Investors Appear Satisfied With Christian Dior SE's (EPA:CDI) Prospects

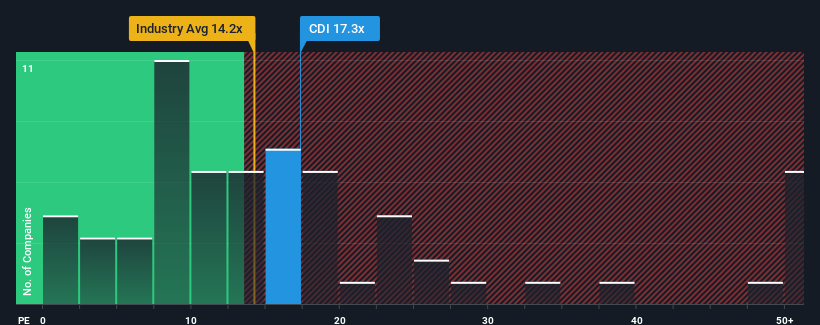

Christian Dior SE's (EPA:CDI) price-to-earnings (or "P/E") ratio of 17.3x might make it look like a sell right now compared to the market in France, where around half of the companies have P/E ratios below 15x and even P/E's below 8x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Christian Dior has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Christian Dior

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Christian Dior's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 22% last year. The latest three year period has also seen an excellent 264% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 11% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Christian Dior's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Christian Dior revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Christian Dior with six simple checks on some of these key factors.

If you're unsure about the strength of Christian Dior's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CDI

Christian Dior

Through its subsidiaries, engages in the production, distribution, and retail of fashion and leather goods, wines and spirits, perfumes and cosmetics, and watches and jewelry worldwide.

Adequate balance sheet average dividend payer.