- Switzerland

- /

- Basic Materials

- /

- SWX:HOLN

European Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As European markets face a downturn with the STOXX Europe 600 Index retreating from record highs amid political turmoil and international trade tensions, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. In such volatile times, stocks that consistently provide dividends can offer a measure of resilience and appeal, particularly for those looking to navigate the current economic uncertainties while still seeking returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.61% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.67% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.07% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.27% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.05% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.69% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.91% | ★★★★★☆ |

Click here to see the full list of 226 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Groupe Pizzorno Environnement (ENXTPA:GPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Pizzorno Environnement, with a market cap of €231.10 million, provides environmental services primarily in France.

Operations: Groupe Pizzorno Environnement generates revenue through its Cleanliness segment, amounting to €223.96 million, and its Treatment Segment, which contributes €48.42 million.

Dividend Yield: 4.2%

Groupe Pizzorno Environnement's dividends are covered by both earnings and cash flows, with a payout ratio of 44% and a cash payout ratio of 79.6%. Despite a recent increase in earnings, the company has an unstable dividend track record over the past decade. Its dividend yield is lower than the top French market payers. Recent half-year results show net income growth to €16.8 million, though future earnings are expected to decline annually by 14.2%.

- Unlock comprehensive insights into our analysis of Groupe Pizzorno Environnement stock in this dividend report.

- According our valuation report, there's an indication that Groupe Pizzorno Environnement's share price might be on the cheaper side.

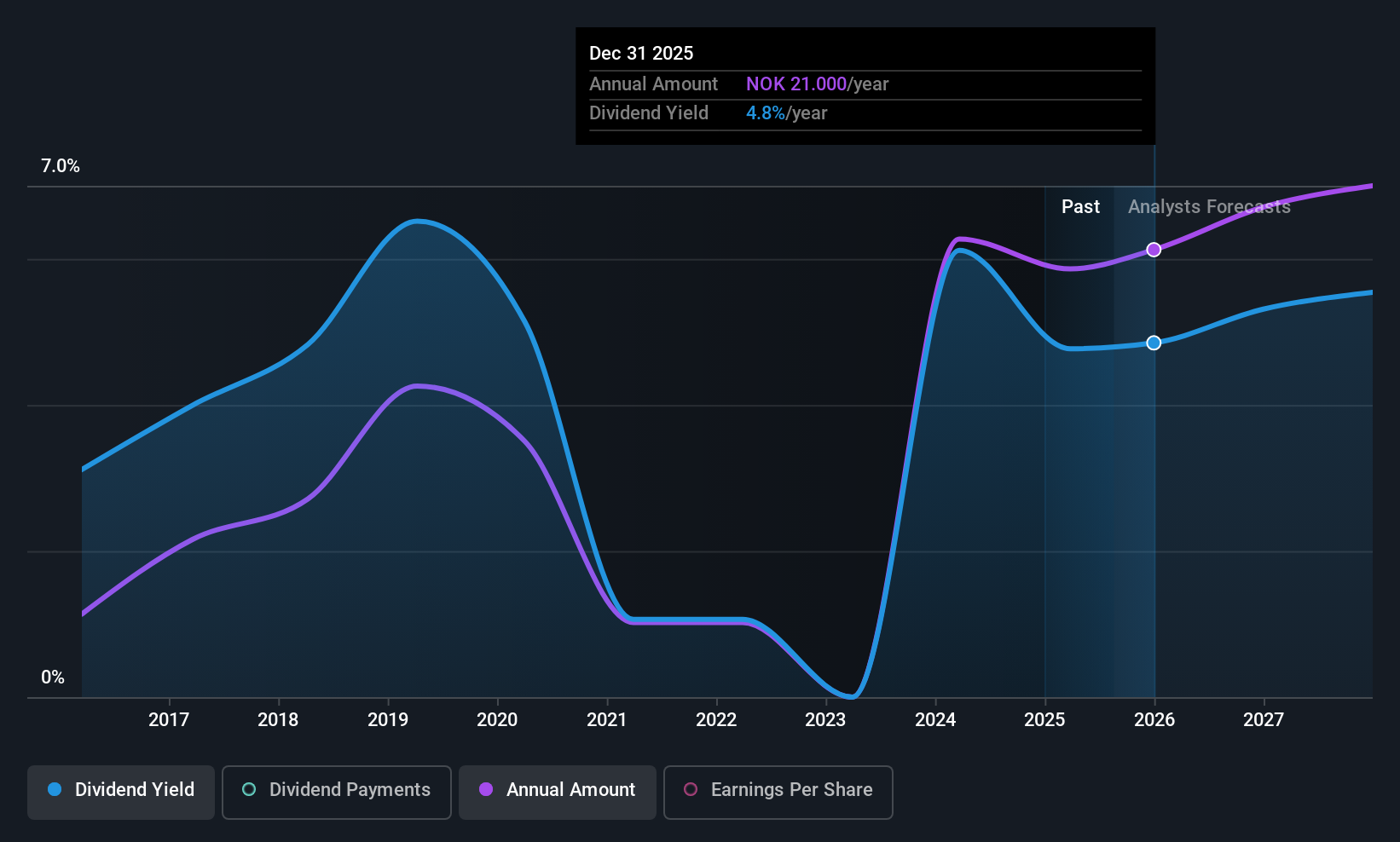

SpareBank 1 Østfold Akershus (OB:SOAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpareBank 1 Østfold Akershus is a Norwegian savings bank offering a range of banking products and services, with a market cap of NOK5.45 billion.

Operations: SpareBank 1 Østfold Akershus generates its revenue through a diverse array of banking products and services tailored to the Norwegian market.

Dividend Yield: 4.6%

SpareBank 1 Østfold Akershus's dividends are well-covered by earnings with a payout ratio of 43.2%, though the dividend yield is lower than the top Norwegian market payers. Despite a history of volatility, dividend payments have grown over the past decade. Recent results show net income increased to NOK 243 million for Q2 and NOK 357 million for six months ending June 2025, yet future earnings are projected to decline by an average of 5.3% annually over three years.

- Dive into the specifics of SpareBank 1 Østfold Akershus here with our thorough dividend report.

- Our valuation report here indicates SpareBank 1 Østfold Akershus may be undervalued.

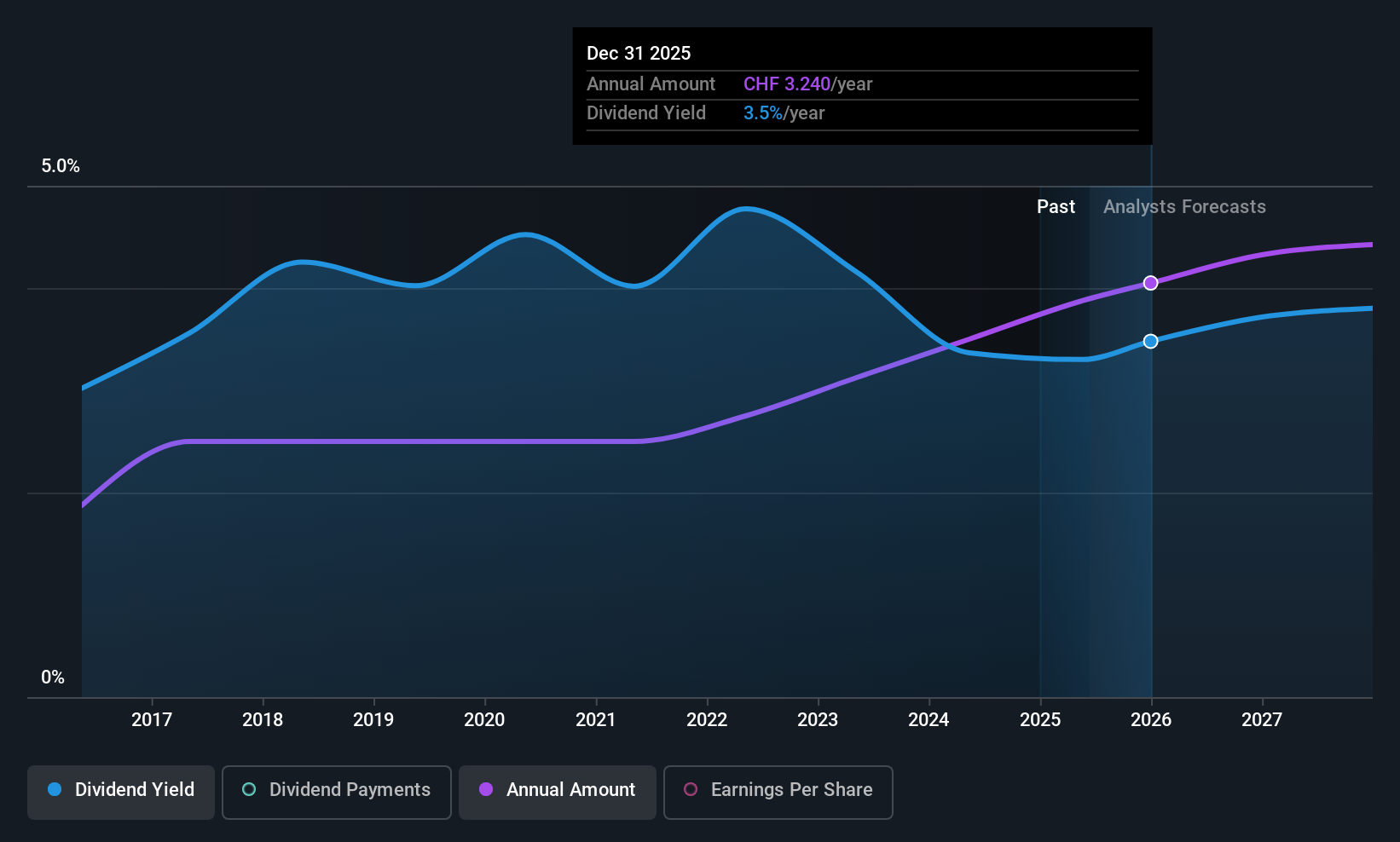

Holcim (SWX:HOLN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Holcim AG, along with its subsidiaries, offers building materials and solutions globally and has a market cap of CHF35.76 billion.

Operations: Holcim AG generates its revenue through various segments, with a total segment adjustment of CHF28.83 billion and corporate/eliminations amounting to -CHF2.60 billion.

Dividend Yield: 4.7%

Holcim's dividend yield of 4.67% ranks in the top 25% of Swiss market payers, with stable and growing dividends over the past decade. The payout ratios, at 54.2% for earnings and 49.4% for cash flows, suggest sustainability. Despite recent earnings growth of 28.6%, future declines are forecasted at an average of 4.1% annually over three years. Recent financials show net income surged to CHF13 billion, while sales decreased slightly year-over-year to CHF7.87 billion.

- Navigate through the intricacies of Holcim with our comprehensive dividend report here.

- Our expertly prepared valuation report Holcim implies its share price may be lower than expected.

Make It Happen

- Gain an insight into the universe of 226 Top European Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Holcim might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:HOLN

Outstanding track record 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives