- France

- /

- Electrical

- /

- ENXTPA:SU

Schneider Electric (ENXTPA:SU) Valuation in Focus After NVIDIA Partnership and AI Data Center Launch

Reviewed by Kshitija Bhandaru

Schneider Electric (ENXTPA:SU) has partnered with NVIDIA to unveil fresh reference designs that target faster adoption of AI-ready infrastructure, with a strong focus on integrated power management and liquid cooling for data centers. This move could shape how operators approach complex AI implementations.

See our latest analysis for Schneider Electric.

Schneider Electric’s big push into AI-ready infrastructure comes amid a noticeable upswing in momentum this year, helped along by collaborations like the NVIDIA partnership and a string of conference appearances. The company’s 1-year total shareholder return stands at 3.2%, but its impressive five-year total return of over 150% shows the longer-term story is one of robust growth and compounding value.

If Schneider Electric’s tech focus has sparked your interest, you might want to check out other sector leaders. See the full list for free with our See the full list for free..

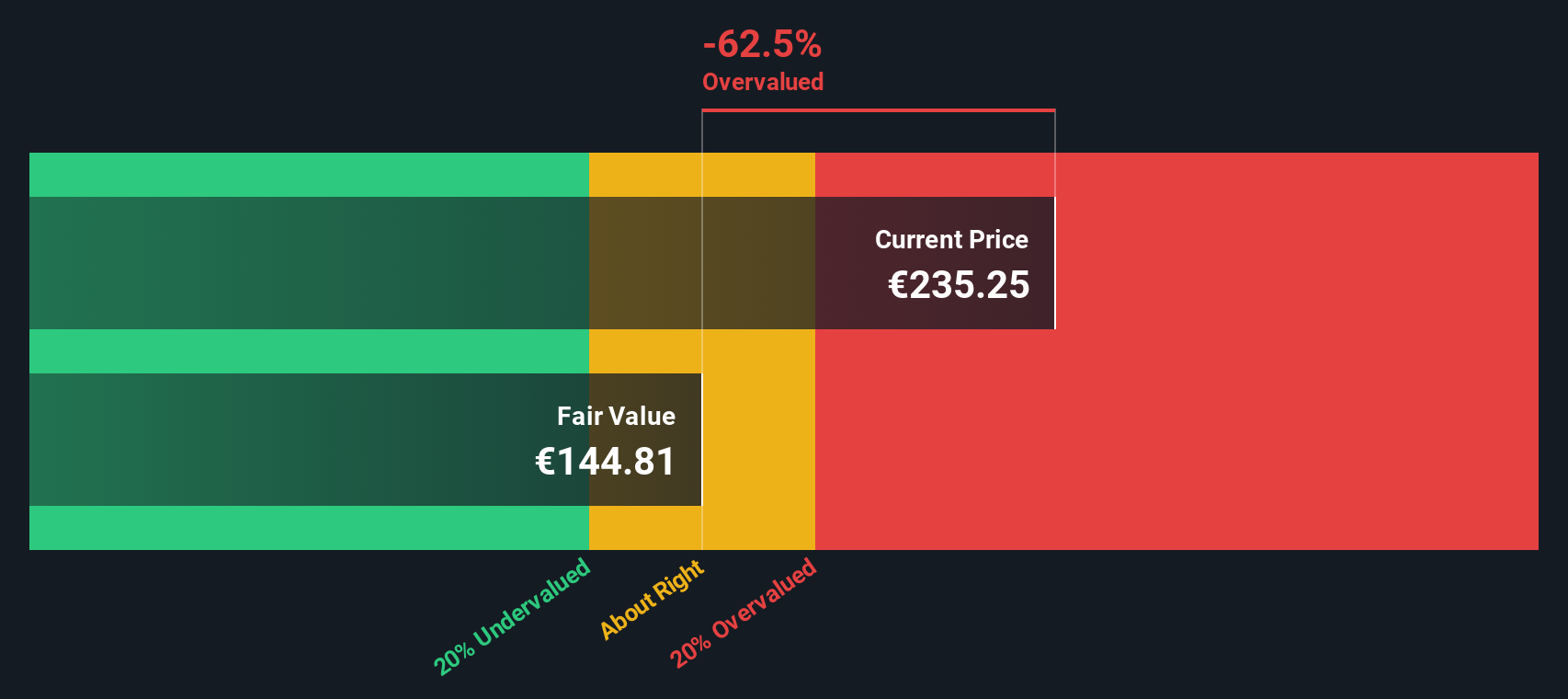

Given its solid long-term track record and recent innovations in AI infrastructure, the key question now is whether Schneider Electric’s positive outlook is already fully reflected in the share price, or if there may still be room for investors to benefit from further upside.

Most Popular Narrative: 4.1% Undervalued

Schneider Electric’s most widely followed narrative points to a fair value slightly above its last close, signaling renewed optimism from analysts as new product launches and digital transformation drive higher expectations. The recent upward revision in fair value comes as investors weigh the company's ongoing expansion in data centers and energy management.

Sustained double-digit growth pipeline and robust backlog in data centers, driven by the expansion of AI computing, digital infrastructure, and global investment in power reliability, indicate Schneider Electric is poised for multi-year revenue and margin growth as digitalization accelerates worldwide. The accelerating global shift towards electrification, renewable energy, and energy efficiency, supported by both corporate and government sustainability initiatives, continues to expand Schneider's addressable market and supports steady long-term revenue growth, particularly in energy management and grid modernization.

Want to understand the forces driving this premium valuation? The secret sauce of this narrative lies in bold growth forecasts and industry-leading profit targets you won’t want to miss. The assumptions behind these numbers could surprise even seasoned investors. Get the full picture behind this story’s upside.

Result: Fair Value of €257.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure or regional weakness, especially in European construction, could quickly temper Schneider Electric's bullish outlook if these challenges persist.

Find out about the key risks to this Schneider Electric narrative.

Another View: A Deeper Look at Valuation

To balance the optimism of analyst forecasts, our SWS DCF model puts Schneider Electric’s fair value at just €91.90, which is well below today’s price of €246.90. The difference between the DCF and consensus targets highlights how much future growth is already priced in, or perhaps how cautious some models remain.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Schneider Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Schneider Electric Narrative

If you have a different perspective or want to shape your own view, try exploring the numbers and building your own narrative in under three minutes, then Do it your way.

A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Step ahead of the crowd and upgrade your portfolio by tapping into some of today’s hottest themes with these three powerful Simply Wall St stock screens:

- Capture steady payouts and long-term compounding by checking out these 18 dividend stocks with yields > 3% with yields above 3%. Do not miss these proven income opportunities.

- Seize your chance in the booming artificial intelligence sector by using these 25 AI penny stocks and spot ambitious companies set for explosive growth.

- Ride the wave of financial technology with these 79 cryptocurrency and blockchain stocks to uncover innovators reshaping how the world transacts and transfers value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives