- France

- /

- Commercial Services

- /

- ENXTPA:BB

Is BIC Offering Value After Recent Stock Dip and Steady Five Year Gains in 2025?

Reviewed by Bailey Pemberton

If you are weighing up what to do with Société BIC stock right now, you are not alone. Many investors find themselves at a crossroads with this storied global brand. Over the last year, the company’s share price has dipped by 3.2%, with year-to-date returns still in the red at -15.1%. These numbers might seem discouraging at first glance, but look closer and a more intriguing story begins to emerge. In fact, BIC has managed a steady 59.0% gain over the last five years, reminding us that long-term resilience can outweigh short-term volatility.

The past month has seen a mild uptick, with the stock inching up 1.3%, following small but positive signals across broader European markets. The market’s perception of risk around consumer staples like BIC seems to have shifted, possibly pointing to renewed confidence in essential product segments and global supply chains. While headline news has not driven immediate price action, the stock’s gradual movement suggests that investors are beginning to reassess what they value in steady, diversified manufacturers like BIC.

When it comes to judging whether Société BIC stock is a bargain or a stretch, valuation metrics are essential. Our latest value score, which rates the company across six key checks for undervaluation, lands a solid 4 out of 6. That is a reassuring signal and sets the table for a closer look at how BIC fares under several tried-and-true methods of valuing stocks. Before you make any moves, stay tuned for a smarter, more holistic way to look at valuation. This approach goes beyond the usual ratios and checks.

Why Société BIC is lagging behind its peers

Approach 1: Société BIC Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future free cash flows and discounting them back to today’s value. For Société BIC, this approach starts with its latest trailing twelve months Free Cash Flow of €219.3 million. Analyst forecasts predict relative stability, with free cash flow projected at €218.9 million by the end of 2027. After that, Simply Wall St extrapolates further growth at rates up to 1.8%, placing BIC’s free cash flow at €245.3 million in 2035.

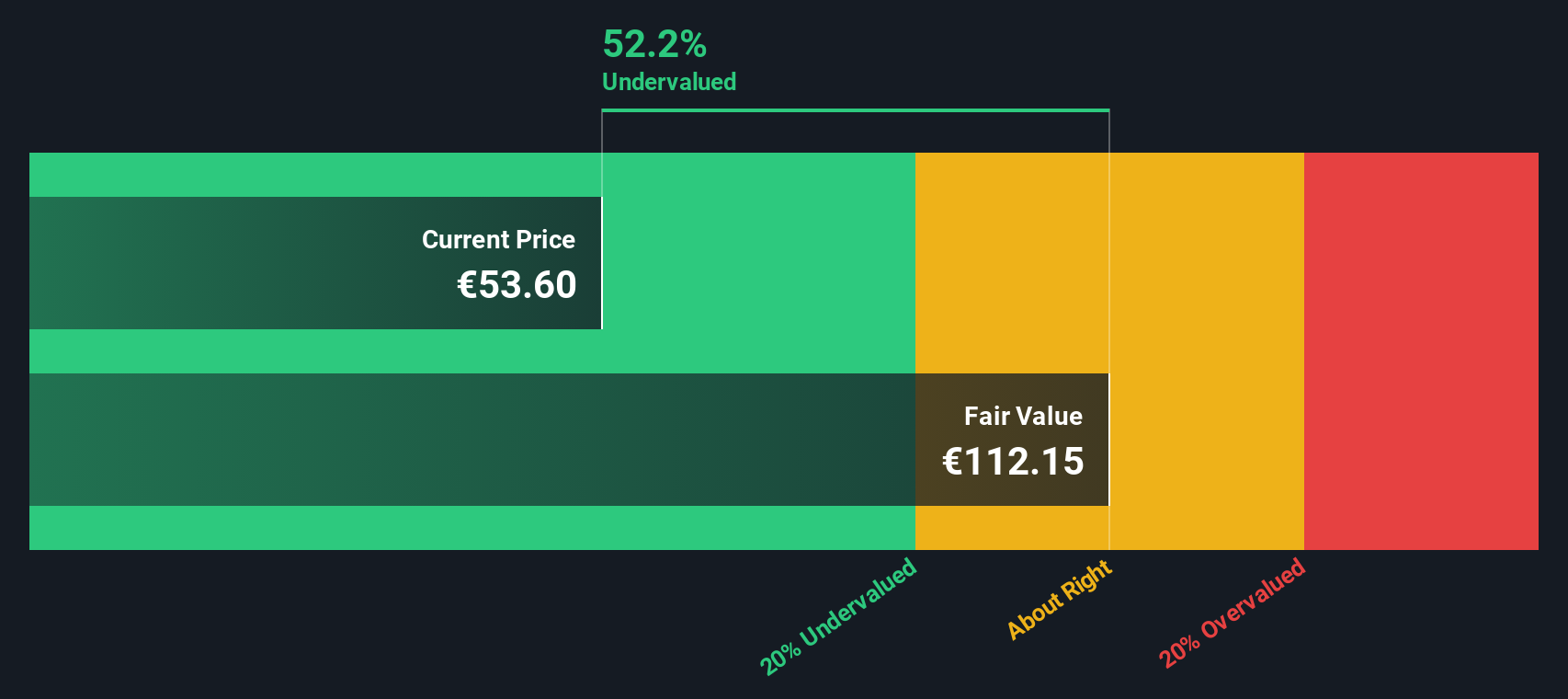

All cash flows are denominated in euros and none cross the billion-euro threshold. Trends and projections remain within the hundreds of millions. This two-stage DCF assessment leads to an estimated intrinsic value of €111.89 per share. Given the current market price, this calculation implies the shares are trading at a significant 51.8% discount to their fair value.

This signals that, on a conservative cash flow basis, Société BIC may be considerably undervalued by the market. This could potentially offer a sizeable margin of safety for long-term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Société BIC is undervalued by 51.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Société BIC Price vs Earnings

For profitable companies like Société BIC, the price-to-earnings (PE) ratio remains one of the most widely used and insightful valuation measures. The PE ratio reveals how much investors are willing to pay for each euro of current earnings, helping to gauge whether a stock is priced fairly relative to its profit-making power. Typically, factors such as a company’s expected earnings growth and perceived risk will dictate what is considered a “normal” or “fair” PE ratio. Higher future growth or strong business resilience can justify a premium multiple, while increased risk or slowing profits will drag it down.

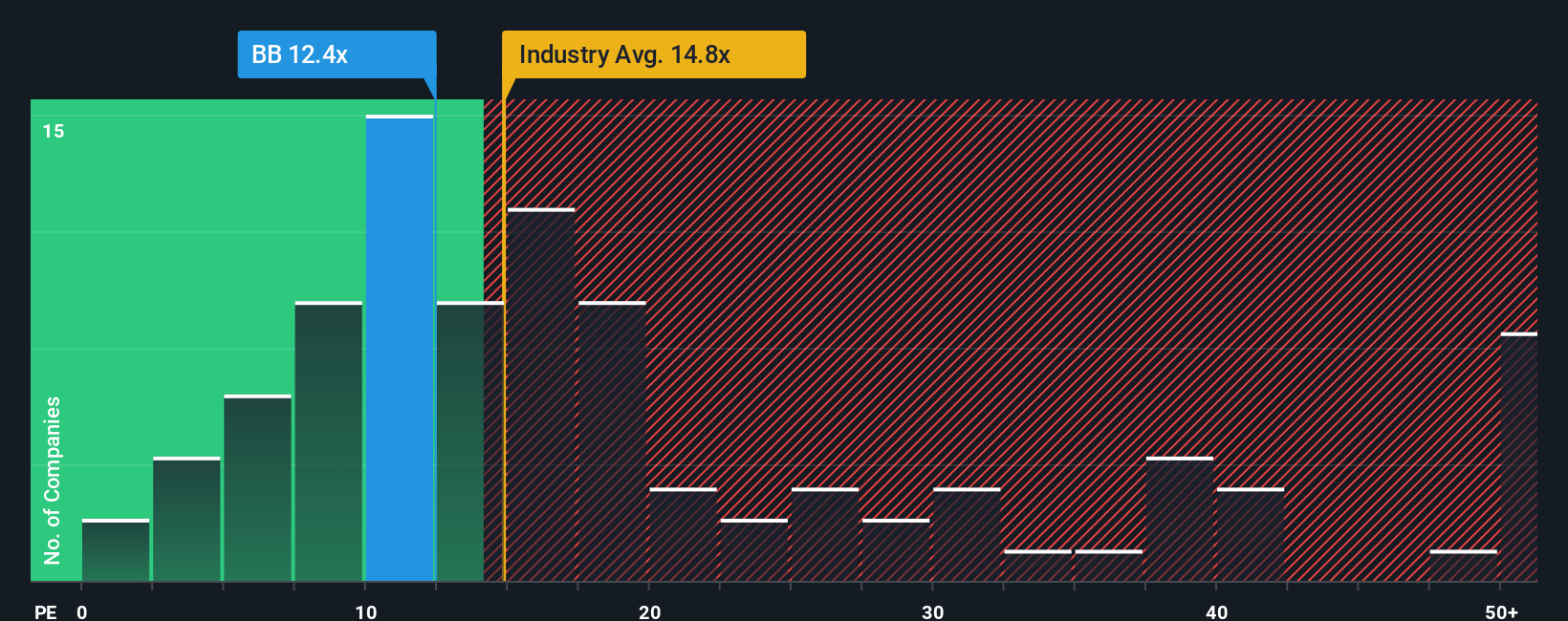

BIC currently trades at a PE ratio of 12.56x, which is in line with many peers and modestly below the Commercial Services industry average of 16.80x. In comparison, the peer group average sits at 11.46x, highlighting that BIC falls somewhere in the middle of the pack in terms of valuation against typical competitors. To get a more tailored assessment, Simply Wall St’s Fair Ratio provides a more precise benchmark. BIC’s calculated Fair Ratio is 14.45x, a value that considers the company’s unique earnings growth, profit margins, business risks, industry standing, and market capitalization, unlike blunt industry averages or simple peer comparisons.

The Fair Ratio serves as a custom-fit yardstick, allowing investors to sidestep the pitfalls of generic multiples. For Société BIC, the current PE ratio (12.56x) sits notably below its Fair Ratio (14.45x), suggesting that the stock is trading at a discount when fully accounting for its strengths and context within the market.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Société BIC Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company that connects your own assumptions and perspective to future forecasts, blending what you know about Société BIC’s products, strategy, and risks with financial expectations to arrive at a fair value.

Narratives bridge the gap between qualitative judgments and the numbers. They turn your unique take on the company's prospects into a dynamic forecast, making investing far more approachable and grounded in real-world insights. On Simply Wall St’s Community page, you can easily create and explore Narratives, tapping into a popular tool used by millions of investors to make decisions that reflect both facts and viewpoints.

Narratives make it simple to spot whether BIC is a buy or sell, as each Narrative’s fair value updates live alongside new news or earnings. If you think BIC’s global expansion and margin growth will exceed consensus, your Narrative might give a fair value near €71.0, while a more cautious view could result in a value closer to €55.0.

By focusing on Narratives, you empower yourself to invest with confidence, see both sides of the story, and react quickly to change, all while staying grounded in your beliefs and the latest information.

Do you think there's more to the story for Société BIC? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BB

Société BIC

Manufactures and sells stationery, lighter, shaver, and other products worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives