like a reset than a runaway rally.

- Recent headlines have focused on LVMH doubling down on experiential luxury, from expanding its hospitality footprint to high profile collaborations that keep its brands culturally relevant. At the same time, investors are weighing macro headwinds in key markets and shifts in high end consumer demand, which helps explain why the 3 year return of -6.7% lags the long term story.

- On our checks, LVMH currently scores 2 out of 6 for undervaluation. This suggests some metrics flag value while others look fully priced. In the sections ahead we will walk through those different valuation lenses, before finishing with a more holistic way to think about what this stock is really worth.

LVMH Moët Hennessy - Louis Vuitton Société Européenne scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: LVMH Moët Hennessy - Louis Vuitton Société Européenne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back into today’s euros.

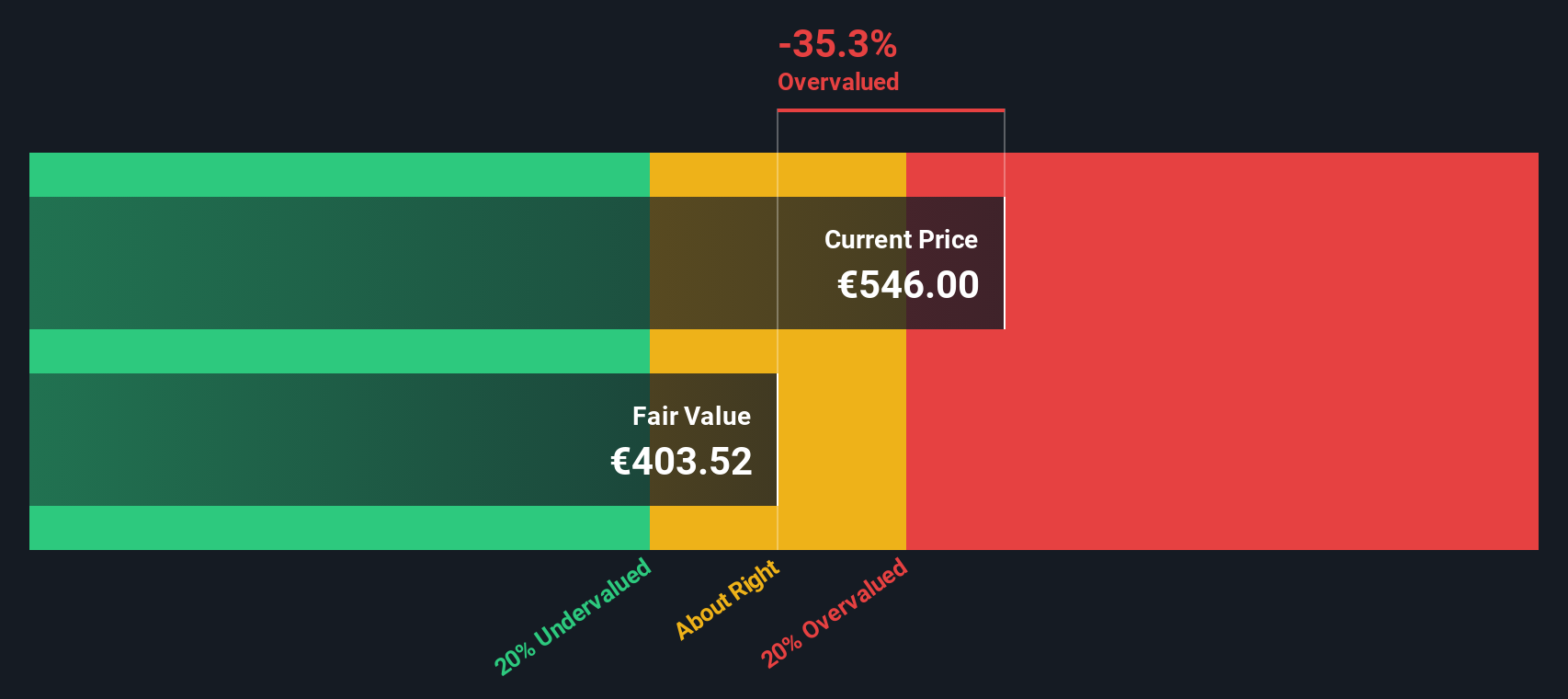

For LVMH Moët Hennessy - Louis Vuitton Société Européenne, the latest twelve month Free Cash Flow is about €13.3 billion. Analysts provide detailed forecasts for the next few years, and beyond that Simply Wall St extrapolates the trajectory, resulting in projected Free Cash Flow of roughly €17.3 billion by 2035. These long term projections feed into a 2 Stage Free Cash Flow to Equity model that assumes stronger growth in the near term and more moderate growth further out.

Putting all of those discounted cash flows together gives an estimated intrinsic value of about €447 per share. Compared with the current market price, this implies the stock is roughly 41.5% overvalued on a DCF basis, suggesting investors are paying a premium for LVMH’s cash generation and brand quality.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LVMH Moët Hennessy - Louis Vuitton Société Européenne may be overvalued by 41.5%. Discover 912 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: LVMH Moët Hennessy - Louis Vuitton Société Européenne Price vs Earnings

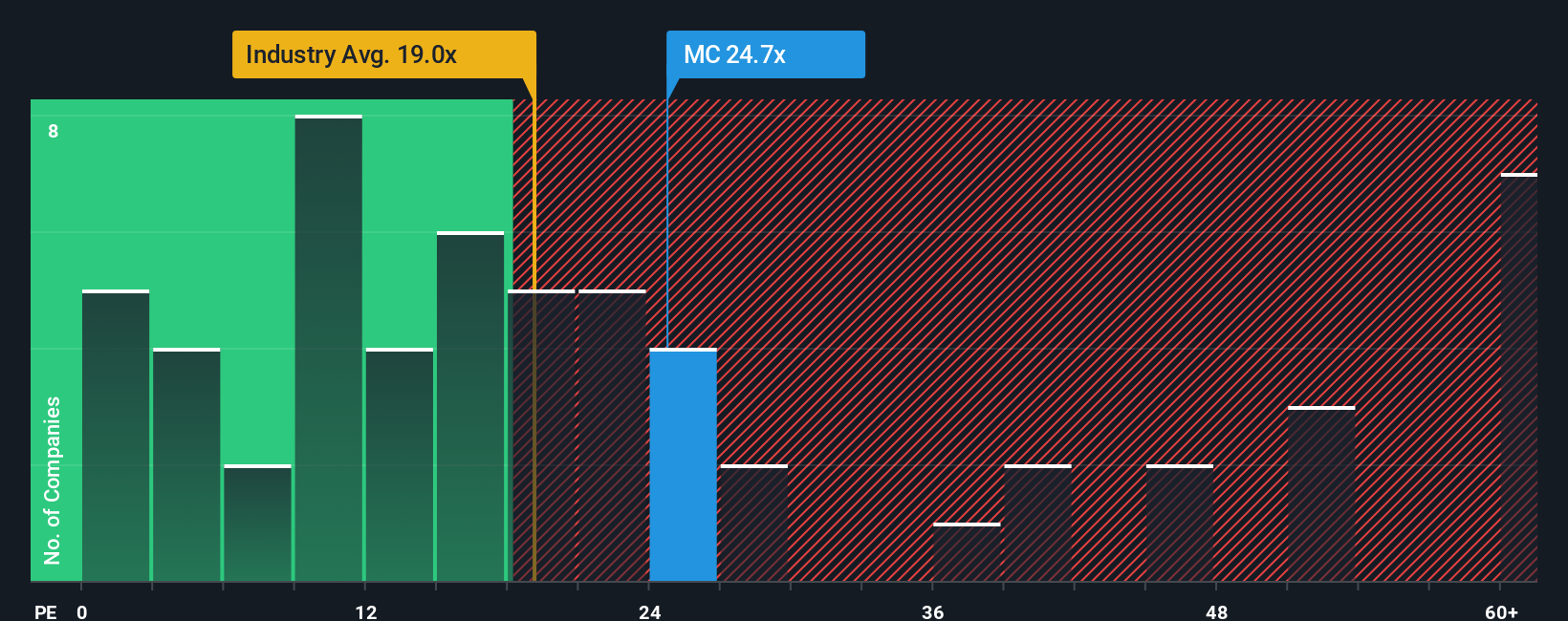

For a profitable, mature business like LVMH, the Price to Earnings (PE) ratio is a useful starting point, because it directly links what investors pay for each share to the earnings that share generates today.

What counts as a normal or fair PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher, more reliable growth can justify a higher PE, while slower or uncertain growth usually deserves a lower one.

LVMH currently trades on about 28.7x earnings, which is rich versus the broader Luxury industry average of roughly 17.6x, but at a discount to its more premium global peers at around 37.8x. To go beyond simple comparisons, Simply Wall St uses a Fair Ratio, which estimates the PE you would expect for LVMH once you factor in its earnings growth outlook, margins, size, industry positioning and risk profile.

This Fair Ratio is about 31.1x, slightly above the current 28.7x, indicating that the market is pricing LVMH a little below what those fundamentals might warrant, which suggests modest undervaluation on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LVMH Moët Hennessy - Louis Vuitton Société Européenne Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to turn your view of LVMH Moët Hennessy - Louis Vuitton Société Européenne into a story that connects the company’s brands, growth drivers and risks with concrete forecasts for revenue, earnings, margins and, ultimately, a fair value estimate you can compare to today’s share price.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to capture their perspective on a business, link that story to a set of financial assumptions, and then see instantly whether their Fair Value suggests the stock is a buy, a hold, or a sell at the current Price, with those numbers updating dynamically as fresh news, results and guidance come in.

For example, one LVMH Narrative might assume resilient Asian demand, improving margins and justify a fair value closer to the optimistic targets around €699. In contrast, a more cautious Narrative, focused on slower luxury demand and margin pressure, might anchor nearer the low end around €435. The power of Narratives is that you can see exactly which assumptions bridge the gap between those views.

Do you think there's more to the story for LVMH Moët Hennessy - Louis Vuitton Société Européenne? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MC

LVMH Moët Hennessy - Louis Vuitton Société Européenne

Operates as a luxury goods company worldwide.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026